___

(Updated at 18:15 UTC to clarify that Balancer Labs raised new funds by selling BAL tokens.)

Investments news

- Fold, a bitcoin (BTC) rewards app, announced a USD 13m series A round to fuel its growth. Also, the company has opened access to the bitcoin cashback debit card to all US residents. „Since its launch in 2019, Fold accrued a waitlist of over 250,000 awaiting access to their bitcoin cashback debit card,“ they said.

- Talos, an institutional technology provider for digital asset trading, also said it has completed a USD 40m Series A investment round.

- QuickNode, that has built out blockchain software for firms crypto-based and outside, raised USD 5.3m in a round led by Seven Six, based by Reddit Co-founder and Chairman Alexis Ohanian, with involvement from SoftBank’s Opportunity Fund, Arrington XRP Capital, Crossbeam.vc, and Anthony Pompliano, Amongst Others, Miami Herald reported. QuickNode’s new financing will be put toward developing headcount and growing its product offering, it added.

- Automated portfolio manager and trading platform on ETH (ETH), Balancer Labs (BAL), has raised USD 24.25m by selling BAL tokens directly from the Balancer Labs treasury in a financing round that comprised investors such as Alameda Capital and Pantera Capital. With the new capital, the provider intends to increase awareness and education of this protocol in the Asia-Pacific region, as well as increase community participation, the emailed release said.

- Crypto exchange Pintu, based in Indonesia, said it has raised USD 6m in a Series A funding round led by investors Pantera Capital, Intudo Ventures and Coinbase Ventures.

Economics news

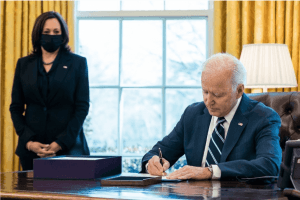

- US President Joe Biden will seek USD 6trn in US national spending for the 2022 fiscal year, increasing to USD 8.2trn by 2031, the New York Times reported. The growth is driven by Biden’s two-part schedule to upgrade the country’s infrastructure and considerably expand the social security net, included in his American Jobs Plan and American Families Plan, together with other planned increases in discretionary spending, “ it added.

Exchanges news

- Coinbase said it is launching a Fact Check section of the site, which will cope with“misinformation and mischaracterizations“ about either Coinbase or crypto.

- Coinbase also said they’re focusing on tailoring their“loading tests to better simulate real world scenarios, such as traffic spikes“ „This can help surface more issues such as untuned autoscaling principles, during controlled testing,“ the firm said in a May 19 Incident Post Mortem. „Another improvement which we’re investing in is the implementation of kill buttons for parts of the customer application so that when failures happen, we could keep unaffected elements of our applications working while we work to deal with the failures,“ they added.

DeFi news

- AllianceBlock, a property funding market, has announced the launch of its Liquidity Mining as a Service (LMaaS) merchandise,“breaking down barriers to entry for new DeFi projects and increasing the flow of capital across the sector,“ said the emailed press release. The product is targeting business newcomers, providing emerging endeavors with the means to produce their own customized liquidity mining systems, allowing them to deploy pools, launch liquidity mining and staking campaigns, and gain access to analytics tools to monitor key performance indicators. The very first decentralized fund (DeFi) job to leverage AllianceBlock’s LMaaS will probably be DAFI Protocol.

- Securitize, an electronic asset securities company, said it has launched Securitize Capital, LLC, a wholly-owned subsidiary, which will function as an alternative investment manager of digital asset capital to provide investors exposure to cryptocurrencies and decentralized fund (DeFi) in the kind of digital asset securities

CBDCs news

- A bipartisan bill called the 21st Century Dollar Act has been introduced, asking the US Treasury Department to evaluate the dollar’s role in the international market, but also consider specifics about central bank digital monies (CBDCs). These include other central banks‘ efforts to produce their very own CBDCs, as well as updates to the committee about the research and potential creation of their Digital Dollar CBDC.

Mining news

- American tech firm Nvidia still is based on PC gamers more than cryptocurrency miners for their earnings, the company’s CEO Jensen Huang told CNBC. However, their crypto-specific line of chips that found in February generated USD 155m in sales in the first fiscal quarter of this year–but that line is“a bone thrown into cryptocurrency obsessives to shield gamers,“ the article said.

Get your everyday, bite-sized digest of cryptoasset and blockchain-related information — exploring the stories flying under the radar of the crypto news.

____