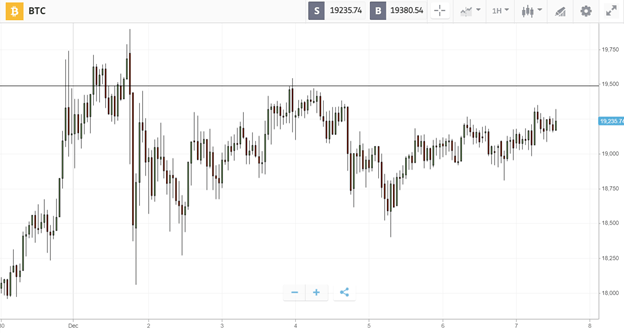

Right after briefly peeping earlier mentioned the all-time superior previous Tuesday, Bitcoin has spent the 7 days discovering a agency foothold all around the $19K mark.

The market’s resilience is supported by escalating acceptance of cryptocurrency among the the biggest world businesses. S&P Dow Jones Indices, the organization behind the renowned market benchmarks, has introduced that it will debut digital asset indexing for additional than 550 of the top rated traded coins in 2021, and Visa has mentioned it will be linking its network of 60 million merchants to the greenback stablecoin $USDC.

In the meantime, community fundamentals are flourishing. Blockchain analytics firm Glassnode has pointed out record-breaking person exercise on the Bitcoin blockchain, with the variety of lively entities (consumers) topping 432,451 past Tuesday, surpassing the December 2017 peak of 410,972.

This Week’s Highlights

- Bloomberg analysts forecast $50K Bitcoin

- Bitcoin shrugs as regulators get purpose

Bloomberg analysts forecast $50K Bitcoin

Institutional buyers opting for Bitcoin above gold could induce the selling price to double in 2021, in accordance to Bloomberg.

Analysts at the organization hope Bitcoin to hit $50K as the move of institutional money into crypto continues, pushed by unconventional monetary procedures built to counter the coronavirus-induced slowdown.

The prediction follows a spate of comparable forecasts from other institutional analysts. Bloomberg’s Mike McGlone said in Oct that the first-born crypto could strike $100K in 2025, and Citibank built an even bolder prediction in November, projecting a superior of up to $318K in 2021.

Bitcoin shrugs as regulators choose purpose

Even as policymakers search for to make their mark on the swiftly rising crypto industry, Bitcoin is holding regular.

On Wednesday, Congresswoman Rashida Tlaib declared the Stable Act that would properly keep stablecoin issuers to some of the same requirements as financial institutions, which lots of argue would stifle innovation.

Elsewhere, Congresswoman Maxine Waters is calling on Biden to rescind progressive assistance that would allow banks get custody of cryptocurrency. However as the news was unveiled, Bitcoin didn’t even flinch, suggesting that any advertising tension was met with equivalent pressure from potential buyers.

The 7 days forward

Following producing the greatest regular near ever in November, Bitcoin has shut the initial week of December even bigger, breaking a new document and location the phase for one more upswing.

Now that Bitcoin has examined resistance at $9.5K three times, the wall of market orders is probable to have been steadily eaten absent, generating it far more achievable that Bitcoin could quickly split via and follow Wall St. indices to hit new highs.

In the coming 7 days, numerous probable macroeconomic triggers could assist thrust the industry higher than this critical juncture, which includes continued economic stimulus discussions in the two the US and Europe, the last stages of long-managing Brexit talks, and developing optimism about the rollout of the coronavirus vaccine.