Bitcoin has been stalling close to the superior-$10,000s over the earlier several days irrespective of the surged before this 7 days. The coin now trades at $10,850 as of this article’s creating, a couple of percent shy of the neighborhood high.

Analysts are sure that investors must be favoring longs right now. Here’s why they imagine so.

Linked Studying: Here’s Why This Crypto CEO Thinks BTC Shortly Hits $15,000

This Is Why Bitcoin Is Primed to Transfer Larger

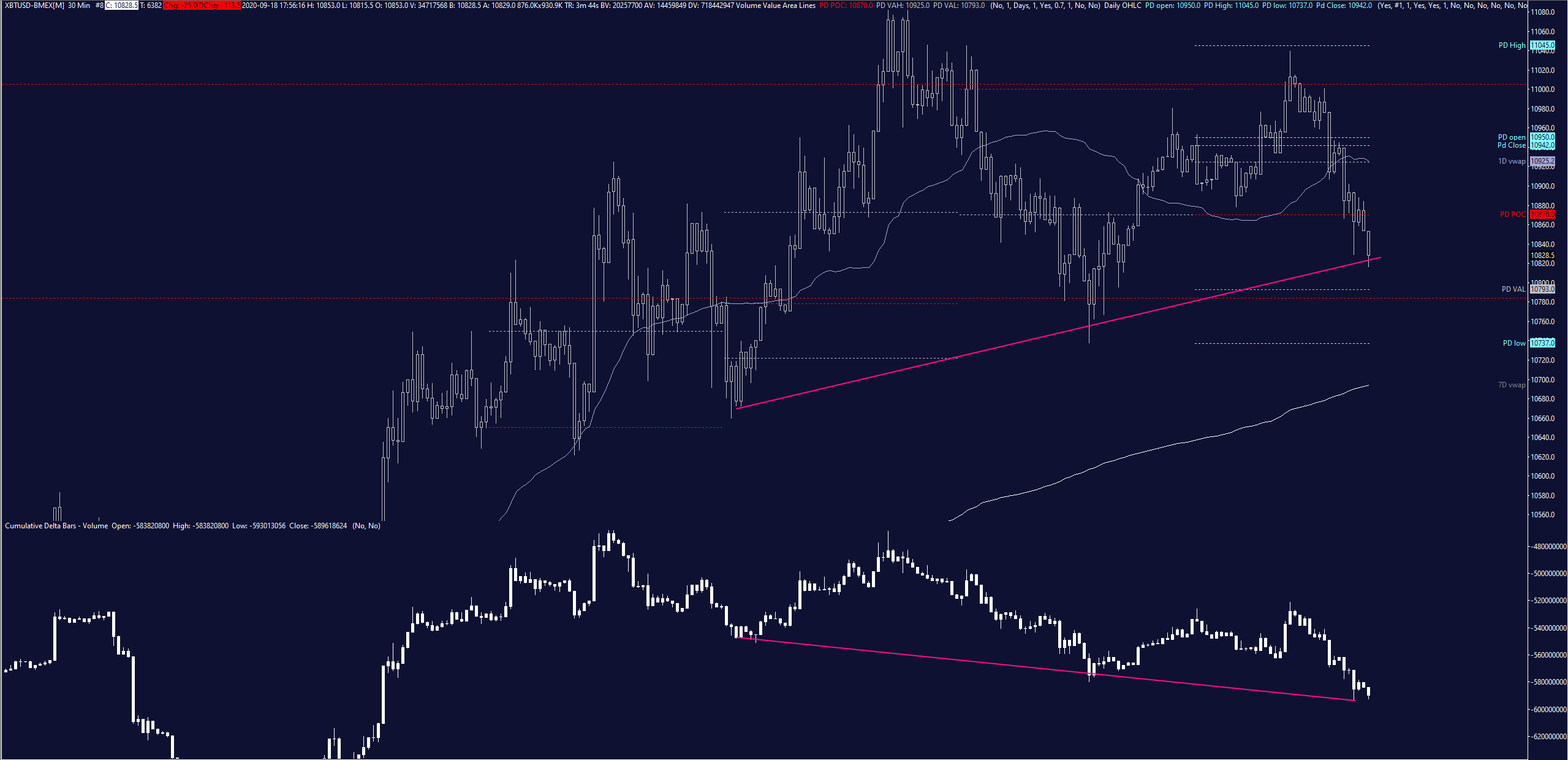

One cryptocurrency trader shared the chart beneath, noting that he thinks sellers (quick place holders) may well be “trapped” ideal now. This could most likely guide to a circumstance exactly where Bitcoin spikes increased, thus liquidating or halting out these sellers.

He posted the chart under, producing the subsequent to reveal why he thinks this is the scenario for Bitcoin:

“I retain looking at bears chatting about trapped potential buyers right here. I am observing the reverse. Foundation continue to favoring opening up a extended. CVD displaying much more of a switch than selling price, and I would not glance at it as main but as currently being sellers absorbed, getting a “101” degree bottom limited. $BTC.”

Chart of BTC's selling price action more than the previous couple several hours with CVD analysis by crypto trader Cantering Clark

Related Reading through: This European Crypto Trade Was Just Hacked for $5 Million

Not the Only Indication Suggesting Upside Is Imminent

Corroborating the expectations of upside is the condition of Bitcoin futures funding premiums. The funding fee of a crypto derivative is the payment that prolonged positions pay back shorter positions to ensure that the cost of the by-product trades in line with the selling price of the index, which derives its price from spot markets.

In accordance to ByBt, a crypto derivatives tracker, the funding costs of leading Bitcoin futures markets are damaging across the board.

This contains Binance, BitMEX, OKEx, Huobi, and ByBit.

When this may suggest to buyers that Bitcoin’s prevailing pattern is bearish, adverse funding premiums are often found before the development reverts increased.

Negative funding prices suggest to some that sellers are too aggressive, creating a reversion to imply very likely.

Related Reading through: It’s “Logical” for Ethereum To Reject At Present-day Rates: Here’s Why

Featured Impression from Shutterstock

Price tag tags: xbtusd, btcusd, btcusdt

Charts from TradingView.com

Here's Why Bitcoin Traders Should really Be Favoring Longs Suitable Now