Crypto is set to advantage immensely in excess of the coming years as the wheels start off slipping off the fiat system. Even though stimulus initiatives could have delayed the social and financial affect of the problem we deal with, it is starting to be a lot more apparent that kicking the can down the street only proliferates the difficulty.

A mass awakening to this is sweeping across the world, as more folks arrive to the realization that there is a little something deeply wrong with the present fiat process.

With that, the search for choice means to exchange benefit has crypto in competition. And whilst no-just one at present is aware of all of the answers to the practicality of this scenario, centered on the Venezuela example, it is only a subject of time right before fiat is littering US streets.

In Venezuela fiat currency is literally garbage. pic.twitter.com/cVYEw1kLoa

— Dan Hedl (@danheld) May well 30, 2020

Firms of all Dimension are Having difficulties

Smaller firms account for 50 % of the US GDP and utilize 48% of US staff. But a current survey executed by LendingTree reveals that optimism from little business enterprise entrepreneurs is at a very low.

As little firms start to re-open up throughout the US, numerous tiny business entrepreneurs are expressing reluctance to do so. The primary reason provided is is a lack of liquidity. This can only mean that the trillions printed so far have not observed their way to exactly where it is wanted most.

“Approximately 46% of tiny business enterprise house owners cite funding as the most important impediment to reopening, and that at the time open, elevated wellbeing and basic safety measures could even more stifle product sales.”

As devastating as that is for the US economic system, big firms as a full are not fairing any improved, specifically those people that work in the journey and auto sectors.

The greatest scalp to occur undone recently is Hertz, which filed for personal bankruptcy safety in the US following it failed to satisfy a payment deadline with lenders. The 102-year motor vehicle rental small business relies heavily on income from airports, which has all but dried up as vacation limitations were being enforced.

The knock-on impact is observing a glut of cars and trucks flood the applied sector, as Hertz desperately attempts to liquidate belongings.

Adverse Rates Incoming?

With that, the Fed, and central banking companies close to the earth, are rapid managing out of possibilities. A person thing left to attempt is unfavorable interest costs. Or in the case of the European Central Bank and Financial institution of Japan, even further adverse charges.

The theory holds that business banking companies would shell out curiosity on the deposits they keep with the central financial institution. This, in turn, would persuade commercial banks to limit individuals deposits by lending resources, and so economic activity is stimulated as borrowers invest.

Passing this down the line at a retail level signifies debtors are paid out to borrow dollars, but savers are penalized for being prudent.

As backward as that seems, President Trump is all in with this idea. He not too long ago tweeted his approval of adverse fees by calling it a “gift.”

Source: twitter.com

As considerably as crypto folk like to bash Peter Schiff for his anti-Bitcoin stance, his reaction on this matter tends to make total sense. In reply to Trump, he raised the point of this becoming a small expression fix by stating:

“Adverse charges are not a present. They are a transfer of prosperity from savers to debtors. But the inflation established to make negative rates doable will hurt wage earners way too, moreover the total overall economy will be considerably less effective and dwelling expectations will be lower as a outcome.“

Crypto Can Capitalize From the Madness

The operative word listed here is backward. This sort of has been the absurdity of economic procedures to day that we now probably locate ourselves in a scenario in which savers shell out banking companies for the privilege of keeping their cash.

Notwithstanding the inflationary factor of about stimulus, the actual concern is the place do savers switch in the event of damaging rates? And the respond to is to a more true absolutely free market place in crypto.

