When it comes to the cryptocurrency markets, the term „Ethereum killer“ is starting to acquire momentum once more, as the native tokens of multiple competing blockchain networks are registering strong increases during the month of September. It is necessary for every alternative network to have one important element that serves as the backbone of the Ethereum network in order for it to be regarded a member of this category. This feature is smart contracts.

As a result of this, the most significant blockchain networks in terms of market capitalization that typically fall under this jurisdiction are Cardano (ADA), Solana (SOL), Binance Smart Chain (BSC), Polkadot (DOT), and Terra (TRX) (LUNA). This year, the native currencies of these networks have experienced an incredible surge in value. Most lately, Solana (SOL) has been in the spotlight after the bulls who have been driving its ascent have kept it going even in the face of a market-wide selloff on September 8 that pushed Bitcoin back below $50,000.

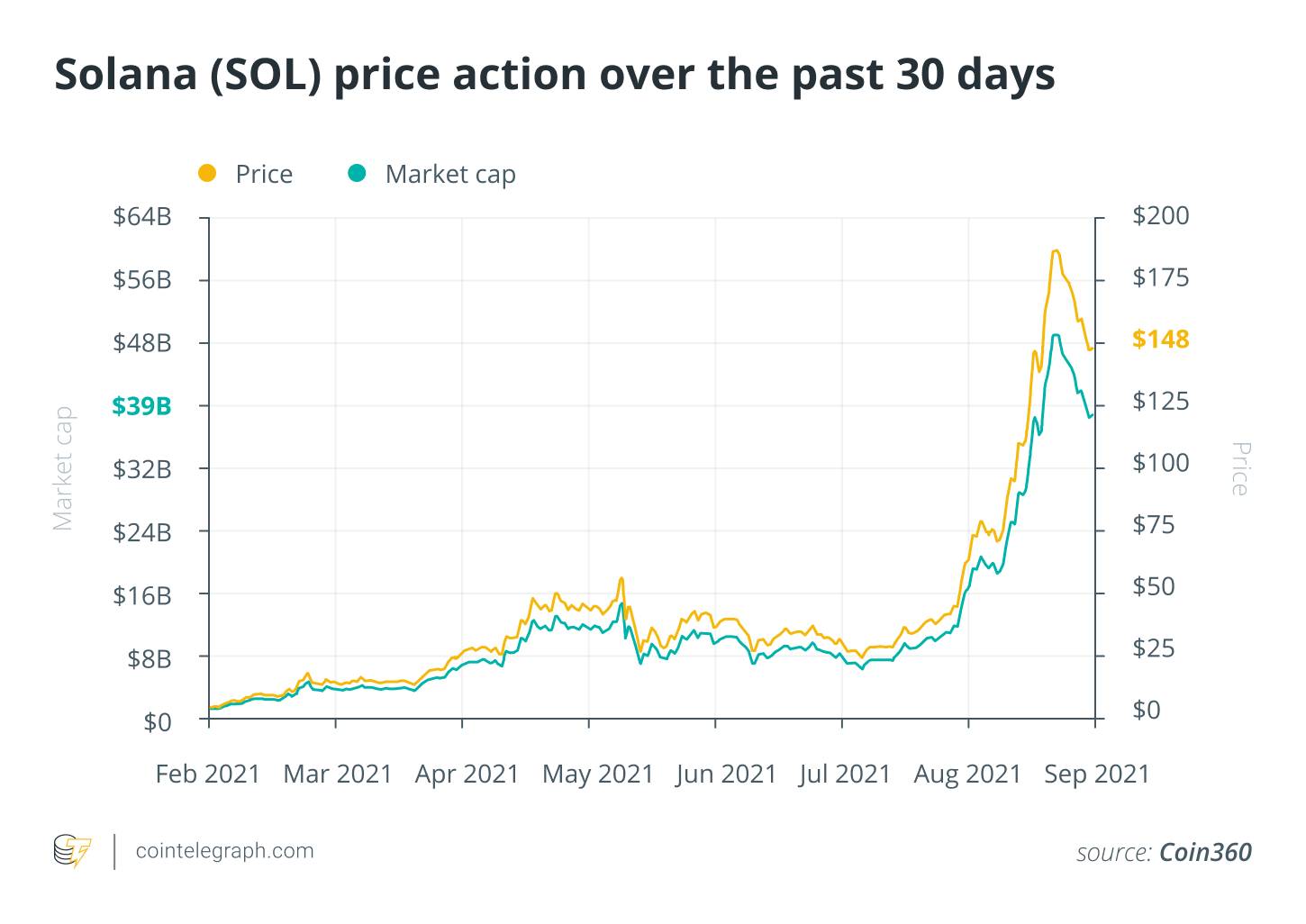

SOL’s price has more than doubled in the last 30 days, but it has since fallen and is currently trading around the $155 mark. The coin has gained more than 300 percent in the last 90 days, and it has gained an incredible 7,871.16 percent year-to-date, according to CoinMarketCap (YTD). In comparison, these gains dwarf ETH’s gains of 63.77 percent over the past 90 days and 385.36 percent over the past year. Ethereum’s market value is currently above $400 billion, which is nearly nine times greater than SOL’s market capitalization of $47 billion.

Ethereum killer tokens post gains

Numerous networks have demonstrated promising futures and advantages. Cardano recently completed its Alonzo hard fork, which enabled the network to run decentralized finance (DeFi) and Web 3.0 applications via Plutus-powered smart contracts. Even though the project’s native token, ADA, responded poorly to this milestone in the project’s roadmap, it has nonetheless seen a significant increase this year.

