Ethereum has seriously underperformed Bitcoin about modern days as bears have returned to the crypto market place. The top cryptocurrency has collapsed by 17% in the earlier 24 several hours by itself, slipping underneath pivotal assist amounts.

ETH trades at $325 as of this article’s composing, considerably underneath the nearby highs about $490. $325, in reality, is 33% beneath the 12 months-to-day highs.

With Ethereum going through these types of a solid retracement, analysts have been attempting to gauge what is upcoming for the now beaten-and-bruised crypto market.

Similar Reading through: These 3 Trends Propose BTC Is Poised to Bounce Just after $1,000 Drop

What’s Subsequent for Ethereum?

Ethereum is working up versus pivotal support regions from a complex point of view even with currently slicing by way of a series of crucial degrees.

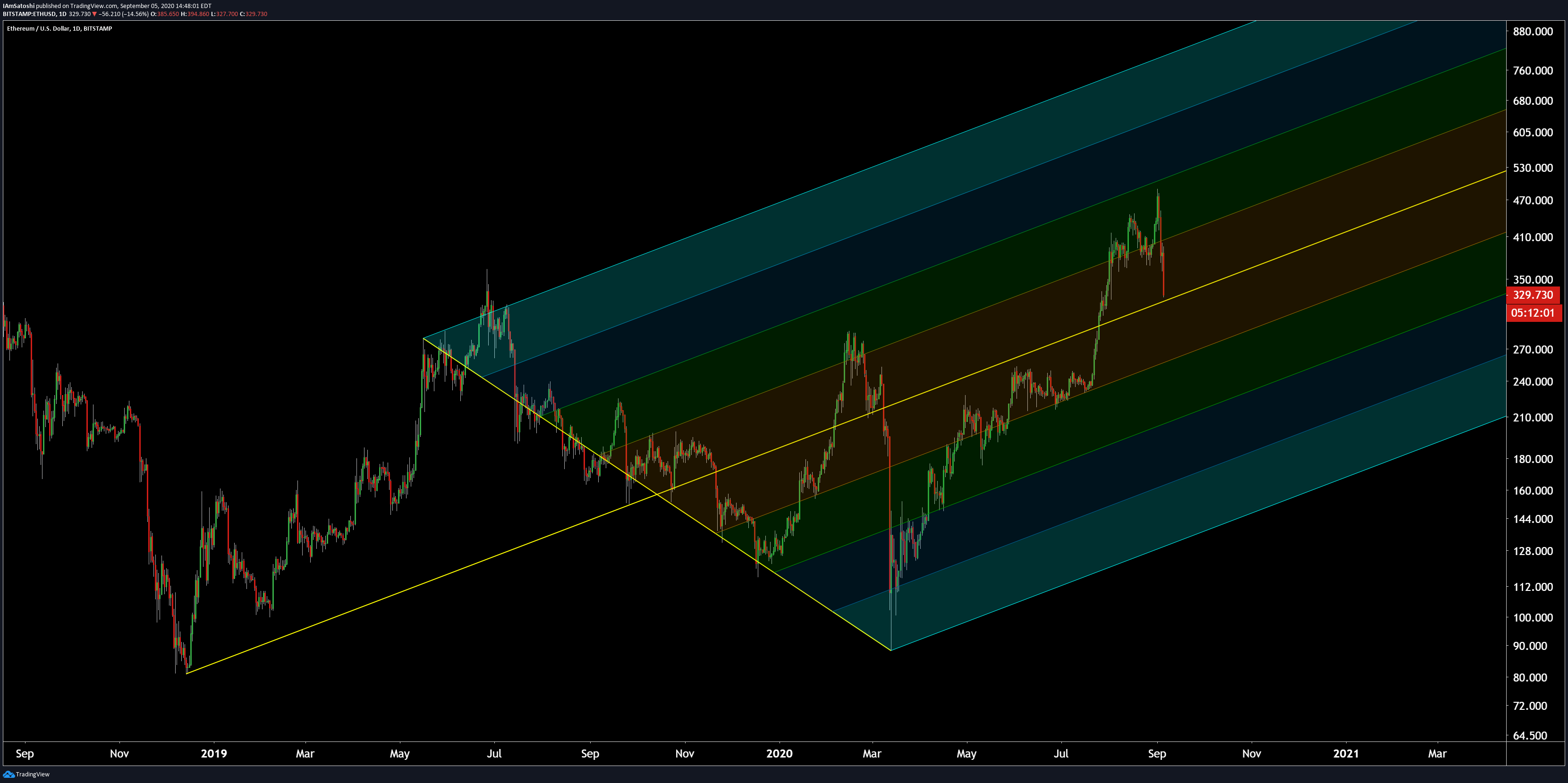

Josh Olszewicz, an analyst for Brave New Coin, shared the chart underneath on September 5th. The chart exhibits that ETH is trading at the midline of a macro pitchfork formation that formed in 2019.

The cryptocurrency should bounce right here or face a deeper correction to reduced concentrations indicated by the pitchfork, like one particular at $280 and one more at close to $240.

Chart of ETH's macro value motion with pitchfork investigation by crypto trader Josh Olszewicz (@Carpenoctum on Twitter). Chart from TradingView.com

Depsite this guidance, it could not previous.

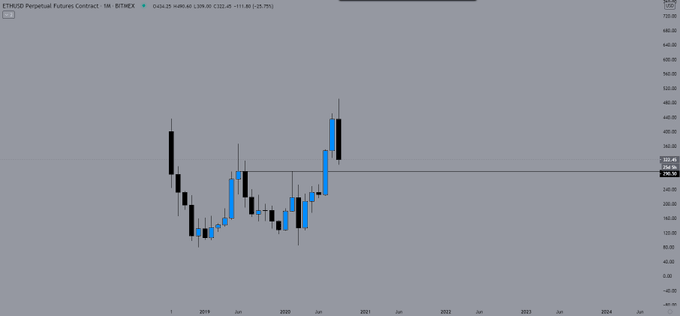

A further trader famous that on Ethereum’s BitMEX chart, there is no distinct macro assist until the $290 value point, which is close to 10% down below the present-day current market value of ETH.

Chart of ETH's macro cost action with an examination by crypto trader Chase_NL (@Chase_NL on Twitter). Chart from TradingView.com

Connected Studying: There’s an “Unusual” Total of Bitcoin Sellling Strain From Miners

ETH Is Really Top

ETH is truly seemingly primary the relaxation of the cryptocurrency sector.

This indicates that even further weak point in the price of Ethereum could trigger more draw back in Bitcoin, then altcoins.

Bitcoin has consequently much weathered the storm very perfectly. When ETH has dropped all over 33% from its nearby highs, BTC has get rid of a reasonably low 25%.

Related Looking at: Here’s Why This Crypto CEO Thinks BTC Soon Hits $15,000

Highlighted Picture from Shutterstock

Value tags: ethusd, ethbtc

Charts from TradingView.com

Ethereum Just Plunged 15%: Here is What Analysts Assume Arrives Following