Bitcoin has noticed a robust surge about the earlier a few months, shifting from $11,200 to a higher of $15,300. That is a 36.5% attain in the span of 20 days, earning it the best-performing asset above that time frame.

Though some are expecting a retracement from right here, on-chain info demonstrates that the market can sustainably shift increased. This counteracts the potent sentiment shared by some commentators that Bitcoin is plainly overextended to the upside.

Related Looking through: Here’s Why Ethereum’s DeFi Current market May perhaps Be Near A Bottom

Bitcoin Could Quickly Shift Even Better, On-Chain Developments Propose

Bitcoin’s immediate go to the upside has still left lots of wondering if huge buyers will pay by themselves and get profit. There have already been rumors shared on Twitter that selected traders and whale Bitcoin addresses have been liquidating coins in anticipation of a solid correction.

But in accordance to Rafael Schultze-Kraft, CTO of notable information organization Glassnode, Bitcoin has home to sustainably rally from listed here. He shared information from his organization displaying that the Relative Unrealized Earnings of Bitcoin is at this time considerably from bubble ranges:

“#Bitcoin Relative Unrealized Earnings: – Previous world wide tops have been strike at about .8 – Final year’s regional prime at $13k was hit at .64 – Now we’re at all over $15k and existing stage is only .53 However lots of space to grow, this is bullish.”

As the chart exhibits, the last time this metric was this large was in the center of 2019’s rally, when BTC was investing for $8,000-10,000. The metric holding these lows inspite of Bitcoin’s price surging higher signifies that BTC will proceed better before really serious revenue-taking normally takes area.

Chart of BTC's macro selling price motion with a relative unrealized gain evaluation by Glassnode and Rafael Schultze-Kraft

Connected Reading: Tyler Winklevoss: A “Tsunami” of Capital Is Coming For Bitcoin

Really do not Depend Out a Drawdown or Correction

Analysts say that it would be unwise to depend out a drop from in this article, nevertheless, or at minimum a period of consolidation for Bitcoin.

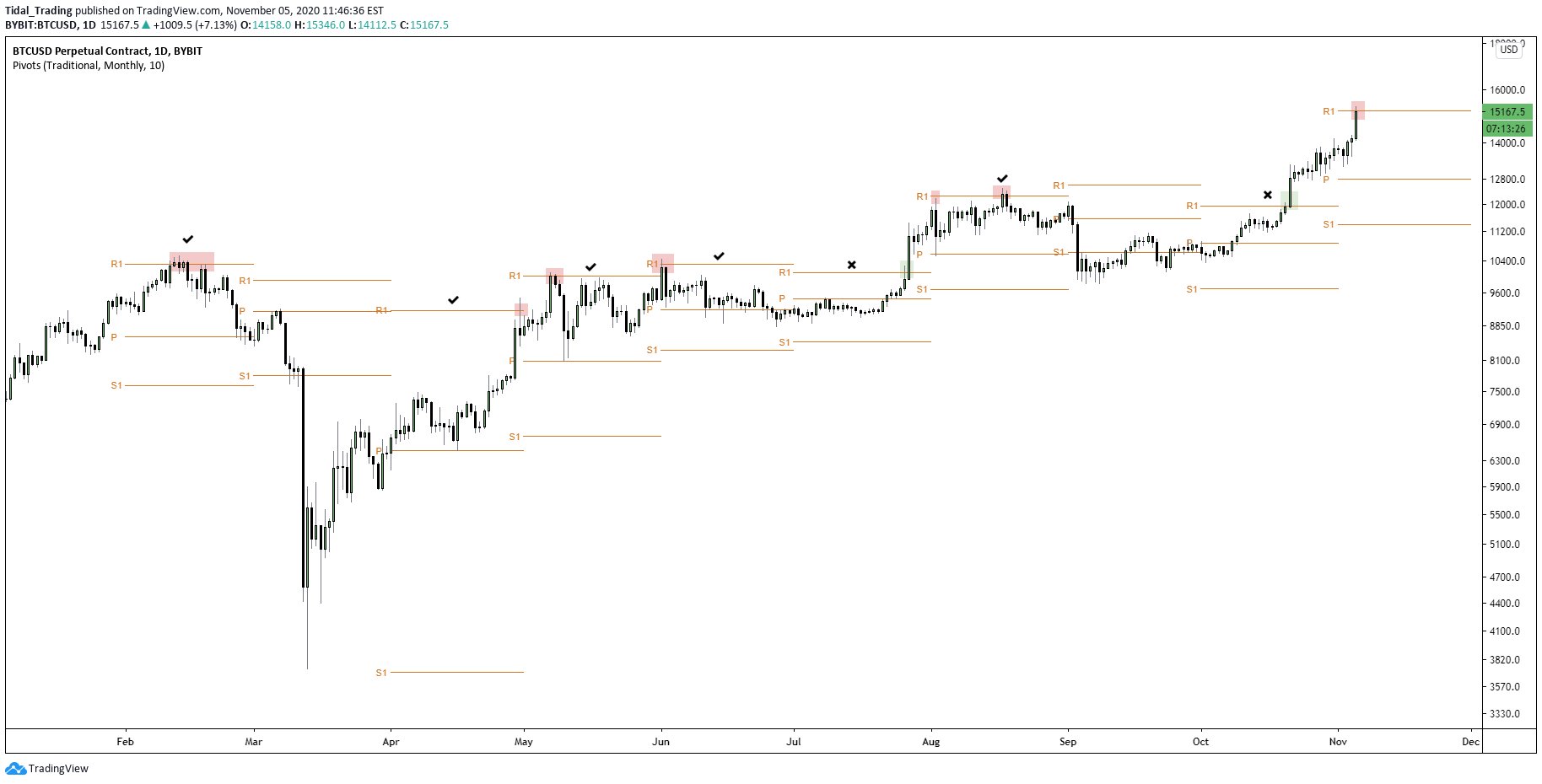

The chart beneath was shared by an analyst all through Bitcoin’s hottest leg better. It implies that the cryptocurrency has a superior probability of reversing right here because of to a historic indicator.

Chart of BTC's value action about the previous number of months with examination by crypto trader HornHairs (@Cryptohornhairs on Twitter). Source: BTCUSD from TradingView.com

Connected Reading through: 3 BTC On-Chain Tendencies Exhibit a Macro Bull Market place Is Brewing

Highlighted Picture from Shutterstock Cost tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Vital On-Chain Knowledge Shows Bitcoin's Rally to $15k is Just the Begin