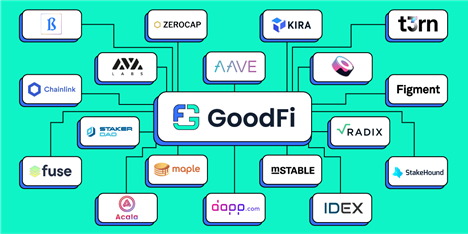

GoodFi, a not-for-income firm made by Radix with the mission of having 100 million people into DeFi by 2025, declared currently the addition of 22 executives to its advisory board from DeFi market leaders these as Chainlink, Aave, Sushiswap, Avalanche and mStable.

The addition of the Board of Advisors, who fulfill regular monthly to tackle the merged problems experiencing the adoption of decentralized finance, marks an significant move in the expansion of GoodFi following its first unveiling just a couple months ago. The shared working experience, know-how and resources of the GoodFi Board of Advisors will allow initiatives that lower the boundaries to entry into crypto and increase understanding and accessibility to DeFi for new consumers. By reducing these barriers, GoodFi and its members aim to assistance extra persons profit from the options and innovation offered by the DeFi field.

GoodFi’s Freshly Proven Board of Advisors Features:

Michael Zacharski – Account Executive, Chainlink

Trent Barnes – Principal, ZeroCap

Clayton Menzel – Head of Marketing and advertising & Content material, Figment.io

James Simpson – Co-Founder, mStable

Fauve Altman – World wide Community Direct, mStable

Isaac Rodgin – Head of Organization Development, Fuse.io

Amanda Joki – Organization Advancement & Advertising and marketing Direct, SushiSwap

Rachel Chu – Venture Administration Lead, SushiSwap

Omakase – Core Developer, SushiSwap

Alex Wearn – CEO, IDEX

Piers Ridyard – CEO, Radix

Isa Kivlighan – Electronic Advertising Supervisor, Aave

Jay Kurahashi-Sofue – VP of Marketing and advertising, Ava Labs

Adam Simmons – Head of Tactic, Radix

Kyle Lu – CEO, Dapp.com

Albert Castellana – CEO, StakeHound

Jonas Lamis – CEO, StakerDAO

Sid Powell – CEO, Maple Finance

Lawrence Until – Running Director, NetZero Cash

Scott Trowbridge – Co-Founder, Blockswap Community

Jacob Kowalewski – Main System Officer, t3rn

Milana Valmont, Co-Founder & CEO, KIRA Community

Dan Reecer, VP of Advancement, Acala Community

Jay Kurahashi-Sofue, member of the GoodFi advisory board, and Vice President of Marketing and advertising at Ava Labs, states, “Open, dispersed techniques permit for fantastic velocity and innovation. It is no accident that there are so numerous initiatives with talented groups paving the way forward. What is missing are impartial groups that find to make shared value for all builders and users. The final decision to sign up for GoodFi on behalf of Avalanche was a no-brainer.”

Alongside the new advisory board, the initially version of goodfi.com’s person-targeted web-site has long gone reside, furnishing the introductory content for another person wanting to realize and get involved with DeFi. This initial launch is focused on detailing to a initially-time user the price proposition of decentralized finance, in which the generate arrives from, and the a variety of ranges of hazard/reward that exist. From there, people are guided by receiving their initially wallet and assets centered on their most well-liked platform and how substantially they are searching to make investments.

The introductory academic sources that have long gone stay currently are only the initially iteration of GoodFi’s initiatives to demystify DeFi. The advisory board users are all doing work on creating content for GoodFi and do the job is already underway on new features these as a “matchmaker” element of the website that aids consumers discover newbie-friendly DeFi dApps, opportunities, and asset lessons. The emphasis of this resource, because of to be released following thirty day period, is to present an unbiased view of distinctive DeFi choices and involved threats as nicely as give actual-time knowledge about yields across a selection of confirmed platforms.

The DeFi alternatives that GoodFi are proposing adhere to a few overarching ways to DeFi investing for new end users, centered on their economical working experience and particular person chance tolerance:

- Safe & Steady: This strategy primarily involves lending out stablecoins for yearly returns of 5% – 15% by way of apps like Aave and Compound Finance or furnishing liquidity to secure-steady pairs on automatic market place makers like Uniswap or Sushiswap.

- Consider Calculated Pitfalls: A average technique, ideal for people prepared to just take on calculated risk for increased yearly returns (10% – 20%). This appears to be like generally at possessing some exposure to higher-cap risky property like ETH or WBTC paired with a secure coin in two-sided liquidity swimming pools, or by utilizing automated produce farming chances these as those offered by Yearn Finance.

- Opportunities for the Adventurous: A a lot more aggressive solution can generate returns of 30% or increased and demands improved publicity to risky belongings. This will incorporate prospects such as lending out WBTC/ETH or including to unstable/unstable pairs on automatic marketplace makers.

“While opening a new cryptocurrency wallet and interacting with different DeFi dApps is second-character to crypto-natives, these processes will initially be scary to the uninitiated the greater part across the globe. To get 100m DeFi customers by 2025, GoodFi demands to guideline buyers at every move so they feel self-assured bringing assets into the ecosystem,” said Adam Simmons, Head of Method at Radix DLT.