With the epidemic isolating spectators from their stadiums and sports clubs from their revenues, fan tokens have emerged as a significant participant in the game, assisting teams in generating cash and reconnecting fans.

While other countries have filled stadium seats with paper cut-outs of fans to provide a well-intentioned but spooky facade of normalcy during the pandemic, the gap between teams and their fans has grown wider. One such method is to use sports fan tokens. Many supporters are able to develop a more direct emotional and financial connection to their teams as a result of fan tokens.

Fan tokens, in the broadest sense, are digital assets associated with the fan experience. They are classified as fungible or nonfungible.

On the fungible side, dozens of European soccer teams are currently associated with actively traded „fan currencies“ or „fancoins,“ the sale of which generates over $200 million in Covid revenue per year. Unlike nonfungible tokens, each unit of fungible tokens such as Bitcoin, Ethereum, or Dogecoin is identical to any other – just like dollars.

Chiliz, a Malta-based blockchain sports company, and its fan engagement platform, Socios, are indisputable market leaders, with over 160 employees pushing the fungible fan token/fan currency business model. Chiliz, which just opened a new office in New York, is hoping to further disrupt the sports sector by partnering with the National Football League (NFL), the National Basketball Association (NBA), the National Hockey League (NHL), and the Ultimate Fighting Championship (UFC), among others.

Alexandre Dreyfus, CEO of Chiliz and Socios, envisions „hundreds, if not thousands, of major sporting organizations and some of the biggest entertainment franchises in cinema and music fully embracing“ fungible fan tokens as „a central aspect of their digital engagement strategy“ in five years. This means that the fan token craze has the potential to spread far beyond professional sports and is likely to have an impact on other forms of entertainment, including music, as evidenced by the Kpop Fan Token.

From passive to active

Dreyfus believes that fan tokens will „transform passive fans into active fans through transactional fan engagement,“ providing sports clubs with a „potent revenue stream“ in the post-physical world. Soon, the corporation will likely incorporate NFTs into their approach, as celebrities such as Paris Hilton have already done. He continues:

“We believe fan tokens are the biggest new trend in the industry and that this will be widely recognized as we add hundreds more partners in the future and millions more fans embrace them.”

However, there is no precedent for fungible fan tokens. These fan currencies are charting an entirely new course.

Fungible fan tokens are referred to as „utility tokens“ in blockchain terminology, an accurate descriptor given their undeniable utility as part of „gamifying“ the fan experience. By purchasing and using tokens, fans can demonstrate their support materially and congregate in online communities where they can participate in club governance by voting on proposals (such as what music will be played during a match), entering raffles for merchandise, and even directly interacting with the team.

According to Juventus supporter Giuseppe Bognanni, „it’s good when the music you voted for is the one you hear and think, ‚I was a part of that.'“

Priority entrance for @socios Fan Token holders at San Siro. @chiliz #bemorethanafan pic.twitter.com/1xxIQcdtrI

— Alexandre Dreyfus (@alex_dreyfus) September 16, 2021

However, are fan tokens a true means for clubs and fans to communicate, or are they simply a way for clubs to extract further revenue from fans?

Though securities regulators have yet to act, many in the sports industry are skeptical of the trend toward fan tokens. Malcolm Clarke, chair of the Football Supporters‘ Association in the United Kingdom, claimed that fan tokens may be little more than teams „trying to wring further money from supporters by fabricating insignificant ‚interaction‘ online surveys.“

That would be understandable, given that sales at Europe’s top 20 revenue-generating clubs fell 13% to 8.2 billion euros ($9.9 billion) in the 2020 fiscal year.

