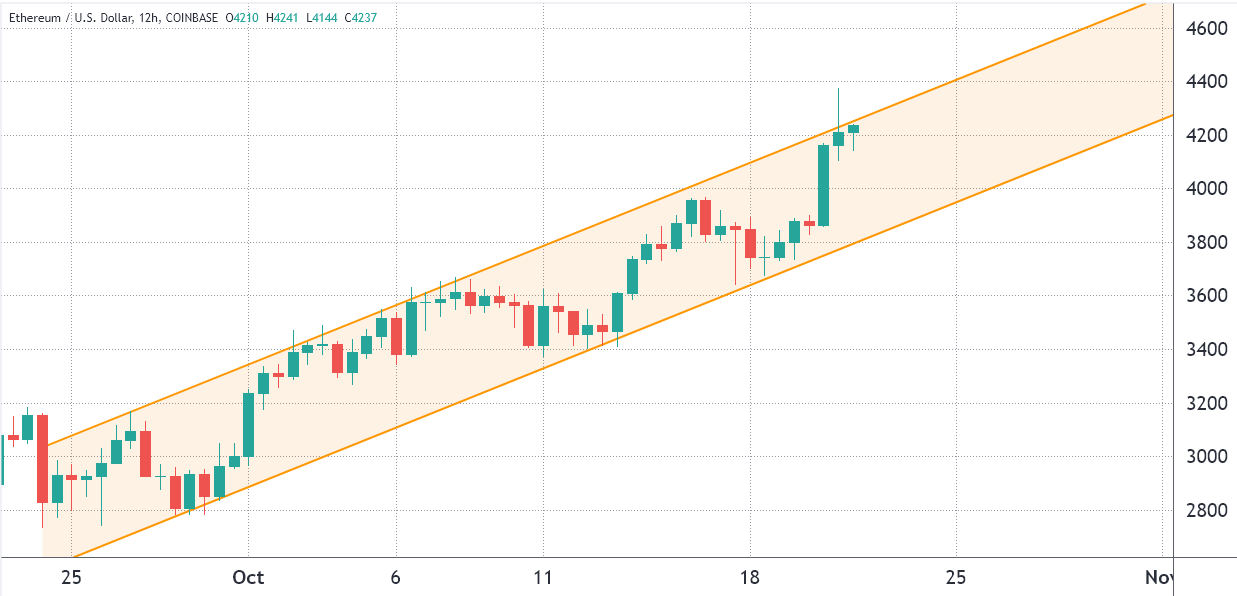

On Oct. 21, Ether (ETH) flirted with its all-time high of $4,380 but fell short by a few dollars.

According to several commentators, like independent market analyst Scott Melker, the US Securities and Exchange Commission’s next logical step should be to approve exchange-traded funds (ETFs) (SEC).

My bet is we will see an Ethereum Futures ETF before we see a physical Bitcoin ETF.

— The Wolf Of All Streets (@scottmelker) October 20, 2021

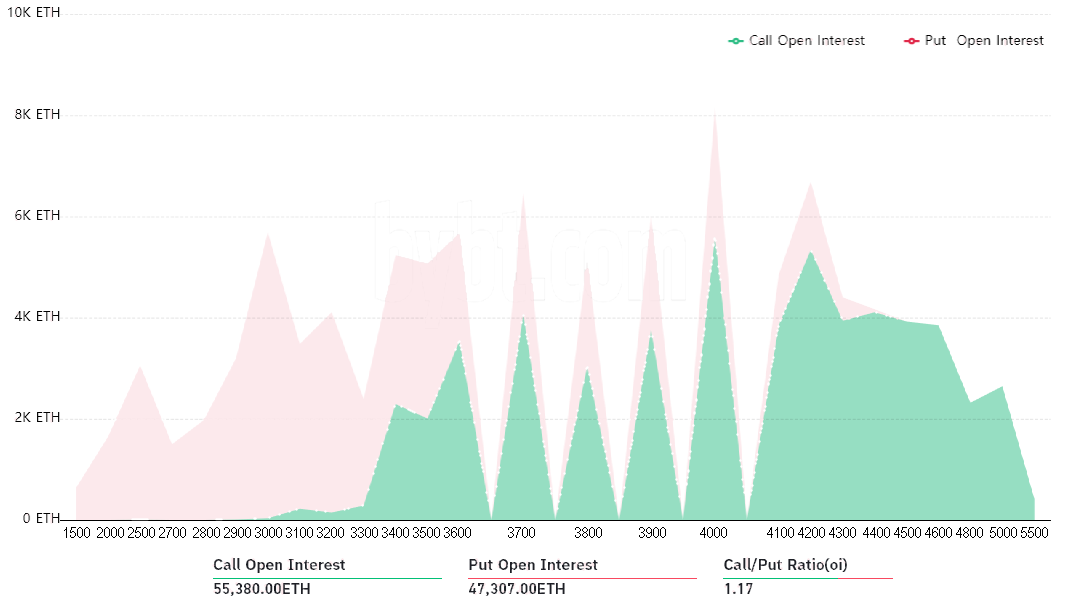

Regardless of how unhappy Ether bulls are, they are poised to benefit by $78 million on Oct. 22’s options expiration.

Bears appear to have been taken aback by Ether’s 35% month-to-date rise.

Investor mood was further boosted by the announcement of a $25 million allocation in Bitcoin (BTC) and Ether by the pension fund for Houston firemen.

