Because „gaming“ is the first part of GameFi, it has grown very quickly.

In the beginning, GameFi isn’t very well-known, and the games there aren’t very well-known, either.

A lot of money is made by trading non-fungible tokens (NFT) and trading game tokens.

So, it is important for players to know how these tokens work in terms of money.

The Economic Model of Tokens

In the game, tokens called GameFi connect NFTs, money, and other things.

A token model that is long-term, fair, and appealing will have a big impact on the game.

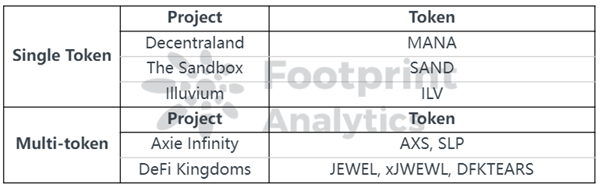

Currently, there are single token and multiple token economies in the game.

1. Single Token

The single token economy model uses one token for all things connected to the platform, like in-game activities, project governance, and transactions in the secondary market. This model is called a „token economy.“

The model is simple, which is a good thing.

Players only need to get one token to play the game, which makes it easier for people to make transactions and lessens the difficulty of integrating resources.

The token used is also an asset that the player wants to keep in order to make it more valuable.

The player’s willingness to keep it is at odds with the game’s setting, which says that tokens must be used to move forward.

Players can easily be affected by changes in the value of the token.

When the price is too low, players will likely lose interest in the game because it doesn’t seem like it could be profitable. When the price is high, players will lose money by taking advantage of the high-value token.

In addition, if a project keeps issuing new tokens, this will cause inflation.

Because a single token model can have a big impact on the ecosystem of the token, more game projects choose to use a multi-token model.

2. Multi-token

Games that have a lot of different tokens usually divide them into tokens that are used to run the platform and tokens that are used in the game’s ecosystem.

- The platform governance token is mostly used to get people to help run the community and make the value of the platform more well-known.

- People use the tokens to do things like buy and sell things in the game, as well as level up.

A lot of them don’t even need to be virtual currencies on a blockchain or traded on secondary markets. There’s usually no limit on how many of them can be made, and some don’t even need to be virtual currencies.

The multi-token model comes in many different forms depending on the game. It also has more advantages and disadvantages than the single token model.

The main benefit is that the game’s economy will stay stable.

The model lets people play without having to worry about the price of the main token changing.

Separating in-game tokens also makes it easier for game developers to change the economic model of different tokens.

The downside is that it makes it more difficult for the gamers to get together and for the players to learn.

Examples of GameFi Projects

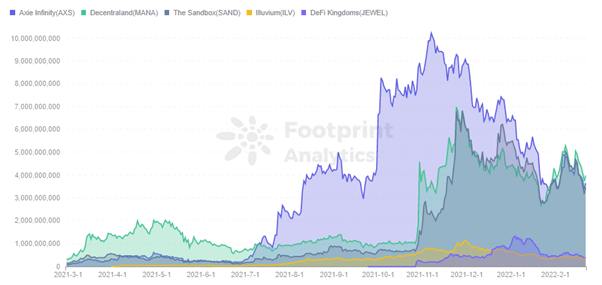

Footprint Analytics – The Economic Model of Top Gaming Tokens

The top-ranked games that use a single token are mostly about buying land in the metaverse.

Decentraland’s token, MANA, can be used to buy land and other goods and services in the virtual world. In the Sandbox, SAND is used as the basic token for transactions and interactions. Players can use SAND to buy, rent, hire, vote, stake, and so on.

There are many ways to use the ILV, not just in the game. You can also put it in the pool and be a part of the governance.

It’s the most common way for other projects to work.

If you want to buy Heroes and props in DeFi Kingdoms, the main token is JEWEL, and xJEWEL is used for governance after you stake it.

Use DFKTEARS to call up Heroes in the game.

Players can earn SLPs through battles in the game. They can then use them to breed their own unique Axie. AXS are governance tokens that can also be staked for rewards, and SLPs can be earned through battles in the game.

Key Economic Aspects of GameFi

It’s also important to know how the money works in a GameFi project.

A token can be judged on the following points.

1. Issuance and Burning Mechanism

Limited issuance size and a reasonable economic model keep tokens from becoming more valuable, but an unlimited economic model could cause tokens to lose value and players to lose confidence in holding them for a long time.