However, Jorge Chemez, an Argentine football enthusiast and supporter of the national team, is optimistic about the Chiliz initiative „since it is applicable in a variety of ways and to all types of sports, including eSports – every human being enjoys at least one sort of sport, the potential is unlimited.“ While the majority of sports fans are unlikely to adopt tokens, those who do will be able to „feel more connected to their teams.“

“Socios gives you privileges, like Inter Milan fan token owners were invited to a VIP sector to watch the football match”

The practice of sports clubs obtaining funds via the sale of cryptocurrencies is certain to spread globally as Chiliz’s incumbent platform faces new challengers and business models. Are fungible fan tokens a new form of indirect equity in teams (or celebrities/groups)?

Fungible fan tokens

Generally, fungible fan tokens are sold as „utility tokens,“ meaning that the tokens have specific applications. This concept of utility tokens extends all the way back to the 2017 initial coin offering (ICO) frenzy, when companies began raising money through the sale of cryptocurrencies in a manner similar to stock offerings.

These are referred to as initial public offerings, or IPOs, in the regulated securities market, and cryptocurrency issuers exploited the „utility token“ moniker to skirt securities restrictions, as tokens with use cases were arguably not securities. Among the early use cases were access to proprietary services or online forums, as well as gaming.

In comparison to „security tokens,“ „utility tokens“ sought to avoid the perception of being investments. All sorts of digital currencies are frequently distributed via initial exchange offers, or IEOs, straight from the exchange on which trading will begin.

Today, fungible sports fan tokens are being issued as utility tokens via an initial coin offering (IEO). The Chiliz platform is the market leader in this space, having sold fungible fan tokens in exchange for its native CHZ platform token in what they refer to as a fan token offering, or FTO.

Though the majority of fan tokens are used in Chiliz’s Socios app, Turkish exchange Bitci offers a competing fan token platform and has inked arrangements with the national teams of Spain, Brazil, and Uruguay, as well as Mclaren F1. Despite Bitci’s advances, Alexandre Dreyfus, CEO of Chiliz and Socios, is unconcerned about Chiliz and Socios losing their dominant market positions, stating that „we do not believe we have competitors; we believe we have people attempting to compete.“

Sale is over! Rangers Token pre-sale is completed!

Thank you to all our investors who bought Rangers Fan Token, which has sold out within seconds! @RangersFC#BitciTechnology #Bitcicom #Bitcicoin #RangersToken pic.twitter.com/bfwVLOKNhw

— Bitci Global (@bitcicomglobal) July 5, 2021

Socios‘ motto, „impact your team and earn rewards,“ draws analogies to governance tokens for decentralized autonomous organizations, or DAOs, which also have voting rights. A promising example of this is The Krause House DAO, which has a plan in place to acquire a „fan-owned“ National Basketball Association (NBA) club once it reaches a $2 billion treasury valuation.

The critical distinction from the DAO’s plan is that fan tokens as they currently exist do not include collective ownership of any sports club’s assets, nor are fans likely to be granted the ability to make material business decisions regarding significant matters such as player or coach recruitment.

And, despite the „utility“ role of fan tokens, it appears impossible for buyers not to view their fan tokens as investments in some capacity. Even Chiliz‘ IEO portal’s large risk statement advises that „users are strongly recommended to carefully evaluate their investing objectives“ before participating in the IEO. The similar opinion was expressed by Bitci CEO Alan Tan, who stated emphatically that „these coins will also serve as an investing tool.“

Fan concerns

There have been technical difficulties that have disappointed supporters – Chemez, for example, is disappointed since, despite Socios‘ sponsorship of Argentina’s national football team, he has difficulty to obtain complete verification via his mobile phone carrier in order to acquire tokens. „You cannot be the official sponsor of Argentina’s national football team and exclude Argentinians,“ he said.

