The flagship cryptocurrency kicked off the 7 days on the ideal foot, mounting to a higher of $9,800 on Monday. But the upswing appears to have been important plenty of for some traders to take gain. Subsequently pushing the price of Bitcoin down to practically $9,000.

The sudden bearish impulse wiped out above $62 million worth of extended and shorter BTC positions on BitMEX on your own. No matter, a substantial amount of purchase orders ended up brought on all around the $9,100 help amount allowing Bitcoin to rebound quickly.

Bitcoin's $9,100 Aid Amount Retains Continuous. (Supply: TradingView)

The recent rate action despatched traders into “fear,” according to the Crypto Anxiety and Greed Index. Even with the negativity all over Bitcoin, a vital on-chain metric reveals that sizable alternatives are ordinarily offered when panic reigns the markets.

Bitcoin Is On the Cusp of Its Up coming Bull Marketplace

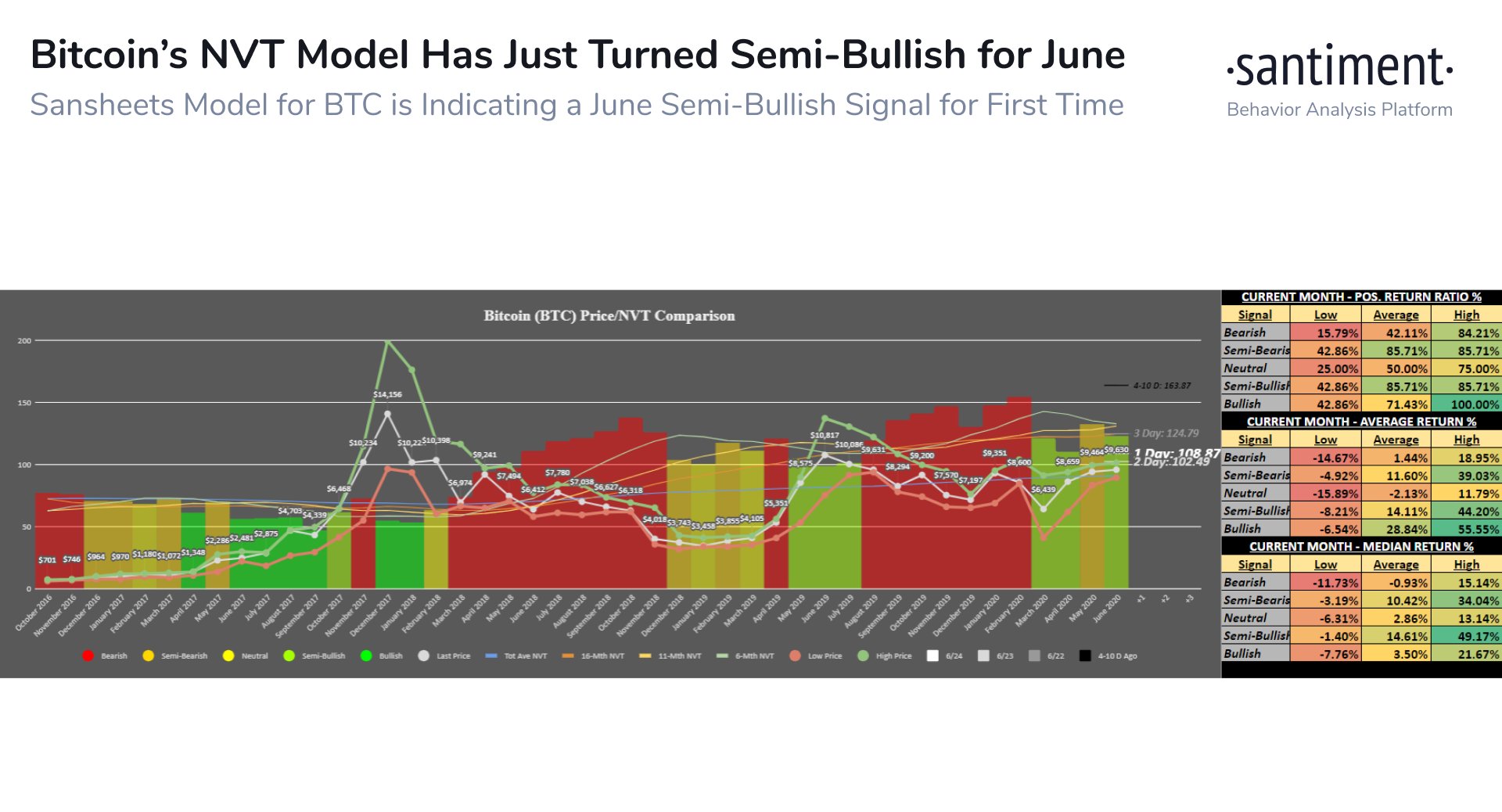

Santiment’s NVT Token Circulation Model estimates that there is a significant chance that Bitcoin will soon resume its background uptrend. This basic index usually takes into thought the recent valuation of the community and the value transacted inside it.

