A different week, a different round of Crypto Tidbits.

The past seven days have been volatile times for Bitcoin and other cryptocurrencies. The cryptocurrency on June 1st rallied past $10,000 for the 1st time in a lot of weeks, reaching as high as $10,400.

It was an explosive transfer that experienced lots of expecting a lot more upside. One Wall Avenue analyst went as much as to say that the breakout past $10,000 was the largest in BTC’s storied heritage.

But just as quickly as Bitcoin rallied, the asset tanked. Just 24 several hours immediately after the asset moved into the five digits, it plunged by $1,600 in 3 minutes on BitMEX, falling as small as $8,600 as longs had been squeezed out of their positions.

Bitcoin selling price chart from TradingView.com

Due to the two explosive moves — a single to the upside and one to the downside — over $200 million really worth of derivatives on BitMEX by itself ended up liquidated.

Analysts are at present divided as to what to make of this crypto market selling price motion.

One particular outstanding technological analyst, John Bollinger, creator of the “Bollinger Bands” indicator, is bearish. He a short while ago wrote that buyers in BTC should be careful at present price ranges:

“The is a Head Phony at the higher Bollinger Band for $btcusd, time to be cautious or brief.”

Other folks have been additional optimistic. Mike McGlone of Bloomberg’s commodities investigation desk released a report this 7 days on the crypto sector.

In it, the strategist claimed that a thing will require to go “really wrong” for Bitcoin not to rally. McGlone cited a confluence of essential factors, like the funds printing by central banks, the adoption of futures, the advancement of Grayscale Investments, and the block reward halving.

Related Looking through: Crypto Tidbits: Bitcoin Nears $10k, Goldman Sachs Talks Cryptocurrency, Chinese Yuan Slumps

Bitcoin & Crypto Tidbits

- Crypto Use Circumstance Swells as Trump Goes Just after Twitter: There’s been a controversy brewing among President Trump and social media platforms like Fb and Twitter over the previous 7 days. Twitter flagged an election-similar tweet from the American chief as one thing that needed to be “fact-checked.” In accordance to Su Zhu of A few Arrows Money, the ongoing battle amongst the Administration and these social media companies will assist crypto’s “web 3.0” use case:

“With the the latest politicization of facebook, google, and other bigtech social media giants, the website3 thesis for crypto has by no means been as underrated as it is now.”

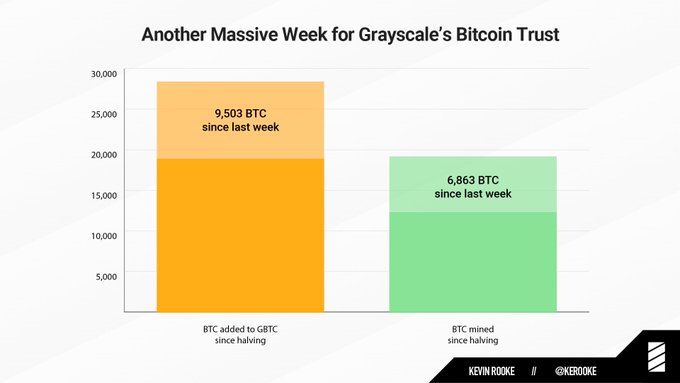

- Grayscale’s Shoppers Are Accumulating Bitcoin at a Immediate Speed: According to know-how knowledge analyst Kevin Rooke, Grayscale Investments has viewed an inflow of Bitcoin expenditure exercise over the past few weeks. Rooke observed that the crypto financial investment firm, which solutions mostly institutional consumers, has acquired 9,503 Bitcoin in the past 7 days on your own. In the course of that same time body, miners created 6,863 coins.

Picture of Bitcoin accumulation by Grayscale Investments from cryptocurrency and technological innovation data analyst Kevin Rooke (@kerooke on Twitter).

- Grayscale Sees Mass Ethereum Expense As Well: Grayscale’s other flagship product, the Ethereum Trust (ETHE), has viewed a identical frenzy of expenditure. A leading analyst pointed out that the selling price of a share of the Have confidence in a short while ago traded as high as $240, which is notable for the reason that every share is only backed by .094 ETH. That is to say, the buyers paying for the Grayscale Ethereum Have confidence in on secondary markets ended up valuing ETH at $230 billion, better than Bitcoin’s market place capitalization of all around $175 billion.

- Ethereum DeFi Could See Slowing Adoption: According to Multicoin Capital’s Kyle Samani, the adoption of DeFi is possible to gradual thanks to very clear “latency” difficulties with Ethereum:

“You just can’t construct world scale trading methods for a lot of people on POW chains. It just doesn’t operate. Substantial latency –> all forms of damaging next order results. So I imagine for now we are around a plateau for DeFi – measured in ETH conditions (not USD) – right until the core latency difficulties are solved.”

- Fidelity Investments Expects Increasing Institutional Adoption: In accordance to a recent study executed by Fidelity Investments, a $2 trillion asset supervisor centered in the U.S., digital property will “continue to attain adoption and fascination by a selection of institutional investors.” This confirms a report released by the business past year, which located that 47% of institutional traders “view digital belongings as getting a location in their expense portfolios.”

Related Looking at: This Crypto Use Situation Has Hardly ever Been as “Underrated” Owing to Twitter and Trump

Showcased Picture from Shutterstock Cost Tags: xbtusd, btcusd, btcusd Crypto Tidbits: Bitcoin Sees Huge Volatility,