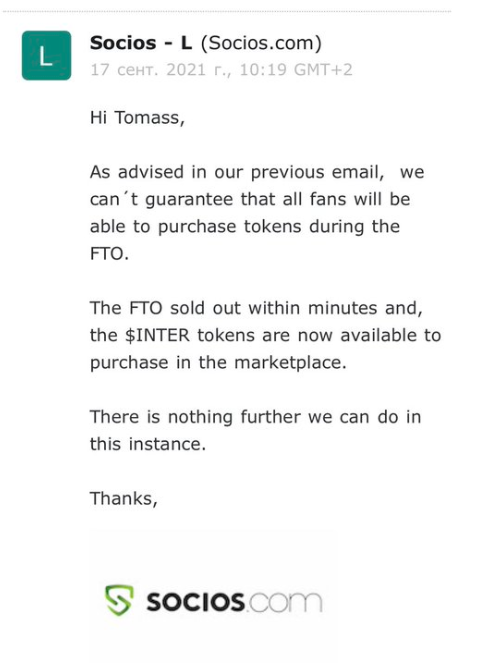

Even after verification, individuals such as Thomas Ragauskas have expressed disappointment after being unable to purchase tokens during an FTO due to the token supply being limited and selling out in 17 minutes.

Ragauskas tells how, after setting an alarm to guarantee he did not miss the event, he was forced to log out five seconds after launch due to a technical fault, as Socios explained it. „The system kicked me out of the app, and there was no way to re-enter,“ he explained, adding that when he did re-enter three hours later, all the tokens were gone. „The pre-sale price was €2, and it has been increased to €7. I desired to purchase 250 coins.“

Dreyfus, the CEO of Socios, is aware of the difficulties, stating that „a few growing pains are unavoidable“ when adding millions of people to the network. He is optimistic that with the addition of additional people, platform-related difficulties will be resolved and the company will be able to „provide the greatest possible experience for our users.“

“The velocity at which the business grew this year, especially over the summer, with multiple major new partners and fan token launches on a weekly basis meant that we had to move extremely fast to keep up.”

Lion’s share — tokens as club equity?

When Lionel Messi, one of the world’s most recognizable soccer players, signed a two-year contract with Paris Saint-Germain (PSG) following 21 years with Barcelona, a „substantial“ chunk of his $30 million signing bonus was paid in $PSG tokens. This was a source of pride for the club, which bragged that Messi’s tokens „instantly connect him to millions of PSG supporters worldwide.“ Messi’s entire stake in the tokens is minimal, but considering the token’s supply cap of roughly 20 million, it has a market capitalization of more than $500 million.

????????: Lionel Messi becomes first player in the world to receive Fan Tokens as part of signing package with @PSG_inside.$PSG ⚡️ $CHZhttps://t.co/4Fzm6HGTFG

— Socios.com (@socios) August 12, 2021

Thus, what utility do PSG tokens have for Messi, perhaps the team’s best player? He is unlikely to care about voting for „a motivational message on the dressing room wall“ or exchanging tokens for „personal video calls“ with his teammates or with himself. He has no choice but to hold them, hoping they appreciate in value, and eventually sell — possibly after his 2-3 year contract expires.

As a business, PSG has invested considerably in bringing Lionel to the team, and it makes sense for the club to align incentives with him, just like a firm would offer newly hired executives golden handcuffs in the shape of generous share packages.

Last week, we gave away 150 tickets/experiences to Fan Token holders, games, etc … That’s 20 a day, that’s 7,000 a year. It’s just the beginning of @socios investment in fan experiences. #bemorethanafan

— Alexandre Dreyfus (@alex_dreyfus) August 28, 2021

However, why sell stock when you can distribute hype-shares? After all, hype is the entertainment industry’s money. As the star, Messi is able to energize supporters, which results in cash for the club in the form of ticket sales, broadcasts, merchandise, and possibly PSG due to the association. Messi gets compensated monetarily for boosting the team’s brand power through this „hypequity.“ This is unsurprising for the club, which attributes the recent boost in „interest“ in PSG to „buzz surrounding the latest signing.“

Daytrading sports teams?

Sports betting is big business, worth an estimated $203 billion globally and employing roughly 200,000 people across 30,000 organizations. With an estimated $8 billion in revenue, the online fantasy sports business is a modest but growing power. With this in mind, it seems evident that merging the online community components of fantasy sports with „crypto betting“ and sports has enormous potential.

