Ethereum has embarked on a stellar rally about the previous couple months. Since the March lows, the asset has attained about 400%, rallying from ~$90 to $425, the place it trades as of this article’s crafting.

The cryptocurrency, in the earlier month on your own, has gained 80%. It is not very clear what exactly has been catalyzing this rally, but analysts have suggested that it’s a confluence of at least 3 points:

- Bitcoin attaining toughness, both equally in price tag and in intrinsic worth because of to macroeconomic trends like dollars printing.

- Decentralized finance applications mainly based mostly on Ethereum garnering quite a few consumers, rising the demand from customers for ETH as gas.

- ETH suffering from an inflow of expense as scaled-down altcoins attain in price and as the current market recognized that the asset was oversold.

Blockchain analytics business Santiment, nevertheless, has just claimed that Ethereum’s medium-time period rally is at danger because of to on-chain components.

Related Studying: Crypto Tidbits: MicroStrategy’s $250m Bitcoin Obtain, Ethereum DeFi Growth, BitMEX KYC

Ethereum’s Medium-Time period Rally Is At Hazard: Santiment

Santiment claimed on August 18th that Ethereum is displaying some on-chain signals that it may possibly soon accurate lessen, even with sturdy fundamentals:

“However, on the shorter phrase scale, our everyday active deal with vs. price model continues to clearly show a about deficiency of exceptional addresses transacting on the community to maintain its present-day market cap. At the moment, $ETH looks to be outputting its 10th straight day of a bottom 10% sign when comparing its median DAA vs. its median rate.”

Chart from Santiment, a blockchain analytics agency, that demonstrates Ethereum's day by day active addresses vs. the selling price divergence design. Present as of August 18th.

The business added that except if Ethereum’s lively addresses “surge once more,” the “viability of $ETH‘s midterm rally may perhaps be set to the check.”

The rather modest number of buyers transacting on Ethereum arrives in spite of a spike in each day transaction counts. It can be claimed that large Ethereum transaction service fees, alongside with the complex experience essential to use DeFi, is forcing numerous consumers to sit on the sidelines as decentralized finance gains steam.

Prolonged-Time period Uptrend Is Intact

Whilst there is the quick-term possibility of a correction, Santiment suggests that Ethereum’s lengthy-time period uptrend is intact due to other on-chain tendencies:

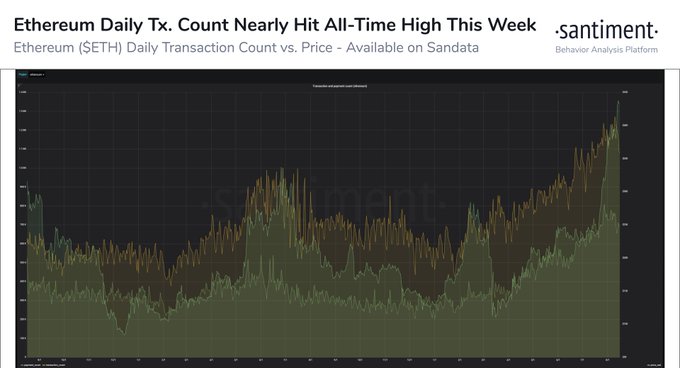

“The $ETH day-to-day transaction rely neared an all-time substantial this week. Its ATH of 1.34M was established back again on Jan 4, 2018 when #Ethereum had an average industry price tag of $1,042. Before this week its transaction depend was within just shouting length at 1.27M. $ETH transaction costs also broke all-time highs two days in a row, with charges of 17.8k $ETH (8/12) and 20.3k $ETH (8/13).”

Chart of ETH's selling price action with the range of day-to-day transactions from Santiment, a blockchain analytics company.

The firm discussed that these metrics achieving these levels is “a superior extensive-term indicator of factors to appear for #Ethereum holders.”

Associated Reading: Is Bitcoin Genuinely In a Bull Current market? Here’s Why Analysts Think BTC Is not

Featured Impression from Shutterstock Price tag tags: ethusd, ethbtc Charts from TradingView.com Soon after 80% Surge in a Thirty day period, Ethereum's Rally Is at Threat: Here's Why