Bitcoin faces the prospects of going through a substantial draw back correction as on-chain information shows a plunge in its above-the-counter bargains.

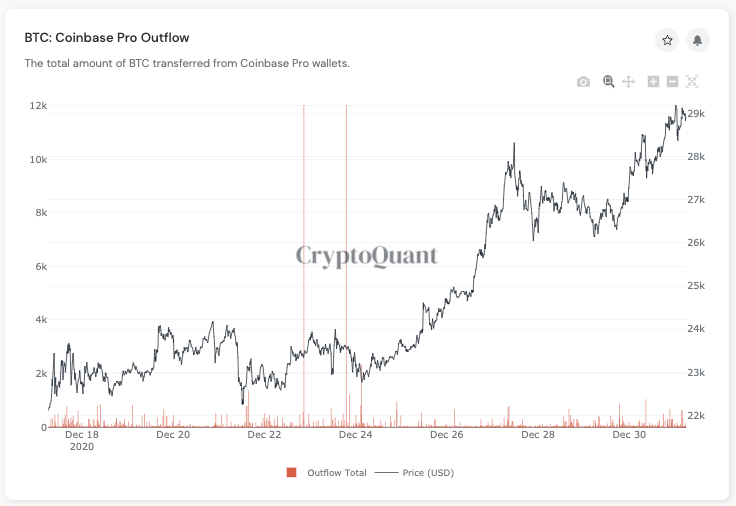

According to data fetched by CryptoQuant, the complete sum of Bitcoin tokens flowing out of Coinbase Pro’s addresses to their recently-created custodial cold wallets has reduced at any time considering the fact that BTC/USD crossed previously mentioned $23,000.

Coinbase Professional Bitcoin Outflow chart. Resource: CryptoQuant

As CryptoQuant’s CEO Ki-Youthful Ju observed before, these wallets maintain Bitcoin for important crypto-enabled corporations like Genesis Buying and selling (which purchases Bitcoin for Grayscale Investments, one of the greatest crypto accumulators) and Ruffer Investment (which acquired around $750 million truly worth of BTC final year).

That permits the facts analytics portal to equate big BTC transfers from Coinbase Pro to new wallets as OTC transactions.

Retail Involvement High

The statements appeared as Bitcoin logged a different all-time superior on Thursday, hitting $29,321 ahead of New Year’s eve. Its latest rally came on the backs of a devaluing US greenback and prospective buyers of new institutional investments into the cryptocurrency house, in particular just after Skybridge Capital’s major reveal that it retains Bitcoin really worth $182 million.

The news also coincided with a restoration in stablecoin inflows into all cryptocurrency exchanges from their December 13 very low. A CryptoQuant metric earlier this 7 days showed that the complete variety of stablecoin counts improved from 20,000 (BTC cost: $19,270) to 30,590 ($27,000).

Bitcoin rally pauses just after hitting $29,000. Supply: BTCUSD on TradingView.com

That confirmed that the rally to $29,000 was majorly retail-pushed, which further more amplified Bitcoin’s probable to proper lessen in the coming classes. Smaller and medium-capital traders are likely to offer the cryptocurrency at its local prime even though buyers with a long-term outlook use those dips to obtain it.

With OTC specials likely down, it may possibly be achievable that institutions are ready for the next Bitcoin correction to accumulate a lot more of its units.

“We haven’t experienced important Coinbase outflows due to the fact $23k, tokens transferred is lowering, and the fund stream ratio for all exchanges is escalating,” described Mr. Ju. “Still attainable that institutional traders would join at any time soon, but we could deal with a correction if it proceeds like this.”

The 2021 Bitcoin Forecast

Numerous analysts agree that Bitcoin’s rally has develop into overheated adequate to go through a price correction. Nonetheless, that has not modified their point of view about a bullish 2021 forward as prolonged as the Federal Reserve stays on its indefinite financial stimulus options to aid the US financial system by the coronavirus pandemic.

David Grider, the guide digital strategist at Fundstrat, mentioned in a take note that he expects the Bitcoin rate to contact $40,000 inside the up coming 12 months. He additional mentioned that the cryptocurrency might confront lots of bumps on its way upward, led by opportunity regulatory actions or mere profit-using.

“We wouldn’t look at these situations as lengthy-expression negatives for Bitcoin, but if this kind of situations unfold, they could negatively effects broader market place sentiment and prices,” Grider stated.