After reviewing Ether (ETH) choices for June 25, an individual might feel that traders either became overly optimistic or ultra-bearish. At this time, there are big bets for prices under $1,000 while others target for $3,800 and greater.

A current report from Coinshares reveals that multiple crypto funds have started seeing net inflows after weeks of record outflows. The report notes Ether automobiles saw a total of $47 million in inflows, bringing its market sprung around 27 percent.

DeFi expansion supports greater Ether costs

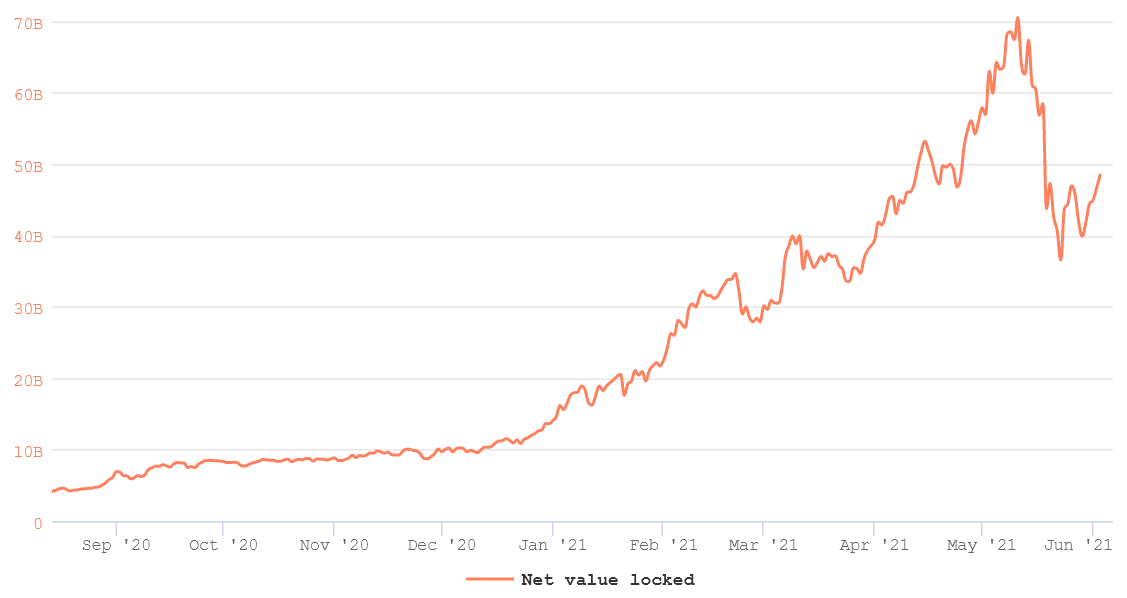

Another positive factor is that DeFi protocols maintain a $48 billion total worth locked (TVL) although the sector took a significant hit after the current Ether price crash.

The 57% growth over the past three months must please even the most optimistic investors, however crypto traders infamously subtract whatever situation took place over the latest weeks. So, as Ether dropped out of the 4,380 all-time large on May 12, investors quickly scrambled to put up protective places down to $400.

On the other hand, the much-anticipated transition into a proof-of-stake consensus model might be the root of the positive expectations. The EIP-1559 improvement proposition place for next month is yet another important stepping stone, and some traders have price goals ranging from $4,000 to $10,000.

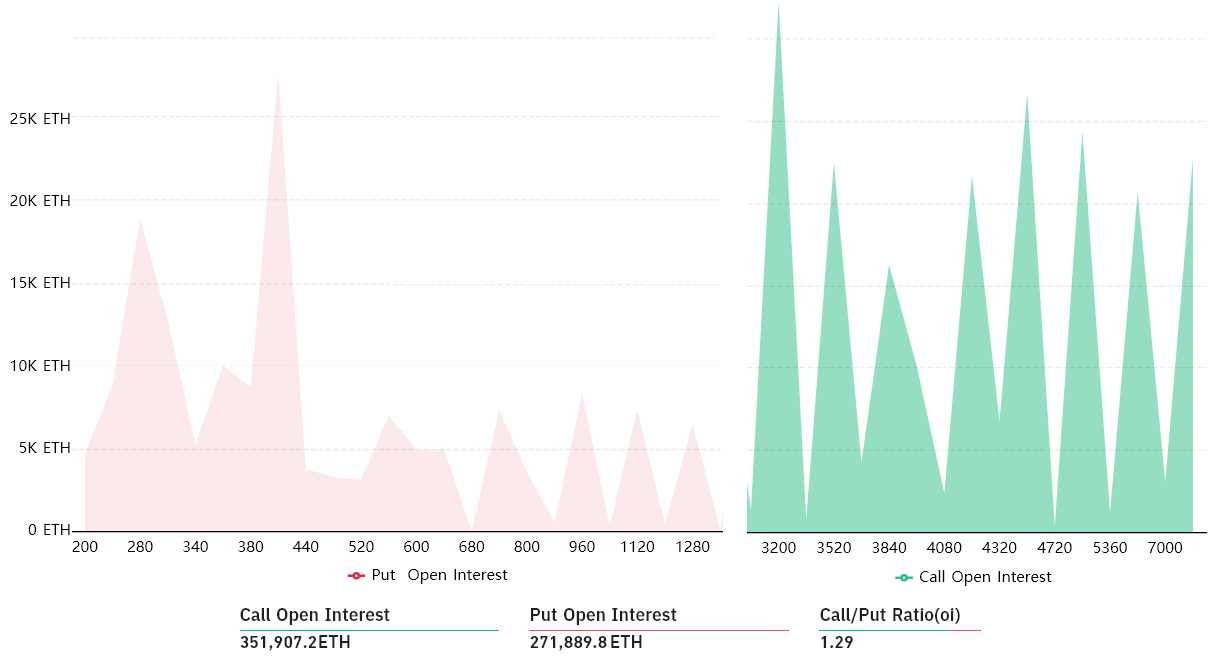

There are currently 623,800 Ether alternative contracts expiring on June 25, totaling a $1.75 billion open interest. The neutral-to-bullish call (purchase ) options are currently 29% more represented, but this call-to-put ratio uses an equivalent weight for every single attack regardless of its probabilities.

Bears spent more than $1 million constructing their rankings

However, considering the approximately three weeks left until the June 25 expiry, these contracts are trading under $32 each. The market value for those bearish options stands at $1.2 million.

On the other hand, bulls likely have exaggerated by buying call options at $3,800 and greater. All these 160,000 Ether contracts amount to some $450 million open curiosity but considering their current face value is under $80 each, their market value stands at $5 million.

Thus, bulls spent money setting up their position despite the similar open curiosity placed on both sides.

These out-of-the-money choices are an excellent means for options sellers to cash in the premium beforehand. The identical methodology can be applied for $2,100 put options and $3,800 call choices.

The perspectives and opinions expressed here are solely those of this writer and don’t necessarily reflect the views of CoinNewsDaily. Every single investment and trading move involves risk. You need to run your own research when making a determination.