Chainlink has found an impressive rally therefore significantly this yr. It has been fueled by various partnerships that have put this altcoin in the spotlight of the cryptocurrency marketplace.

The decentralized oracles token supplied traders a mid-12 months return of financial investment of practically 160% as its selling price rose from a yearly open of $1.76 to shut June at $4.57.

Irrespective of the significant returns, market place members worry about a likely correction that could wipe out some of the gains incurred.

Chainlink Sorts a Potential Double Leading

The cost action that Chainlink has viewed over the past pair of weeks seems to have led to the improvement of a double best sample on its 12-hour chart. This specialized development is regarded as an extremely bearish reversal pattern, according to Investopedia.

Even though the next rounded prime seems to be at this time forming somewhat beneath the very first major, it indicates that the development is finding fatigued, and there is a higher chance of a sharp retracement.

The TD Sequential indicator provides credence to the bearish outlook. This index is presenting a provide sign in the variety of a environmentally friendly nine candlestick in the same time body. The bearish pattern indicates a a single to 4 candlestick retracement ahead of the continuation of the uptrend.

Chainlink Seems to Sort a Double Top. (Supply: TradingView)

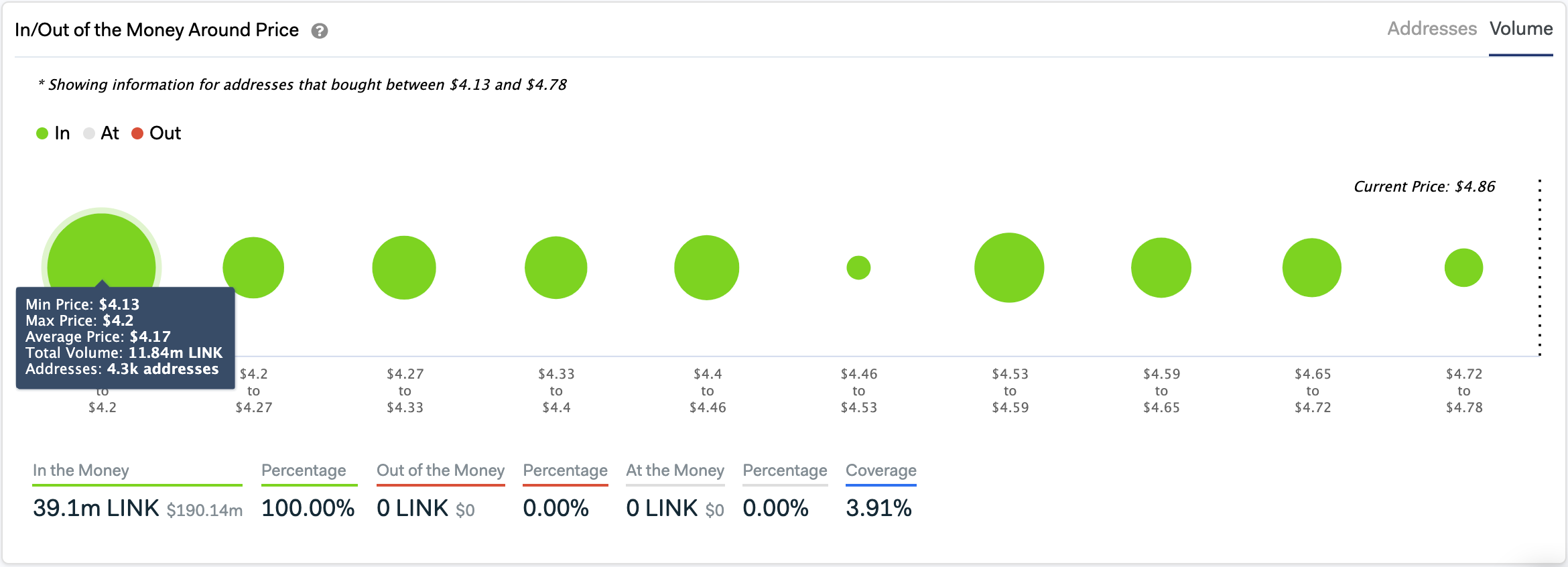

If these bearish signals are validated, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) design signifies that Chainlink could drop to $4.15, which is also in which the 23.6% Fibonacci retracement amount sits. Right here, the IOMAP cohorts reveal that 4,300 addresses experienced earlier purchased almost 12 million Url.

This massive supply barrier could have the capacity to soak up any draw back strain and allow for oracles token to bounce off towards new yearly highs. But failing to do so could induce a even more drop to the 38.2% or 50% Fibonacci retracement amounts.

The Most Major Assistance For Chainlink Sits at $4.16. (Resource: IntoTheBlock)

Everything’s Not Missing

A appear at Cainlink’s Network Worth to Transactions Ratio, or “NVT”, supplies insightful facts what is the honest benefit of this token. When the LINK’s NVT is superior, it suggests that its community valuation is outstripping the benefit being transmitted on its payment network.

“LINK is getting an abundance of token circulation correct now. 5 straight months of getting perfectly under the trendlines is excellent to see. And as long as things continue on to glance inexperienced heading into July, assume to see a lot a lot more unbiased surges from Chainlink,” said Santiment.

Chainlink’s NVT Ratio Is Bullish. (Source: Santiment)

Market individuals seem to be nervous about a opportunity correction that is supported by unique complex metrics. No matter, presented the current benefit that is currently being transmitted on Chainlink’s network, it appears to be like this cryptocurrency has additional room to go up. Now, it is just a make a difference of time to see no matter whether or not Link can the $5 resistance stage into assist, which will assist invalidate the bearish indicators and propel its value into new all-time highs.

Featured Graphic by Shutterstock

Charts from TradingView.com