Like DeFi coins, and ICOs before them, non-fungible tokens, or NFTs, are officially the latest crypto “craze.” However, many artists and analysts agree that despite the short-term hype, NFTs do have long-term viability.

Indeed, NFTs have a number of promising use cases–specifically, NFTs have been identified as the future of the creative economy. However, the concept of NFTs is still so foreign to most of the world that many of the people who would benefit from creating them get lost at the utterance of the words “non-fungible.”

In other words, there’s definitely a learning curve when it comes to entering the world of NFTs. Here’s (almost) everything that you need to know.

Should you make an NFT?

Who can make a non-fungible token?

Gagan Grewal, CEO of Mogul Productions, explained to Finance Magnates that the answer is “anyone,” really. However, Danny Holland, Smart Contract Engineer at Vega, told Finance Magnates that “some NFT platforms require artists to be pre-approved by the platform or the community, some do not. Rarible, for instance, is 100% open for anyone to create NFTs.”

Essentially, though, “anyone can create an NFT, including artists, musicians, entertainers, entrepreneurs, companies, and platforms,” Grewal explained. “The important thing is for the creator to consider the value an NFT brings to them. NFTs are great for demarcating intellectual property and creative works that otherwise could be easily copied and disseminated online.”

Tal Eyashiv, founder and managing partner of SPiCE VC, said that when you’re determining whether or not you should you need to have something of value that fits the NFT paradigm,” Tal told Finance Magnates.

“In other words, some unique item or experience that is of value and interest. Currently, the main items offered as NFTs are digital art, physical art, collectibles, assets in games, virtual properties, rare videos, et cetera. It can easily be extended to tokenized physical assets like real estate, cars, wills, and more.”

What do you NFT buyers really “own”?

What is a non-fungible token, exactly? Basically, it’s a unique, digital collectable, analogous to a one-of-a-kind Pokemon card or a unique painting in the “real world.”

However, selling an NFT doesn’t necessarily mean that you sell the intellectual property associated with the work. Additionally, multiple NFTs can be produced and sold in association with the same work. For example, NFT art world superstar Beeple has sold multiple NFTs in association with single works–which hasn’t stopped them from exploding in value.

For many who are new to the NFT space, it’s unclear what an NFT really represents in terms of ownership. Beeple explained the concept of NFT ownership this way in an interview with School of Motion: “We’re used to, like, you are able to copy anything and reproduce it a million times,” he said. “So just the concept of something being like owning a digital file and being able to prove that you are the only one that owns it, that whole concept is like, what the fuck are you talking about?”

“[…] It definitely is something that takes a bit to sort of wrap your head around, especially because like, you can look at the NFTs out there and you can still copy it. Like you could just right click and save the file.” You could then say, “oh, look, I own the file.”

This is true. However, owning a copy of the file is not the same thing as owning a unique, digital collectable that is associated with the file. If you had a rare, one-of-a-kind baseball card, someone could make an identical photocopy of it–but that doesn’t mean that they would own the card in the same way that you do.

And, of course, each NFT is created with different levels of “ownership” programmed in. Some NFTs contain intellectual property rights, and some don’t; some NFTs also include physical copies of the works they are associated with, and some don’t. Some NFTs also offer other perks, like the chance to meet the person who issued the token. Buyers of Beeple NFTs have gotten a piece of the artist’s hair.

NFTs create digital scarcity in the age of internet abundance

But really–what’s the point of making a non-fungible token? After all, why would anyone ever buy such a thing?

Essentially, these tokens offer their creators the opportunity to create scarcity in the world of online abundance. If you create a digital painting and put it online, anyone can copy it at any time; if you release a song on the internet, anyone can listen to it, download it, and essentially do whatever they want with it (short of counterfeit or copyright violation).

Yes, anyone can “buy” the song from services like iTunes or Bandcamp, but what do they really own? A copy of the file, certainly – but there’s nothing unique about that file. The buyer cannot resell the file for any value. This is why NFTs are of interest to investors: investors can buy NFTs associated with songs, paintings, sports moments, or whatever–and they can sell them as speculative assets.

In other words, someone who buys an mp3 file from iTunes can’t expect that the file will appreciate in value; they can’t reasonably expect to resell the file with the potential to earn a profit of it. (In fact, they can’t really legally re-sell the mp3 at all.)

However, the same person could buy an NFT associated with the mp3 file, and very reasonably expect that the value of that NFT would appreciate in value, and could therefore be sold at a profit. The same applies to a JPEG or PNG file of a digital painting.

(Of course, there is some debate about what NFT ownership will look like over the long-term–but that, dear reader, is another story for another time.)

