On June 25, Ether (ETH) will face its largest options expiry in 2021 as $1.5 billion worth of open interest is going to be settled. This figure is 30% larger than March’s 26 expiry, that happened as Ether cost plummeted 17 percent in 5 days and bottomed near $1,550.

But, Ether rallied 56% after March’s options expiry, reaching $2,500 within fourteen days. These motions were completely uncorrelated into BTC’s (BTC). For this reason, it is crucial to understand if a comparable market structure might be penalized for June 25 futures and options expiry.

Recent history shows a mix of bullish and bearish catalysts

On March 11, Ether miners organized a“show of force“ against EIP-1559, which could significantly reduce their revenues.

The situation worsened on March 22, as CoinMetrics established an“Ethereum Gas Report,“ saying that the highly expected EIP-1559 network update would unlikely solve the large gas problem.

Things started to change on March 29, as Visa announced plans to utilize the Ethereum blockchain to settle a transaction made in fiat, also on April 15, the Berlin update was successfully implemented. In accordance with Cointelegraph, after Berlin started,“the average gas fee started to decrease to more manageable levels.“

Before jumping to conclusions and comprehend if these phenomena of the Ether price bottoming close to the coming $1.5 billion options expiry are bullish or bearish, it is best first to examine just how big traders have been positioned.

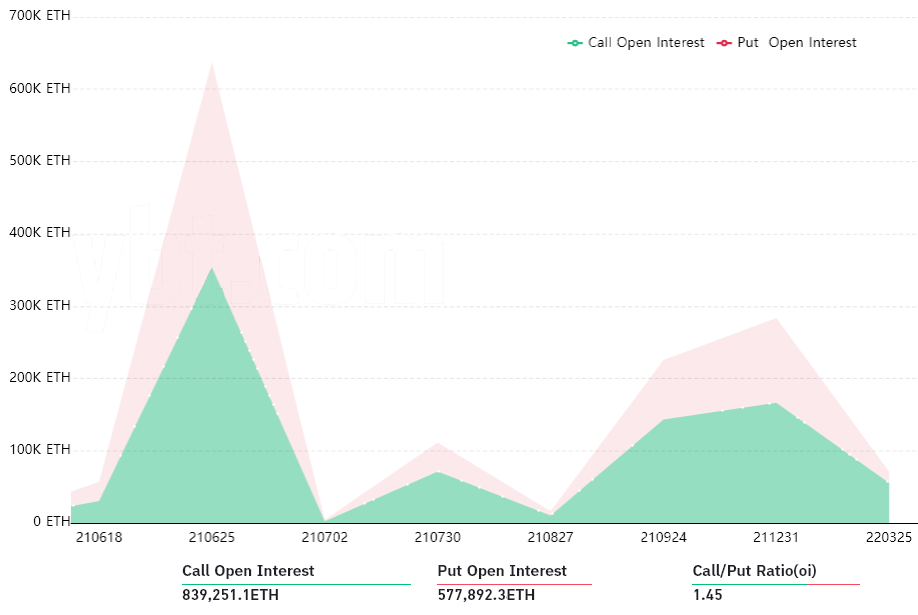

Take notice of how June’s expiry holds over 638,000 ETH options contracts, totaling 45% of their aggregate $3.4 billion open interest.

Unlike futures contracts, options are broken up into two sections. Call (buy) options allow the buyer to acquire Ether in a predetermined price on the expiry date. Broadly , these are utilized on impartial arbitrage trades or bullish strategies.

The place (sell) options are generally utilized to hedge or protect from adverse price swings.