Though the Chiliz Exchange is the primary marketplace for purchasing fan tokens, which are traded against native CHZ tokens, other „conventional“ cryptocurrency platforms have entered the fray. Binance has listed many top-trading tokens, including FC Barcelona fan token (BAR) and Atletico Madrid fan token (ATM), in a bid to attract new customers who have been introduced to crypto through their favorite teams.

The ability to readily rotate fan token positions in the same way as stocks or other tokens encourages users to trade actively, a habit tacitly promoted by the Chiliz exchange’s stock market atmosphere.

Chemez concurs, stating that „if you’re clever, you can profit from the fan tokens even if you’re not a major fan.“ He believes that keeping the CHZ token for the long run, combined with occasional fan token trading, is a realistic approach.

While it is obvious that each club targets its own supporters in the IEO’s, there is nothing to prevent speculators and traders from entering the market — whom we may see as a new species of sports better.

However, there are concerns about fusing the two worlds, since individuals who are unfamiliar with crypto markets may be forced into a potentially addictive gaming experience. Clean Up Gambling, an advocacy group, has referred to Socios-style fan tokens as a „gateway into speculative cryptocurrency,“ implying that speculative cryptocurrency is a bad thing.

On the other hand, depending on how the sector evolves, the development of a proxy stock market for sports teams could have far-reaching implications for the entire industry, as privately held sports clubs could suddenly resemble public companies, with token holders representing a new type of stakeholder in the overall business. Players who do not earn stock in their contracts may receive a major amount of their bonuses in locked team-specific tokens whose vesting timelines may impact their loyalty to the team long after their contracts expire.

As entities in which anyone from anywhere in the world can invest indirectly without restriction, sports teams that generate sufficient excitement can progress from regional and national participants to truly international entities in the manner of multinational corporations.

Things become really interesting when DeFi, crypto games, decentralized social media, JPEGs, and community/social/fan tokens become composable with *each other*.

— Qiao Wang (@QwQiao) August 29, 2021

Additionally, the rise of fan tokens offers additional opportunities to an unknown digital and decentralized future. Consider the DAO-fication trend, which envisions decentralized autonomous organizations operating on the blockchain as serious competitors to the modern corporation. This means that pre-existing communities of fans — cryptographically organized fans — could serve as an excellent foundation for unknown future transitions.