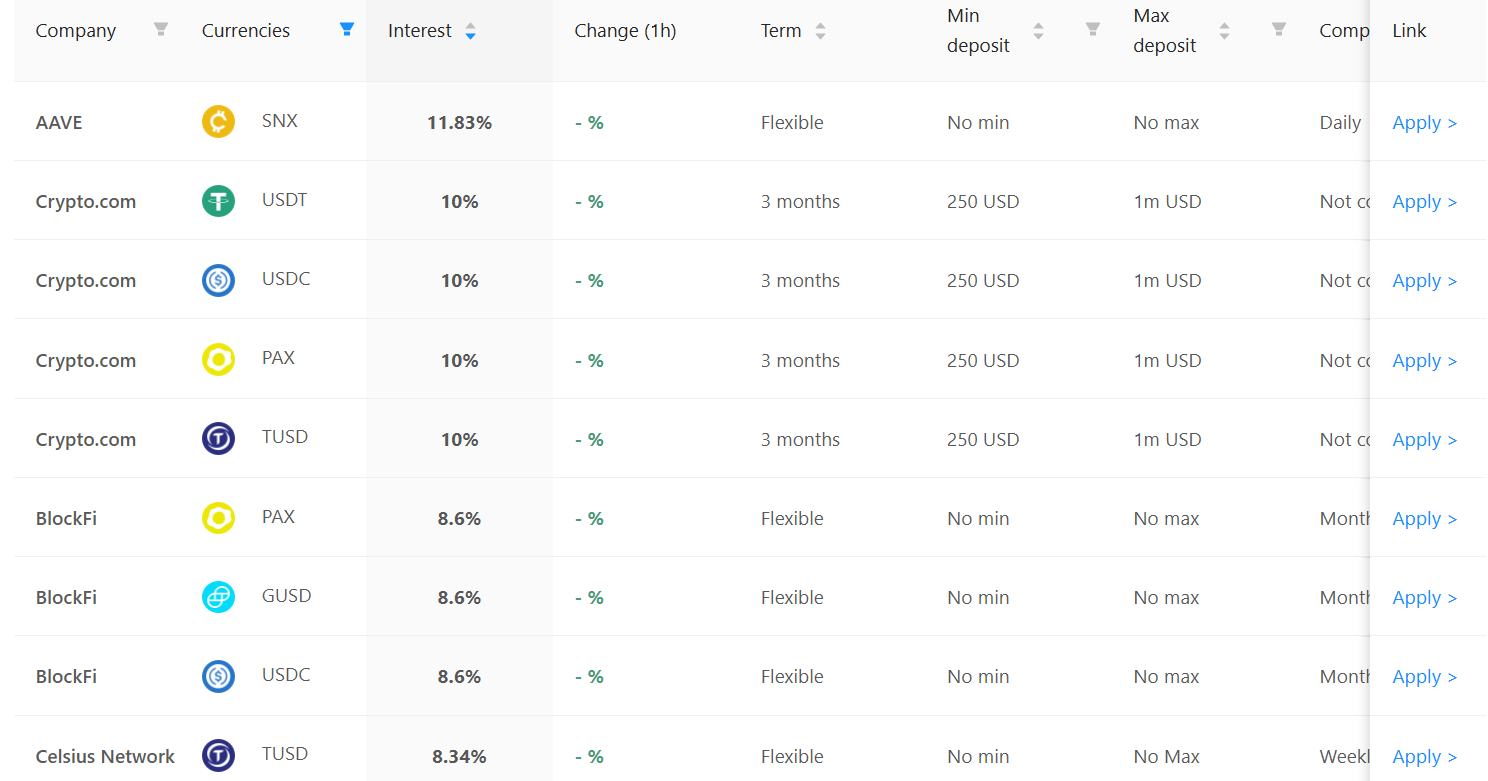

The desire rates on crypto preserving accounts are centered on market place rates, determined by individual lending platforms. When demand from customers is substantial and provide is low, desire rates go up. Lots of accounts are readily available, with AAVE having to pay up to 11.83% on deposits.

Supply: bitcompare.internet

But in advance of we celebrate this victory over the fiat method, there are some sticking factors that need to have to be get over.

For 1, laypeople are nevertheless hugely skeptical of crypto, and for good reason much too. However, as the procedure implodes the look for for alternate options gets to be a naturally transpiring phenomenon. The only factor we will need to do is wait for industry forces to do their issue.

Featured picture from Shutterstock

Further tags: XBTUSD, BTCUSD, BTCUSDT