Out of curiosity I dug into how NFT’s actually reference the media you’re „buying“ and my eyebrows are now orbiting the moon

— Jonty Wareing (@jonty) March 17, 2021

NFT issuance allows digital files to become speculative assets

For example, cannabis executive Edward Fairchild recently wrote in Business Insider that a Beeple non-fungible token he purchased for $969 in December is now worth nearly $300,000. The NFT is associated with a digital painting entitled “Infected Culture.”

Does Fairchild own the intellectual property associated with the work? No. Does he own exclusive rights to view the work? No. Does he own the only NFT associated with the work? Again, no–there are multiple NFTs that were issued in association with “Infected Culture.” However, the scarcity that NFT issuance created around the work allowed it to become a speculative asset.

INFECTED CULTURE pic.twitter.com/mjRDJ9m0Vw

— beeple (@beeple) April 11, 2020

Additionally, the ways that NFT creators can earn cash from their tokens can vary in terms of how the tokens are created. Artists certainly earn cash from NFT token “drops”–the initial creation and first sale of the token. However, artists can continue to earn NFT “royalties” throughout the lifespan of an NFT: each time an NFT trades hands, the artist has the opportunity to receive a cut of the sale.

Suggested articles

YOONIT: A Centralized Solution for FX Brokers (Part 1)Go to article >>

Choosing the right platform to issue an NFT on

Once you’ve determined that you want to issue a non-fungible token, Tal Eyashiv explained to Finance Magnates that “you need to identify the marketplace(s) you would like to list the NFT(s) on, since it may drive the decision of how and where to create the NFT.”

While there are more complicated ways of “DIY-ing” an NFT, Tal Eyashiv recommends using a platform that is dedicated to NFT creation. Tal is not only the founder and managing partner of SPiCE VC; he is also a painter that recently sold an NFT tied to his painting, “The Fingerprint.”

Tal explained to Finance Magnates that “the easiest way to create an NFT is through a dedicated site. There are quite a few. Some commonly used ones are Rarible, Mintbase, or Cargo. Some of the NFT marketplaces like OpenSea also support the creation of NFTs.” Nifty Gateway, another NFT creation platform, has also recently garnered attention for the multi-million-dollar NFT auctions that it has supported.

When choosing a platform to create your NFT, you also may want to determine which blockchain or blockchain that the platform uses. After all, there are a number of blockchains that support NFT creation, including Ethereum, the Binance Smart Chain, Flow by Dapper Labs, Tron, EOS, Polkadot, Tezos, Cosmos, and WAX.

Different NFT platforms have unique ways of mitigating high mining and minting fees

According to CoinDesk, each one of these blockchains has its own non-fungible token standard. This means that if you create an non-fungible token on the Ethereum blockchain, you will only be able to sell the token in Ethereum token marketplaces. (In other words, you couldn’t sell and Ethereum-based NFT on platform that only supports Binance Smart Chain NFT sales.)

James Freeman-Turner (aka Hēran Soun), a music and visual artist signed to Because Editions, also told Finance Magnates that “depending on the number of pieces your project has, the amount you’ll pay in mining fees is a big consideration when looking at platforms to ‘mint’ your works.”

“My first project, an NFT music video (which I believe is the first of its genre) is a Frame-by-Frame project, where collectors can own a frame of the video, which is then associated with them and listed in the video,” Freeman-Turner told Finance Magnates.

“OpenSea has a great USP where you can avoid mining fees at the time of listing and only is triggered when the item sells. For example, with my just under 2000 frames of video for sale, this would have been a $70,000+ project just to list, but that initial outlay was avoided by choosing to use OpenSea.”

Even with these kinds of payment models in place, NFT creatoin price is an important consideration. Danny Holland, Smart Contract Engineer at Vega, told Finance Magnates that “the price to mint an NFT varies greatly depending on what platform and what time of day. Minting NFTs can cost from $20-$500+ at the moment. Creation is not cheap between transaction fees and platform fees.”

