Bitcoin’s current consolidation has thrown most investors for a loop: the vast majority are not much too confident what arrives up coming for the cryptocurrency market place.

Some, nevertheless, have created development in talking about the new selling price action. A person analyst noticed that stepping again and looking at BTC’s medium-time period selling price motion, the earlier a few months glimpse incredibly structurally comparable to a pattern from Might 2019.

Ought to Bitcoin proceed to monitor the trajectory it took previous time this particular marketplace structure was viewed, a sturdy surge will transpire in the coming months.

Linked Examining: Crypto Tidbits: BTC Retains $9k, Ethereum DeFi Gains Traction, Trump Talked BTC in 2018

Bitcoin Appears Just about Precisely Like It Did in Might 2019, Prior to a 50% Surge

A trader just lately shared the chart below, noting that Bitcoin’s price motion considering the fact that the March 12-13 crash to $3,700 appears to be very very similar to that viewed from April to early-June of 2019.

Both periods have a continuous uptrend, a vertical rally, then a choppy consolidation. Final yr, the choppy consolidation resolved increased, with BTC rallying 50% in two months from the ~$9,000 baseline of the rally to the $14,000 12 months significant.

Bitcoin investing as it did back again then will see it strike $15,000 by the conclude of the month.

Bitcoin value examination by trader "Caesar" (@Thrillmex on Twitter). Chart from TradingView.com

The anticipations that BTC will split greater from the current consolidation have been echoed by a details analyst.

He spelled out that in the past two decades, the current consolidation “is the 10th occurrence of $btcusd staying caught in a sub 20% range for for a longer time than 5 months.” Seven out of the nine historic consolidations have “led to a pump.”

Though it is not a 100% strike charge, this historical precedent suggests that there’s a bigger probability of Bitcoin’s latest assortment resolving bigger than resolving reduce.

Buyers Are Betting on Upside

Buyers are betting on the bull circumstance.

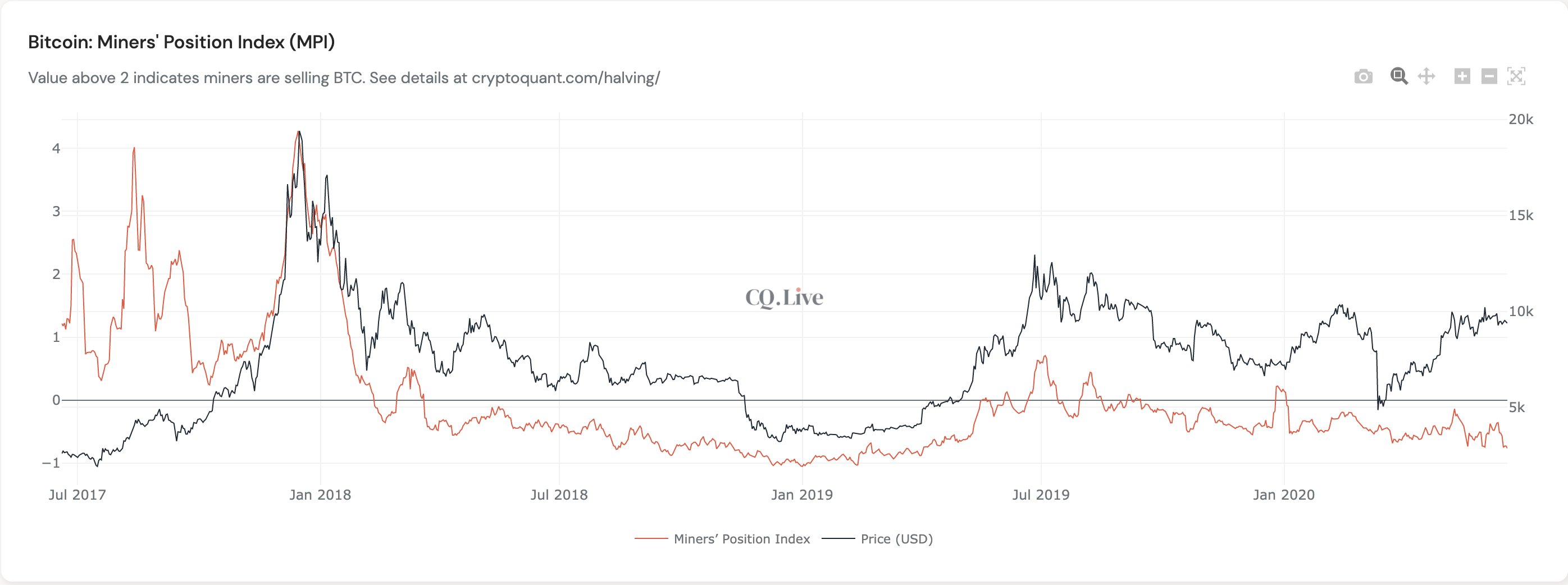

According to facts shared by CryptoQuant (CQ.stay), Bitcoin miners are scarcely selling any of the cryptocurrency that they maintain.

Bitcoin Miners' Position Index chart shared by company CryptoQuant (CQ.reside)

As can be witnessed in the chart over, the BTC Miners’ Situation Index (MPI) moves above zero when rates near a area peak. The metric is at this time nearing lows not viewed because the sector base in late-2018/early-2019, suggesting miners see equivalent probable in BTC to transfer higher.

Adding to this, Alistair Milne of Altana Digital Currency Fund lately observed that there is a growing quantity of Bitcoin that has not moved about the past calendar year:

“What if I informed you that the sum of #Bitcoin held without relocating for >12 months is on class to make new ATHs (>61%) and hardly altered in the March COVID panic … These degrees of HODL’ing have been past witnessed when the price was $200-500 back in 2015/16.”

This propensity to HODL among BTC buyers has the prospective to increase rates owing to offer-desire dynamics.

Similar Looking at: Very last 2 Times This Signal Was Witnessed, BTC Dove 50%. It is About to Occur Once more

Featured Impression from Shutterstock Value tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Very last Time BTC Seemed Like This, It Rallied 80% In Two Months