Destruction mechanisms also play a big part in keeping prices from going up, and active burn mechanisms can help keep prices stable.

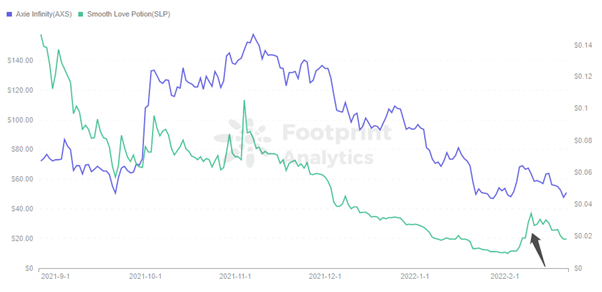

On Feb. 4, 2022, Axie Infinity said that it would no longer give SLP tokens as rewards for daily quests and adventure mode, and it added more ways to burn SLP (including special cosmetics and skins, upgraded Axie body parts, in-game emojis, Axie naming, etc.)

In the past, SLP prices had been going down, but now they’ve started to rise again.

2. Distribution

Token distribution schemes are also worth noting. The team gives more weight to the community in order to get more players interested in the game.

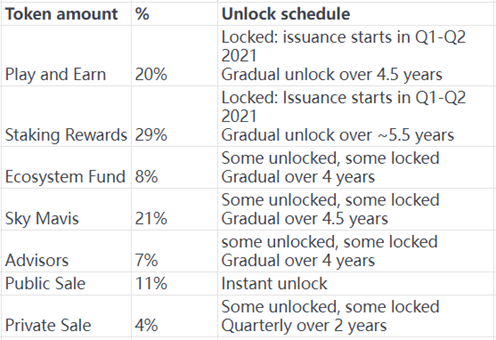

It’s like this: Axie Infinity’s token, AXS, is split into 20% for Play to Earn, 29% for Staking Rewards, and almost 50% for users.

A good way to distribute funds has a big impact on the project.

Everything that makes a game successful is for people to play it.

3. Utility

The more useful a token is, the more appealing it is to players.

Most games have tokens that can be used for things like daily quests, in-game leveling, purchases, PVP, and so on. Some can be staked for more NFTs or tokens.

Tokens that can be used outside of the game can be traded on the secondary market, used to make money for other projects, and so on.

4. Locking Period

Setting the unlocking time helps to keep people from influencing the price of the token and keep them coming back.

At the same time, having the same lock-up period for the project team and the players is also a good way to keep their interests in line with each other.

Over the course of four years, Axie Infinity allocations to the community and teams are mostly unlocked.

The goal is to get more people looking for token rewards while still giving teams a reason to build.

A lock-in period is when investors can’t sell their assets for a set amount of time.

This helps investors stay focused on the project for a long time. It also stops them from dumping a lot of money on the market, which is bad for the project.

Gaming Tokens’ Data Performance

For example, Footprint Analytics says that as of March 2022, the top five GameFi token projects by market cap are Decentraland, Axie Infinity; The Sandbox; DeFi Kingdoms; and Illuvium. There is a nearly 10x difference between the top three projects starting in fourth.

A good user experience and playability are also important, as shown in Illuvium.

Even though the game isn’t officially online, it has released gameplay trailers with beautiful graphics and interesting characters.

Illuvium is still in the top five, even though it lost a lot of popularity in December because of attacks and protocol bugs. This shows that people still want high-quality games.

DeFi Kingdoms isn’t like the other top 5 projects in that its main focus is decentralized finance (DeFi), and the games are just the cherry on top.

Tokens in DeFi Kingdoms are fun to invest in because they’re like playing a game. JEWEL has risen to number four on the market cap list since its launch.

Summary

With more money coming into the GameFi space, there is no shortage of GameFi projects. There is, however, a shortage of projects that are good both in terms of game quality and token economics.

If you compare GameFi projects to more developed traditional games, they are still in the beginning stages.

There is a red sea in the game field that is filled with red. However, its financial and community involvement qualities open up a new blue ocean in the red sea.

Playing a game better is just as important as improving the economy in the game with tokens from the game.

People who play games to earn money, or those who hold a token that makes them rise, must know enough about gaming tokens to start before they can start playing. This is true no matter what.

Market data is provided by Footprint Analytics community.