For bulls, $2,200 is the line in the sand

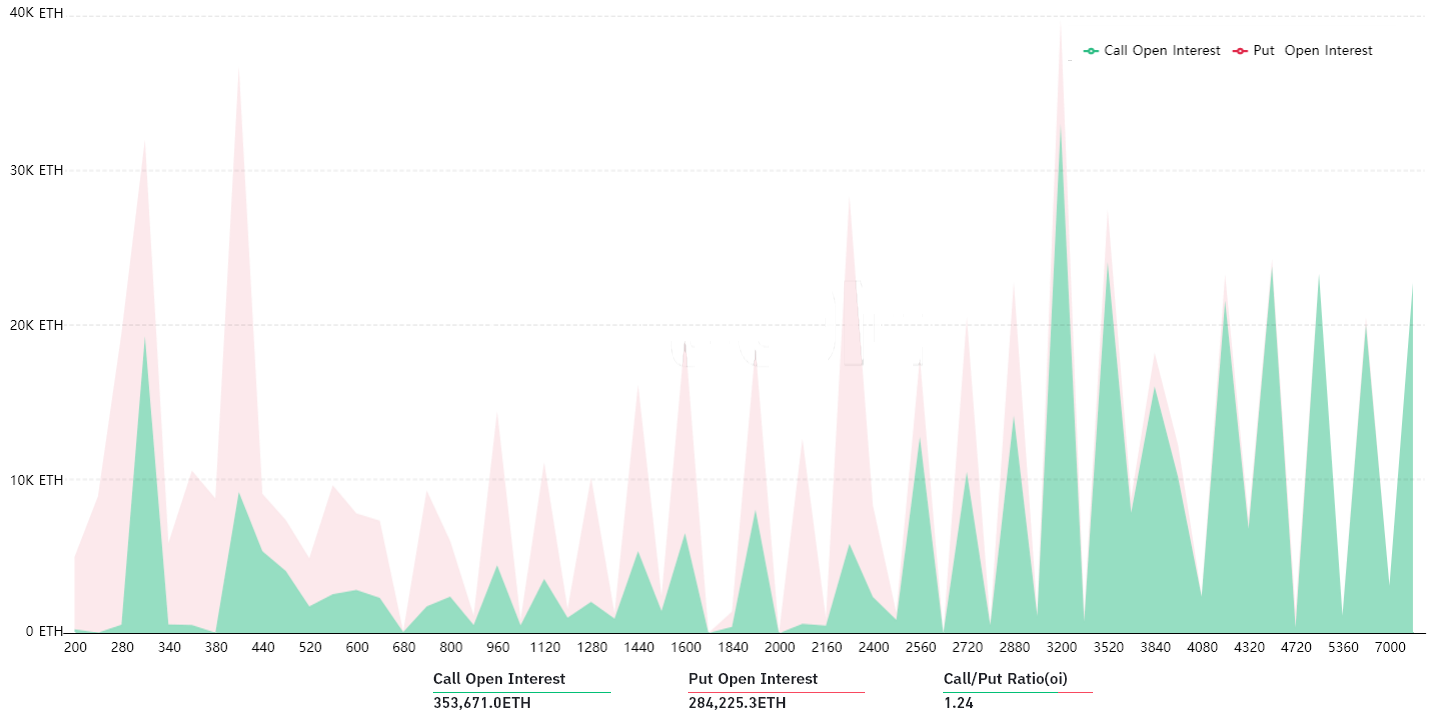

As displayed above, there is a disproportionate quantity of call options at $2,200 and higher strikes. This means that when Ether’s price on June 25 happens to be below this level, 73 percent of the neutral-to-bullish options will be useless. The 95,000 call alternatives still in drama would represent a $228 million open interest.

On the other hand, most protective put options are opened at $2,100 or lower. Consequently, 74 percent of these neutral-to-bearish options will become useless if the price stays above this level. Hence, the residual 73,700 put options would represent a $177 million open interest.

It appears premature to call who are the winner of the race, but considering Ether’s current $2,400 price, it looks like both sides are fairly comfortable.

However, traders should keep a close watch on this event, especially thinking about the price impact that encompassed the March expiry.

The views and opinions expressed here are only those of the author and don’t always reflect the views of CoinNewsDaily. Every single investment and trading move involves danger. You should conduct your own research when making a decision.