Ethereum rallied so significantly and fast in 2017 that there was a place at which analysts have been expecting the marketplace capitalization of ETH to flip that of Bitcoin. Fittingly, this party was dubbed the “flippening.”

But because the 2018 all-time superior, the cryptocurrency has deflated massively. A person Ethereum applied to get shut close to .15 BTC, but now it can invest in only around .025 BTC — a far more than 80% drop from the all-time high.

A developing selection of analysts are coming to the summary, even though, that it may well be time for Ethereum to achieve ground on Bitcoin after yet again. No matter whether the gains of 2017 and 2018 can be repeated, though, remains to be observed.

ETH Is Prepping for An Explosive Breakout

Ethereum is “coiling” for a breakout versus Bitcoin, in accordance to analyst Josh Olszewicz of Courageous New Coin.

He defined that the Ichimoku Cloud is “leaning bull” for the initially time considering the fact that 2018, while the 50-working day and 200-working day transferring averages tighten for a likely golden cross, supporting upside.

“ETH/BTC really coiling for a go primary into 2. period shenanigans. Cloud leans bull (not revealed) for initially time since mid-2018. golden cross poss shortly,” in accordance to Olszewicz.

Ethereum as opposed to Bitcoin value chart shared by Brave New Coin crypto analyst Josh Olszewicz. It demonstrates that the cryptocurrency is now poised to most possible head larger against BTC.

Olszewicz’s optimism has been echoed to a T by Raoul Pal, chief government of True Eyesight.

He mentioned following Ethereum’s recent outperformance that it “looks like Ether will outperform Bitcoin at some point (no place however),” referencing a important breakout taking place as also indicated in Olszewicz’s chart.

Connected Studying: The Ongoing Miner “Feeding Frenzy” Is Bullish for Bitcoin in the Prolonged Run

Ethereum Is Also Bullish Versus the U.S. Dollar

Notably, Olszewicz is also bullish on Ethereum’s general performance against the U.S. dollar, not just its functionality from BTC.

As noted by NewsBTC, the shared the chart viewed under about the time he released the abovementioned chart.

