The Ethereum-based LEND, the native token for the Aave protocol, has noticed a beautiful performance about the past several months as DeFi has risen to prominence. The asset has acquired in excess of 5,000% from the lows of 2019. It now trades for $.76, up around 200% in the past thirty day period by yourself.

LEND’s rally has seemingly been unstoppable, with the asset running to climb exponentially right after the March capitulation. In accordance to a new examination, nevertheless, LEND may be achieving unsustainable heights.

Similar Reading: These 3 Tendencies Advise Bitcoin Is Poised to Bounce After $1,000 Fall

Ethereum DeFi’s LEND Could Appropriate as Selling price Is Seemingly Overbought

LEND has slipped 7% in the earlier 24 hours immediately after a rally on news of a good regulatory party for the Aave protocol.

The asset might be poised to reverse even further more to the downside as it seemingly remains overbought on a macro time frame.

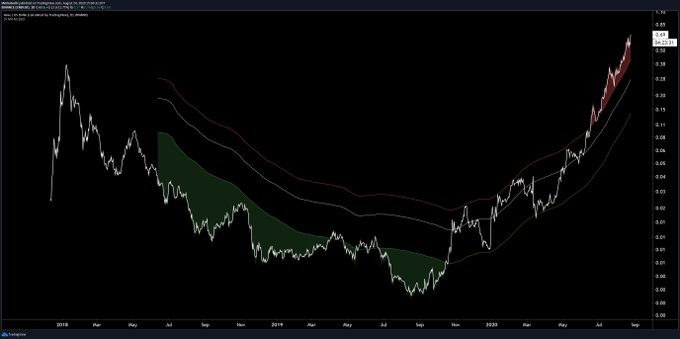

Brave New Coin analyst Josh Olszewicz shared the chart below on August 27th. It displays that LEND is earlier mentioned the two periods numerous of the a person-yr going ordinary.

Though this is the 1st time LEND has finished this as for each the chart, this signal indicates that the Ethereum coin is overvalued on a macro foundation.

Chart of LEND's cost motion more than the past few years with a MA multiplier evaluation by Brave New Coin crypto analyst Josh Olszewicz (@Carpenoctum oN Twitter). Chart from Tradingview.com

Related Looking through: Crypto Tidbits: MicroStrategy’s $250m Bitcoin Buy, ETH DeFi Boom, BitMEX KYC

Fundamentals Continue to be Optimistic

Whilst LEND may well be slipping in the in the vicinity of time period, the protocol’s fundamentals continue to be skewed good.

DTC Capital’s Spencer Midday remarked on the make any difference:

“One of the best alerts of PMF in #DeFi is if a venture can realize success w/o more incentives (liquidity mining). @AaveAave does not have LM nonetheless it’s nevertheless one of the greatest beneficiaries of new generate farming activity. At $1.26B TVL and only $759M mcap—the fundamentals are so powerful.”

Midday is talking about how Aave and LEND have been ready to improve organically, with out incentives like the liquidity mining fad that has taken Ethereum by storm around new weeks. The fact that it has accrued so considerably worth and adoption without the need of liquidity mining, Midday described, goes to demonstrate how the protocol’s fundamentals are “so solid.”

Kyle Samani of Multicoin Funds created a similar comment in response to Noon’s potent assertion:

“If I experienced to maintain a single Ethereum based DeFi asset for 2 yrs, it would be $AAVE. By far the greatest combination of: products/sector healthy, token distribution, local community, pace of innovation, and realistic valuation with upside to go.”

If I experienced to hold a single Ethereum dependent DeFi asset for 2 several years, it would be $AAVE

By much the greatest blend of: products/market match, token distribution, neighborhood, speed of innovation, and sensible valuation with upside to go https://t.co/onqnQQyxk7

— Kyle Samani (@KyleSamani) August 20, 2020

How these narratives will generate LEND’s selling price action in the close to term, however, stays to be found.

Showcased Graphic from Shutterstock Price tags: lendusd, lendbtc Charts from TradingView.com DeFi Darling Aave (LEND) May possibly Deal with Correction as Rate Reaches Overbought Ranges