Wild valuations, mild scarcity

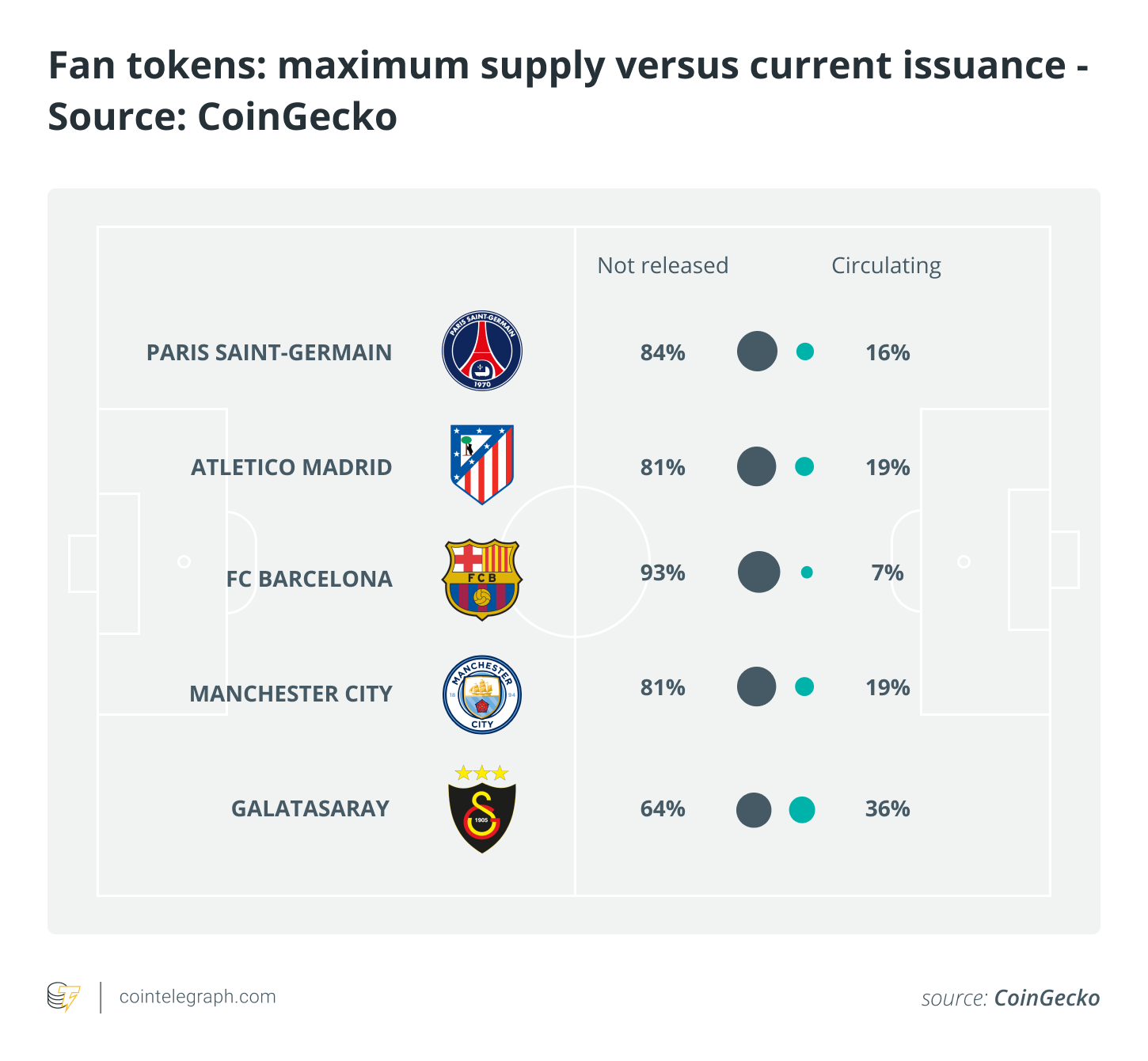

However, it is a long way off, and at the moment, fan tokens appear to be a risky option for seasoned cryptocurrency investors. While circulating supply and overall market capitalization are critical parameters, the Chiliz platform does not display them prominently, making it difficult for traders to make informed decisions.

CoinGecko reports that just a small part of the total issue of fan tokens has been distributed. Around 7.5 percent of FC Barcelona’s 40 million BAR tokens are in circulation, which means the club is sitting on over $600 million in unissued tokens at the current market value of $16 per token — theoretically adding about 10% to the club’s $5.76 billion valuation, or roughly an entire year’s revenue.

The figure is even more severe in the instance of Paris Saint-Germain, where the club’s $440 million in tokens accounts for 18% of its $2.5 billion paper worth — and there is no assurance the clubs will not continue diluting the supply indefinitely. It’s fascinating to speculate on the future implications of this on the genuine value of sports teams, as well as the legislative reforms that the fan token trend may generate.

While many uncertainties remain about how various forms of fan tokens may disrupt the entertainment business in the future, it is evident that they represent a new front of disruption in line with macro trends like as digitization, gamification, and globalization.

While such tokens provide fans with several new methods to interact with their favorite teams, one has to ask what aspects of sports will be lost to history as a result of this progress. With more accessible worldwide fan bases and active markets reacting to team progress on a daily basis, will tomorrow’s sports teams be able to retain their local roots or will they become global actors with little relation to their former hometown glory?