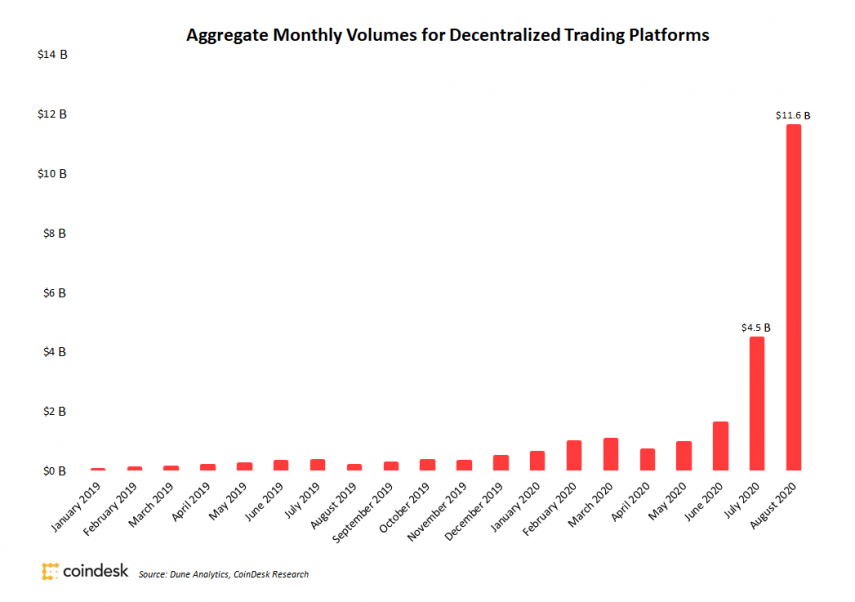

The to start with quarter of 2020 saw $5.1 billion included in volume to decentralized exchanges, 500% maximize from the initially 6 months in 2019.

Knowledge attained from coindex

Knowledge attained from coindex

This is designed doable thanks to the current rave that DeFi jobs have caught on, the DeFi spark ignited the improved use of DEX platforms and platforms this sort of as Uniswap, Bounce came to lifetime, raking in billions on day-to-day volume. In August 2020 it was noted that the day by day quantity of trades on Uniswap surpassed that of Coinbase Professional for the very first time as Uniswap included $1 billion in 24hrs volume owing to the explosion of the DeFi market place.

Now proven jobs would undertake the DeFi rave to achieve remarkable benefit when they listing on a DEX system, new assignments quickly adopted the DeFi theory, quickly everyone’s eyesight is modifying confront and having on the DeFi mantra. What appears to be like a substantial leap for the sector is starting off to sluggish down in momentum for pretty a number of clear motives.

Transaction charges: The difficulty of enhanced gas price has been a lingering difficulty for some time. Common current DEX aggregators, Uniswap and Bounce are developed on the Ethereum network, since of the massive variety of participants at a specified fast, Ethereum transactions would obviously slow down a whole lot, growing the selling price this kind of that Miners would only take on transactions with substantial fees. This by alone has slowed down the adoption of the DeFi marketplace. There is a need to glimpse at other productive chains that present less costly expenses and more quickly transactions.

Interoperability: At the moment there is no DEX protocol that enables for interoperations of many coins from diverse assignments. Only tasks under the Ethereum infrastructure can listing on Uniswap, exact for Bounce and PrimalBlock. It’s very restricting for the advancement and progress of the DeFi economy. With this limitation, cross partnership across distinct chains will not be attained, we will have competitors instead of collaboration.

Cross-chain swap: When interoperability is reached, a cross-chain swap of a pool of interoperable tokens becomes totally wanted. Supplying users the flexibility to make the swap from a single blockchain to a different without the need of incurring extra rates in a brief and efficient way solves the present difficulty in previously existing options, which have started to see a fall in functions in new instances.

Polkastarter protocol will be the to start with DEX aggregator to initiate the cross-chain swaps for interoperable tokens. The job is established to resolve the existing complications involved with DeFi Dex protocol in areas of fundraising, Auctions, and OTC trades. Polkastarter stands out when placed aspect by side with current options.

As described, no existing solution has gotten the cross-chain swimming pools integrated on their protocol save for Polkastarter community, we just can’t emphasize adequate the ease of performing enterprise this will produce. Only 1 of the existing solutions supports any kind of asset forms in the DeFi industry and even that is limited to Ethereum property.

The permissionless nature of Polkastarter DEX provides the community the correct to audit or read/produce the transaction in the network devoid of authorization. This way, jobs are frequently confirmed by both the team and members of the public through good deal auditing. By generating the aggregator general public for verification purposes Polkastarter has scored an remarkable objective in the net of transparency usual of a genuinely decentralized blockchain community.

Governance

Polkastarter delivers a missing ingredient in current protocols with the integration of the governance attribute on its network, holders of the $POL token, the formal token for the community will have the special correct to vote on merchandise capabilities, token utility, kind of auctions, and even decides which assignments get to be outlined, all of these will be fueled by $POL token.

Community involvement in the pursuits completed inside the protocol is important for improvement, increased faith in the protocol, and lengthy term existence of the platform. Some acknowledged DeFi protocols e.g. YearnFinance have adopted this strategy which has increased the advancement of the token worth to an unimaginable peak surpassing the value of Bitcoin.

By enabling all of these characteristics plus cross-chain swaps, Polkastarter is already established up to come to be the typical for DEX protocols, by remaining constructed on the Polkadot network, it implies that the network can cope with the significant viewers of the DeFi industry without having encountering a important setback. The network is analyzed and now exhibits strength. And in contrast to other current protocols, Polkastarter will guarantee simplicity of its UI/UX at ideal for every day end users who are not entirely common with how a usual Dex protocol works.