Dependent on these metrics, it would seem like “enough Bitcoin token circulation has been produced in June” to assist a further upward advance.

“History has demonstrated that this design has been rather precise in predicting when distinctive tokens are staying transacted at an ideal rate in comparison to present market place cap amounts. And soon after May’s sign correctly assessed that a leading was imminent, we are yet again observing an previously mentioned-average overall health in token circulation on $BTC’s community,” claimed Santiment.

Bitcoin's NVT Ratio Turns Bullish. (Supply: Santiment)

If history repeats itself, the present bullish divergence concerning value and token circulation will possible guide to a spike in need that allows Bitcoin to break over the $10,000 resistance amount ultimately.

Potent Resistance Forward of BTC

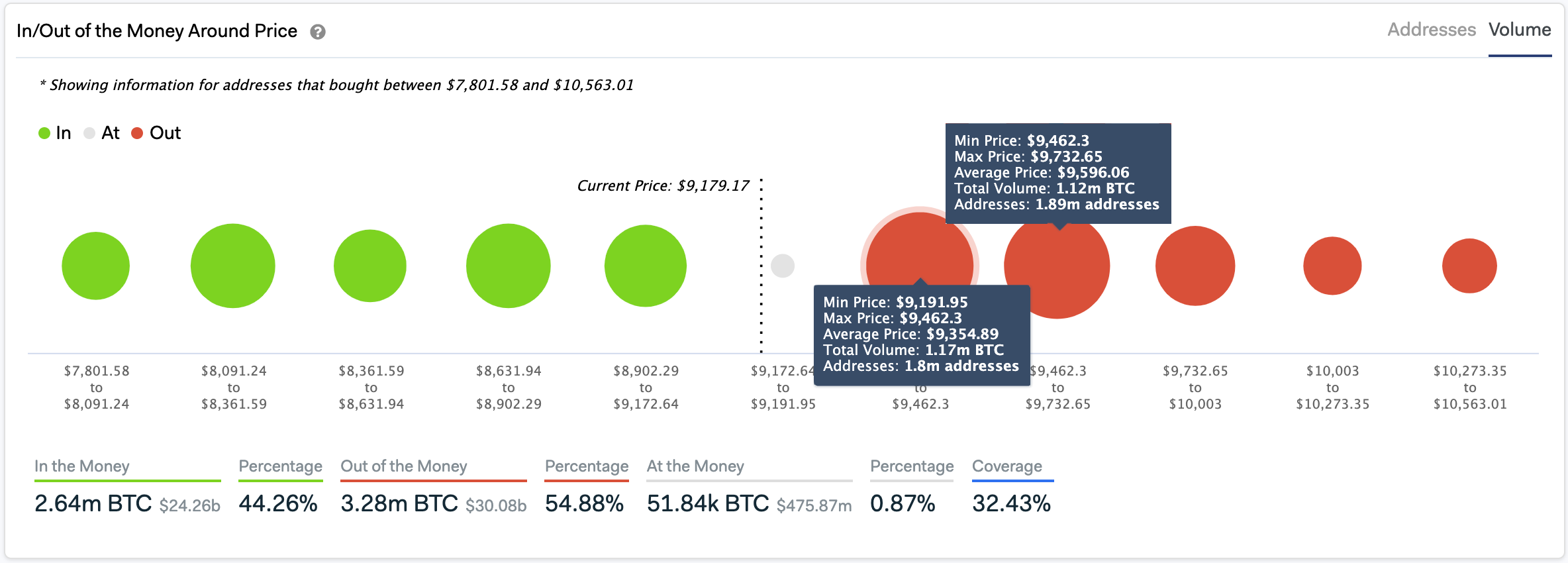

Even so, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) product reveals that there is a large supply wall forward of Bitcoin that it will have to prevail over in purchase to retest or prospective shift earlier $10,000.

Primarily based on this on-chain metric, about 4 million addresses purchased above 2.3 million BTC amongst $9,200 and $9,700. Holders within just this cost vary may well attempt to split-even on their very long positions in the occasion of a bullish impulse. For that reason, absorbing any upside strain.

But if demand from customers is sturdy enough, Bitcoin could rise toward $12,000 because there isn’t any other considerable barrier that will stop these types of an upward movement.

Bitcoin Faces Massive Resistance Ahead. (Resource: IntoTheBlock)

On the flip facet, the most significant support barrier sits amongst $8,600 and $8,900. Below, the IOMAP cohorts demonstrate that roughly 1 million addresses purchased about 626,000 BTC. This kind of a considerable source wall may possibly provide as powerful assistance in the function of a correction.

Now, it remains to be viewed regardless of whether help or resistance will split initially to paint a crystal clear photograph of where by Bitcoin could be headed following.

Featured by Shutterstock. Charts from TradingView.com