Ethereum’s long-awaited transition away from proof-of-work (PoW) mining has been put back again. It is now expected to happen in the second half of 2022.

It was said on April 13 by an Ethereum developer named Tim Beiko „Not in June, but maybe a few months after.

There isn’t yet a set date for the end of PoW on Ethereum. We’re in the last chapter, though.“

Around May, an automatic increase in mining difficulty is set to start. This is meant to make PoW mining less appealing.

It’s called the „difficulty bomb,“ and it will eventually make blocks „unbearable slow.“ This will force the network to move to a proof-of-stake (PoS) network.

Such news might have hurt the value of Ether (ETH), but it could be a great chance for people who believe in the efficiency and benefits of faster and cheaper transactions.

Even though one could use futures contracts to make their long positions more profitable, they could be forced to sell them if the price of the stock drops before the upgrade.

Professional traders, on the other hand, are more likely to use an options trading strategy like the „long butterfly.“

By trading a lot of call (buy) options with the same expiration date, one can make 3.2 times more money than they could lose.

An options strategy lets a trader make money on the upside while limiting their losses.

It is important to remember that all options have a set expiration date, so the asset’s price must rise during that time.

Using call options to limit the downside

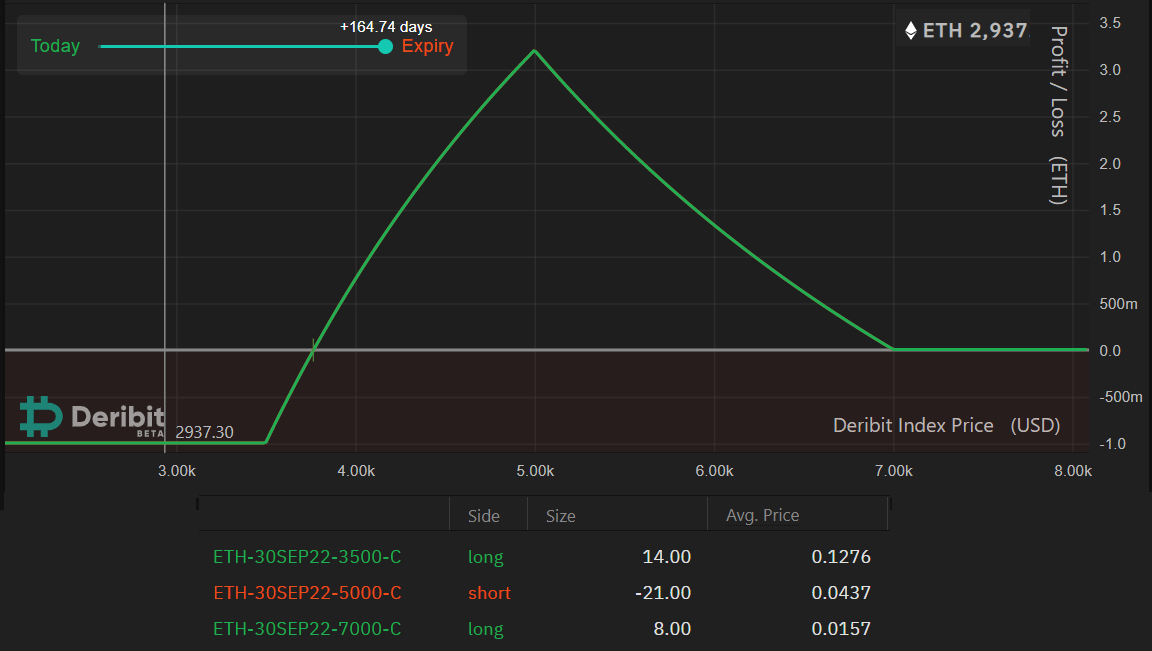

Here are the expected returns for the Sept. 22 expiration of Ether options. This method can also be used with different time frames.

While the costs will change, the general efficiency will not be harmed by this change.

This call option gives the buyer the right to buy an asset, but the seller of the contract could be at risk.

In order to use the „long butterfly“ strategy, you must take a short position with the $5,000 call option.

To start the execution, the investor buys 14 call options with a $3,500 strike and sells 21 call options with a $5,000 strike at the same time.

To finish the trade, one would buy 8 ETH contracts of the $7,000 call options so that they wouldn’t lose more than that.

If you want to trade in derivatives, you pay for them in ETH, and the price was $2,937 when this strategy was being sold.

Trade ensures limited downside with a possible 3.2 ETH gain

If you use this strategy, any price increase between $3,770 (up 28 percent) and $7,000 (up 139 percent) results in a profit. For example, a 40 percent rise in the price to $4,112 results in the profit of 1.1 ETH.

On the other hand, if the price is below $3,500 on Sept. 22, the maximum loss is 0.99 ETH.

Long butterfly: It has a chance to make more money than lose more money, which is 3.2 times bigger than the maximum loss.

Overall, the trade has a better risk-to-reward ratio than trading leveraged futures, especially when you consider that the trade has very little downside.

It looks like a good bet for people who think the PoW migration will happen in the next five months.

If you pay 0.99 ETH up front, that’s enough to cover the maximum amount of money you may lose.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-75x75.png)