Ether (ETH), the native asset of Ethereum, has a strong chance of closing above $14,000 by the end of 2021, based on the striking similarity between its current trend and its trend from the previous year.

Ether price fractal

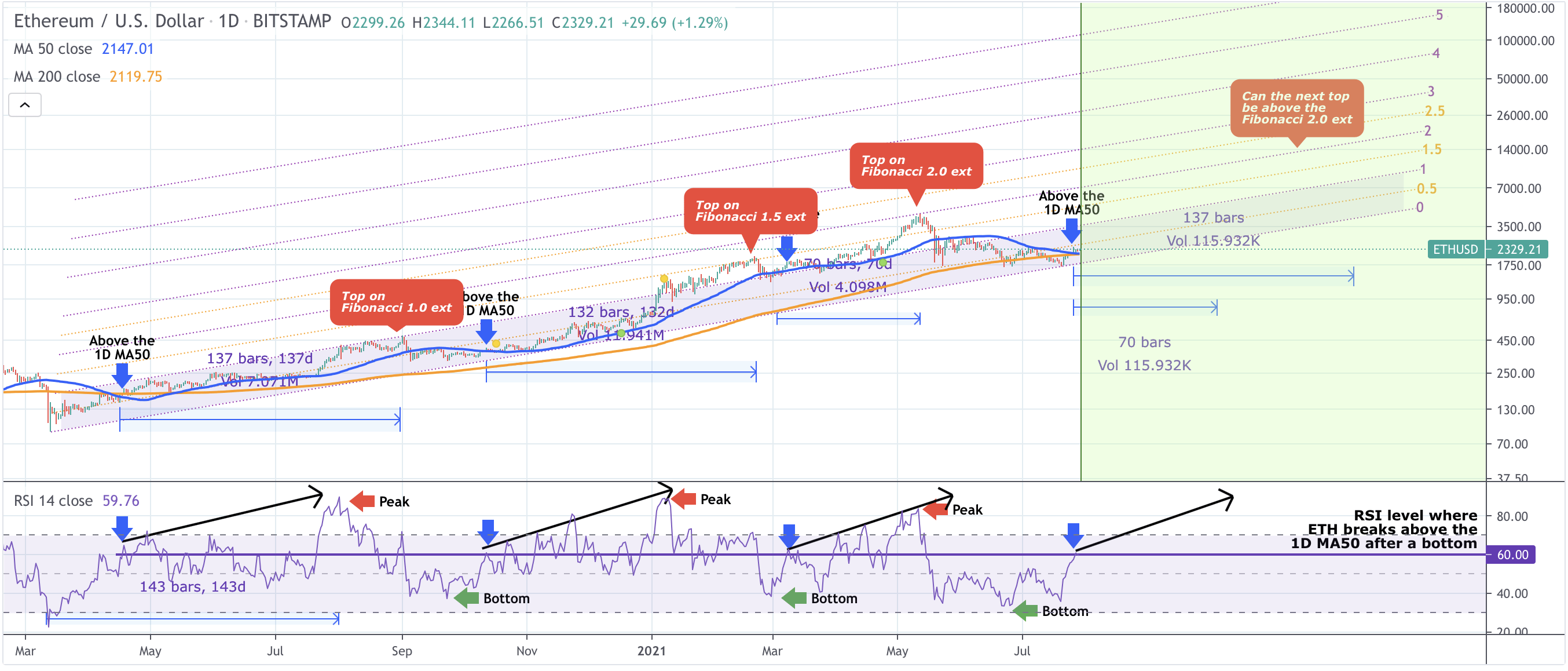

The Ethereum fractal, which was discovered by user TradingShot, is comprised of three technical indicators: a 50-day simple moving average (50-day SMA), a Fibonacci channel, and a relative strength index (RSI).

In July 2021, ether closed above its 50-day simple moving average (SMA), marking the first time since the bearish correction in May 2021.

According to TradingShot, breaking above the aforementioned moving average wave has historically predicted bull runs.

For example, a rally above the 50-day simple moving average (SMA) in April 2020 propelled the Ethereum/USD exchange rate from around $170 to over $500 in September 2020 — a span of only 137 days.

During the period of extreme upside gains, the daily RSI for Ether increased from 60 (neutral) to over 90, indicating a significant increase in momentum (overbought). The price of cryptocurrency has been moving up and down within a Fibonacci channel, which has served as an interim support and resistance level for it.

New all-time high anticipated

On a number of occasions, Ether has closed above its 50-day simple moving average and rallied higher within the Fibonacci channel, all of which occurred while the cryptocurrency’s relative strength index (RSI) oscillated between neutral and overbought levels, according to TradingShot.

In July of the following year, the exact same thing will occur.

The analysts predict that ETH will reach its next Fibonacci top in 132, 137, or 70 days, depending on the time frame used. If the 50-day simple moving average (SMA) is broken, ETH may reach its next Fibonacci top in 132, 137, or 70 days.

Additionally, as illustrated, the difficulty of the tops has increased incrementally each time: from 1.0 to 1.5, and most recently from 2.0 Fib in May.‘

The current price of ETH/USD may be tested, and on the subsequent upward leg, it may reach a high of $4,000.

At the same time, if the current uptrend continues, the pair has a good chance of reaching the 1.5 and 2.0 Fibonacci levels, which are equal to $6,000 and $9,000, respectively, in the not-too-distant future.

According to TradingShot, with each rally that occurs following a close above the 50-day simple moving average, Ether’s upside target moves one level higher on the Fibonacci scale, increasing its potential upside.

This means that the 2.5 Fib level, which is above $14000, could be the next price target for bitcoin in the near future.

Following that, the analyst stated as follows:

„Technically, we may assume that the next Top will be at 2.5 or higher but certainly that appears to be a very high level from the current prices especially if it technically „needs“ to be achieved in 137 days (or even worse 70 days) as the model suggests.“

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of CoinNewsDaily. Every investment and trading move involves risk, you should conduct your own research when making a decision.