Choosing the right blockchain

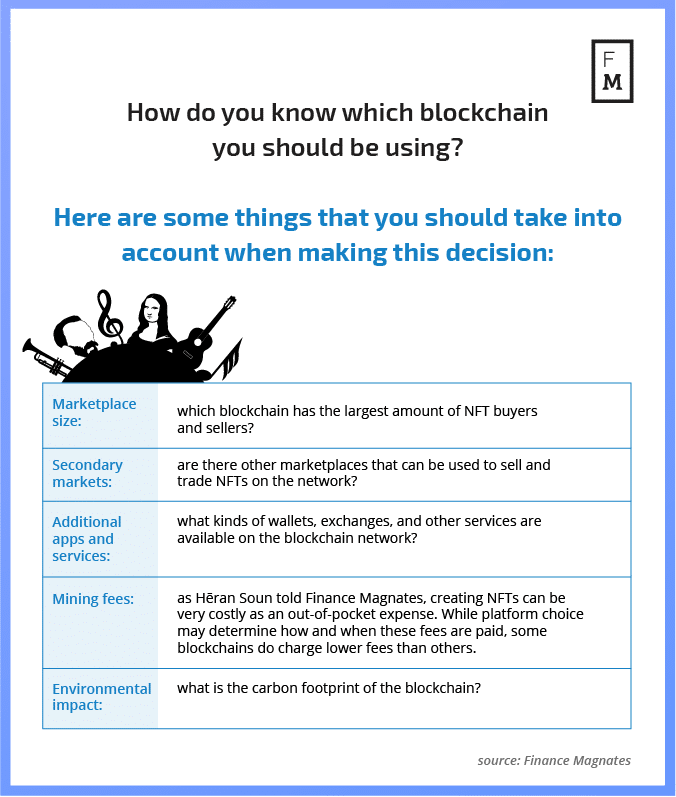

How do you know which blockchain you should be using? Here are some things that you should take into account when making this decision:

- Marketplace size: which blockchain has the largest amount of NFT buyers and sellers?

- Secondary markets: are there other marketplaces that can be used to sell and trade NFTs on the network?

- Additional apps and services: what kinds of wallets, exchanges, and other services are available on the blockchain network?

- Mining fees: as Hēran Soun told Finance Magnates, creating NFTs can be very costly as an out-of-pocket expense. While platform choice may determine how and when these fees are paid, some blockchains do charge lower fees than others.

- Environmental impact: what is the carbon footprint of the blockchain?

Non-fungible tokens and the environment

Many creators who are new to the non-fungible token world–or new to crypto altogether–are very concerned about this final point. After all, Bitcoin’s carbon footprint gets almost as much media attention as its astronomical rise in value.

Therefore, individuals who are casual observers of the crypto world may believe that all crypto-related activities are extremely energy-intensive. Of course, there is some truth to this–all crypto transactions have a carbon footprint. However, the size of that footprint depends on the blockchain that is being used.

Gagan Grewal, CEO of Mogul Productions, told Finance Magnates that “it depends on the blockchain you’re using.”

For example, “right now the most popular blockchain to issue NFTs on is Ethereum, which uses a proof-of-work consensus mechanism to verify transactions on the blockchain (and in turn make sure that the NFT is ‘real’), which is computationally intensive for miners and the Ethereum network.” In other words, it has a big carbon footprint.

However, “Ethereum is moving to a proof-of-stake consensus mechanism that will drastically reduce the energy burden that it takes to run the blockchain.”

”Even now, ETH’s carbon footprint is still better than VISA.”

Additionally, at the risk of “whataboutism,” many crypto advocates argue that virtually all financial activities have a carbon footprint. As Danny Holland, Smart Contract Engineer at Vega, explained to Finance Magnates: “Proof of Stake is coming, but even now ETH’s carbon footprint is still better than VISA.”

“There are much bigger offenders and our industry is doing what it can to transition away from Proof of Work,” he said.

Simona Pop, Head of Community at Status, also told Finance Magnates that “the environmental impact of non-fungible tokens is not fully known at this time.” Status organizes community events for artists based in Latin America who lack access to educational resources on how to create NFTs in their native languages.

“When NFTs are created, bought and sold, the transaction must be verified on-chain. Much like bitcoin mining, registering an NFT for sale and verifying the transaction requires utilizing computing power and electricity, contributing to a carbon footprint.”

If you really think that Tezos does the same thing as Ethereum but at 0.02% of the energy consumption, then I have a cold fusion reactor in my garage I’d like to offer you.

A thread on how the #CleanNFT movement misunderstands energy and undermines decentralization. pic.twitter.com/eUg0XqyHos

— Gene Kogan (@genekogan) March 12, 2021

”The elimination of middlemen from the traditional art market model and the immediate access to a global market means artists can finally earn a living from their art.”

“There has been a lot of FUD (fear, uncertainty, and doubt) and vilification of NFTs as a result of articles portraying the problem in apocalyptic terms. Some artists involved with crypto art have even been blacklisted as a result which is an unacceptable reaction considering the efforts to make NFTs greener are ongoing. A great example of this is Green NFTs.” Green NFTs is a self-described bounty initiative for “more ecologically friendly NFTs (Non-fungible Tokens).”

As the NFT infrastructure community continues to work out the kinds in non-fungible token market energy consumption, artists must decide for themselves if the benefits are worth the risk.

“NFTs are an incredibly exciting moment in the evolution of blockchain technology – they can expand far beyond art and their use cases will evolve and become even more valuable as a result,” Simona Pop said.

“In terms of art NFTs, the elimination of middlemen from the traditional art market model and the immediate access to a global market means artists can finally earn a living from their art, create & grow global supporter communities and generally redesign the relationships and value-flows tied to their work.”

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)