ADA is currently trading at about $2.40, having gained 74.16 percent in the last 90 days and 1,273.86 percent year to date.

Marie Tatibouet, chief marketing officer of cryptocurrency exchange Gate.io, explained to CoinNewsDaily why the Ethereum killer movement began. Concerning the network’s inability to scale, she stated, „As it stands, Ethereum is extremely slow and can only process 15-25 transactions per second with very poor throughput.“

She went on to explain how high demand and limited throughput result in the following cause, inflated transaction costs that are „a little out of hand.“ This could continue to have an effect on the market for nonfungible tokens (NFTs). „Do you really want to pay half an ETH in gas fees only to mint a JPEG?“ she inquired.

According to a spokesman for Solana Labs, „mining an NFT at peak levels can be quite pricey.“ Recently, a minting fee reached 3 ETH, exceeding the cost of many genuine NFTs. Solana provides faster speeds and lower pricing than Ethereum, which is essentially what market share is all about.”

Terra is another Ethereum killer possibility whose token has performed exceptionally well this year. Its indigenous token

LUNA is currently trading at about $36, having gained over 500 percent in the last 90 days and 5,477 percent year to date.

Such huge gains frequently catapult a token into the limelight as a result of its underlying platform and technology gaining more users and adoption rates growing. Lex Sokolin, co-head of global fintech and chief economist at ConSensys — a blockchain technology business that is a backer of Ethereum’s infrastructure — stated:

“DeFi protocols are applications that grow with the number of users and capital. It is likely that DeFi will be multichain and multipurpose, though the largest amount of liquidity will remain secured by Ethereum. However, expanding and incorporating other capital sources through bridges and exchanges is a net good for the ecosystem.”

Ethereum is currently in a critical stage of transitioning to Ethereum 2.0 (Eth2) — an entirely proof-of-stake (PoS) blockchain — following the London hard split that introduced critical improvements such as EIP-1559 — the aftermath of which is still fiercely debated in the cryptocurrency world. This Ethereum Improvement Proposal (EIP), which was approved by developers and miners, included a tweak to the network’s transaction pricing structure.

The modification primarily impacted the token’s inflation rate and miner’s revenue, as a percentage of gas fees are now burned as a result of the upgrade. According to data, approximately 311,300 ETH tokens worth nearly $1.1 billion had been burnt. The current burn rate is 2.7 million ETH tokens each year, which would result in a 2.3 percent inflation rate with the annual release of 5.3 million tokens.

Ethereum is not the only blockchain network to employ this pricing strategy; Solana burns 50% of transaction fees to control the supply of the SOL token. Additionally, a spokesman for Solana Labs stated, „The Ethereum London upgrade altered miner incentives.“ Some expected this would boost the MEV, and while solutions have been introduced to mitigate this, the cost of Ethereum transactions continues to operate as a barrier to entry.”

Ethereum is still dominant, according to on-chain data.

The native currencies of these so-called „Ethereum killer“ networks have seen significant gains, but a closer look at the on-chain statistics reveals that Ethereum’s utilization and volumes continue to outpace the rest of the smart contract platform market as a whole.

Ethereum presently has a market capitalization of more than $400 billion, making it much more valuable than the rest of the cryptocurrency industry as a whole. The nearest network in terms of market capitalization is Cardano, which has a market capitalization of $76 billion, which is less than a tenth of the value of Ethereum.

In accordance with data compiled by DappRadar, the total volume locked (TVL) in DeFi protocols built on the Ethereum blockchain is just over $100 billion, or slightly more than one trillion dollars. In terms of use, the second-placed blockchain network is the Binance Smart Chain (BSC), which has a TVL of $18 billion, which is less than 20% of Ethereum’s TVL in DeFi, according to CoinMarketCap.

During an interview with CoinNewsDaily, Samy Karim, BSC ecosystem coordinator at Binance cryptocurrency exchange, discussed the possibility of Ethereum preserving its market share once the transition to Eth2 is complete:

“It has to be quick, efficient and decentralized at the same time for DeFi to attain mass adoption. Ethereum is one of the first smart contract compatible chains that can leverage its pre-existing communities to grow once Eth2 is out, but it’s next to impossible to forecast its potential market share on the basis of its probable upgrade.”

Ethereum currently leads the market in the NFT space as well, with all of the major NFT platforms, including OpenSea, CryptoPunks, Axie Infinity, Rarible, and Decentraland, built on Ethereum. However, the entire NFT market has been labeled as a bubble by skeptics, with the Chinese Communist Party the most recent addition when it warned Chinese citizens about digital collectibles, and yet the market continues to grow.

Sokolin has expressed his dissatisfaction with this viewpoint, stating, „We disagree with the categorization of the NFT ecosystem as a bubble — it is a reconfiguration of digital media structure.“ […] NFTs provide a different path, and having a meaningful economic system enables the development of a new business model.”

The impact of this „bubble“ even going „bust“ is, however, limited for Ethereum. “NFTs or not, Ethereum is still the market leader when it comes to smart contract platforms,” says Tatibouet. The NFT market, on the other hand, has aided competitors in gaining a competitive advantage.”

As Ethereum gains momentum toward its final transition to a PoS blockchain, the financial markets‘ confidence in its potential grows gradually. A report by Standard Chartered Bank, a British multinational bank, discussed real-world use cases for the blockchain network and valued ETH “structurally” between $26,000 and $35,000. ETH is currently exhibiting bullish trading patterns such as cup and handle and has the potential to reach $6,500 in the coming months.