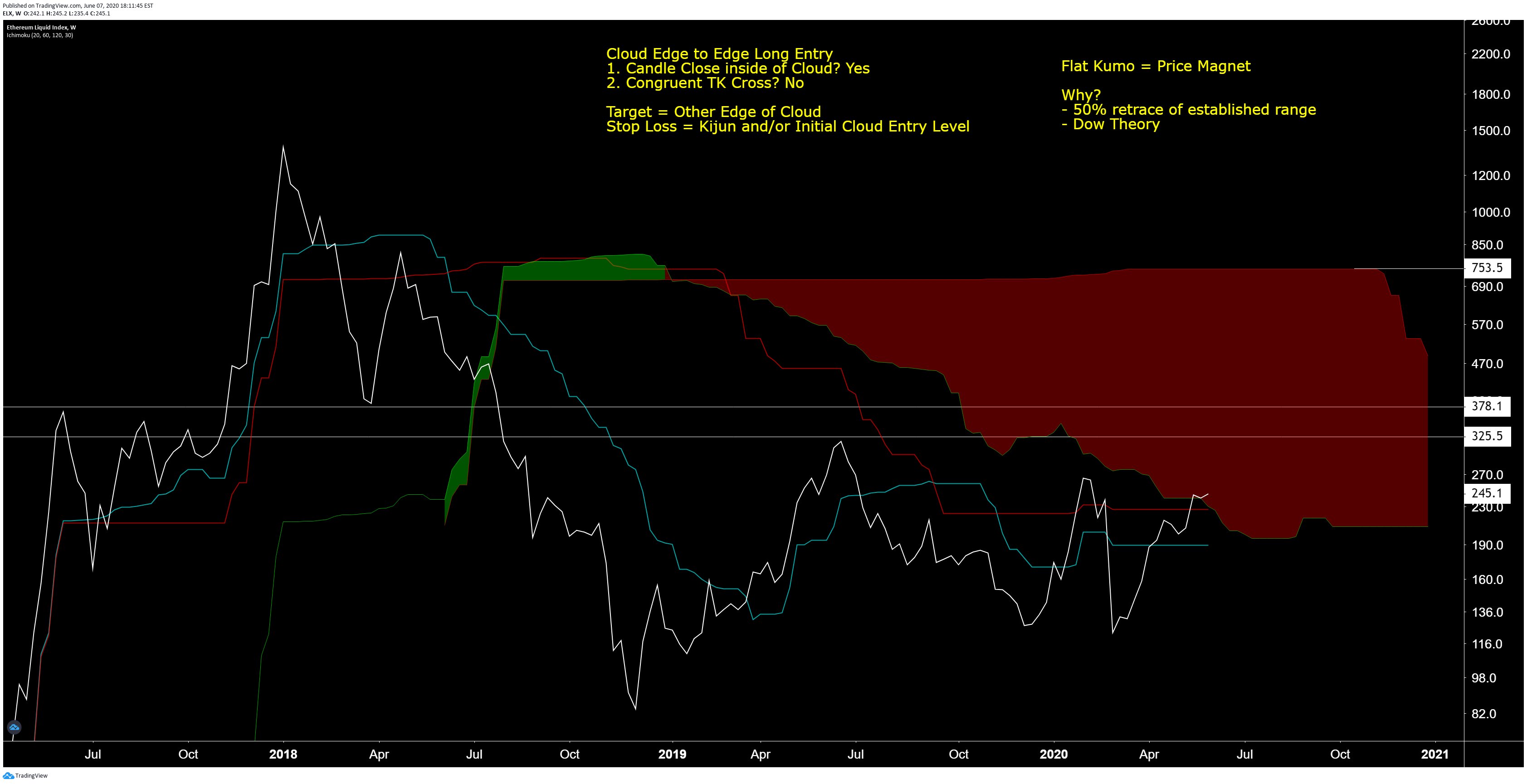

It demonstrates that Ethereum has entered into the crucial Ichimoku Cloud resistance, viewed shaded in crimson. Referencing how the asset is possible to rally to the other conclusion of the resistance in a so-identified as “end-to-finish shift,” Olszewicz remarked:

“One-7 days Ethereum chart. Conclude to end to $750 triggers in the following few months probably.”

Chart of Ethereum’s macro selling price motion from Brave New Coin analyst Josh Olszewicz.

Current market Catalysts Abound

Ethereum is likely to be buoyed by a quantity of current market catalysts playing out at the instant.

For a single, Ethereum-based mostly decentralized finance has witnessed raising adoption around the past number of months, with an growing number of retail buyers interacting with DeFi intelligent contracts and additional income flooding into this room.

In accordance to Ryan Selkis, chief executive of crypto researcher Messari, DeFi offers ETH a “higher ceiling” to rally towards n the prolonged operate. Whether this was in reference to Ethereum’s efficiency in opposition to the dollar or against Bitcoin was not manufactured crystal clear.

Just after the BTC bull run, I’ll start averaging into ETH once again.

+ electronic gold narrative will guide in this local weather, but stablecoin progress / DeFi offers ETH a increased ceiling

+ close to all time lows for the pair

+ allow layer 1 wars settle down, ETH 2. beacon chain start then invest in pic.twitter.com/cPBPmsBVk3

— Ryan Selkis (@twobitidiot) May 16, 2020

Connected Reading through: Crypto Tidbits: $200M of Bitcoin Liquidated, Ethereum DeFi Adoption Constrained, Bloomberg Is Bullish

Highlighted Image from Shutterstock Price tag tags: ethusd, ethbtc Ethereum Is "Coiling" for a Breakout as 2. Nears: Here's What Analysts Are Indicating