One more 7 days, an additional spherical of Crypto Tidbits.

It’s been yet another dull week for Bitcoin. This may possibly sound like a damaged history at this point, but it is true. As the chart under exhibits, the top cryptocurrency has again been caught in the small-$9,000s for days on finish, failing to react to news gatherings and technicals.

Chart of BTC's value action more than the earlier week from TradingView.com

With Bitcoin failing to crack out in any route, volatility indicators have started to tighten even further more than they have been in June.

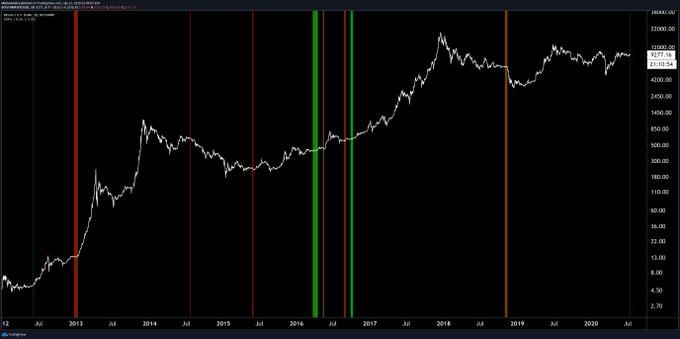

Brave New Coin analyst Josh Olszewicz shared the chart below exhibiting this. He observed that Bitcoin’s a single-day Bollinger Bands are at lows not viewed given that November 2018. This is important as what adopted in the consolidation in November 2018 was a 50% fall that took BTC from the $6,000s to $3,200.

Chart of BTC's macro value motion with the width of the Bollinger Bands indicator. Chart shared by Josh Olszewicz (CarpeNoctum on Twitter). Chart from TradingView.com

The existence of an particularly small amount of volatility as been echoed by Josh Rager, a co-founder of Blockroots. He said that the historical volatility index of the top cryptocurrency has arrived at a 40 looking at. “Every time BTC volatility [was] this minimal [over recent years], [there was] major value motion concerning 30% to 60% motion in the pursuing months,” Rager commented.

This, coupled with it quickly to be Q2 earnings time for Company The us, signifies that Bitcoin is most likely to see a large move in the in close proximity to future.

Sure cryptocurrencies are likely huge moves ideal now, while. Because of to what appears to be to be a change from a Bitcoin-centric narrative to a single based on DeFi and smart contracts, a swath of cryptocurrencies saw exceptionally sturdy performances this week regardless of BTC’s stagnation.

These contain Chainlink, Stellar Lumens, Monero, Ampleforth, Kyber Network, and Synthetix Network Token. Many of these cryptocurrencies observed good essential developments this 7 days, and thus have outperformed the rest of the sector.

Associated Looking through: Crypto Tidbits: TikTok’s Dogecoin Fad, Coinbase on Stock Marketplaces, Bitcoin Retains $9k

Crypto Tidbits

- Twitter Sees “Bitcoin Scam” That Rocks the On the net Entire world: It’s been quite the previous few days for Bitcoin and Twitter. Previously this week, a popular cryptocurrency trader with the moniker of “Angelo” tweeted out that he would be ‘running’ a paid out team for the 1st time at any time. Many quickly considered that the analyst’s account was hacked Angelo has been on BitMEX’s leaderboard, meaning his income operate in the hundreds of Bitcoin. Many thought that this was a a single-off, unfortunate occasion that afflicted a person of crypto’s prime personalities. But in the two hrs that followed, it was distinct that something else was up. As quite a few visitors probably know, the Twitter accounts of Elon Musk, Barrack Obama, Joe Biden, Kanye West, Uber, Apple, and plenty of other outstanding stars and corporations (in the crypto area as nicely) tweeted out a Bitcoin rip-off. Thanks to the extent of the accounts hack, the information went viral, acquiring picked up by key information stations and catching the consideration of the FBI. As the hack was the latest, that has nevertheless to be a breakdown of what just took place and what the hurt is basically like.

- Elon Musk Tweets About Dogecoin… Once more: Elon Musk just tweeted about Dogecoin all over again. When questioned about the aforementioned Twitter scam, the well known Tesla and SpaceX CEO responded by stating: “Excuse me, I only offer Doge.” He released the tweet beneath minutes following the abovementioned comment. The graphic shows a sandstorm, tagged “dogecoin typical,” engulfing a town, which is tagged as the “global money procedure.”

It’s inevitable pic.twitter.com/eBKnQm6QyF

— Elon Musk (@elonmusk) July 18, 2020

- Grayscale Is Looking at Massive Institutional Inflows: In accordance to Grayscale Investments’ Q2/H1 report, the company’s flagship solution, the Grayscale Bitcoin Have faith in, has seen robust inflows over the earlier number of months mainly from establishments. The facts indicates that traders allotted a full of $1.4 billion into all of the company’s solutions, which averages out to $43.8 million for each 7 days. “With so much influx to Grayscale Bitcoin Rely on relative to freshly-mined Bitcoin, there is a sizeable reduction in provide-facet force, which could be a favourable indication for Bitcoin cost appreciation,” the enterprise famous in their most up-to-date report.

Highlighted Impression from DepositPhotos Price tags: Charts from TradingView.com Crypto Tidbits: Twitter's "Bitcoin Rip-off," Elon Musk & Dogecoin, Institutions Want BTC & ETH