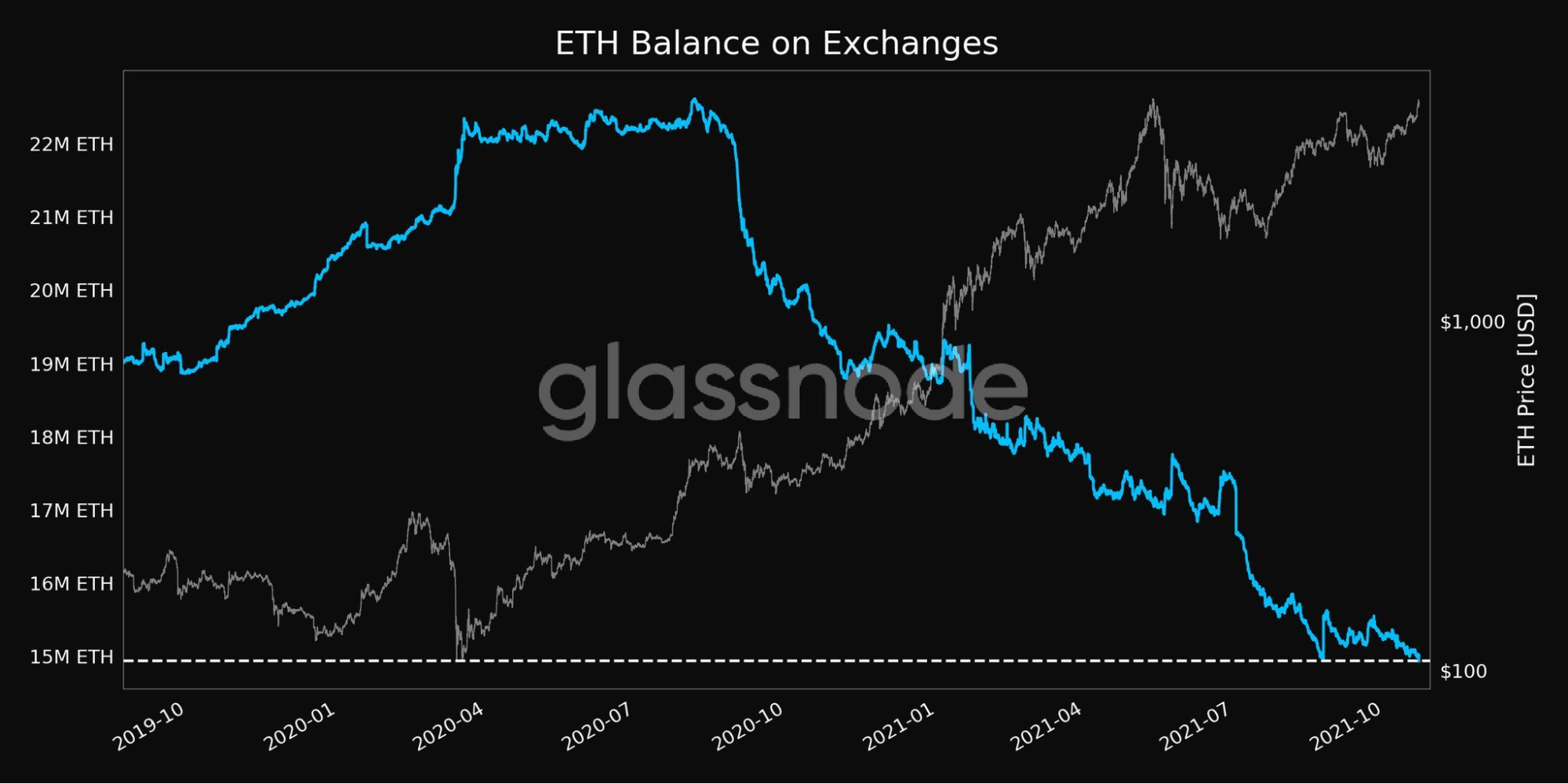

Continuous depletion of Ether’s liquid supply is also a significant element in the recent surge. The Ether balance on exchanges has fallen to a two-year low, according to Glassnode data.

Reduced coin deposits on exchanges, particularly for Ether, may indicate that investors are shifting their focus to decentralized financing (DeFi) in quest of higher payouts.

Although it does not preclude anyone from selling, this movement, along with the ETH 2.0 investment required to become a validator, creates incentives for long-term holding.

Bears were stunned after Ether broke $4,000

Three weeks ago, Ether was trading below $3,000, which partially explains why negative bets on Oct. 22 were 89 percent on Ether trading at $4,000 or lower.

Friday’s total open interest is $230 million in calls (buy) and $195 million in puts (sell), a 27 percent lead for neutral-to-bullish instruments.

Nonetheless, depending on the expiry price, this broad view requires more depth.

The present long-to-short ratio is misleading, since the recent Ether bounce is expected to wipe out the majority of their negative bets.

For instance, if the price of Ether remains above $4,000 at 8:00 a.m. UTC on Friday, only $22 million put (sell) options will be available.

Bears need sub-$4,000 to balance the scales

Any expiration price above $4,000 helps the bulls, albeit the most of the harm happens above $4,200, when their net profit exceeds $136 million.

The following are the four most likely possibilities given the present pricing levels.

The figure indicates the number of contracts that will be offered on Oct. 22 for bulls (calls) and bears (puts).

- Between $3,600 and $4,000: 15,640 calls vs. 14,340 puts. The net result is neutral.

- Between $4,000 and $4,200: 25,000 calls vs. 5,440 puts. The net result favors bulls by $78 million.

- Between $4,200 and $4,400: 34,180 calls vs. 1,890 puts. Bulls‘ profit increases to $136 million.

- Above $4,400: 44,230 calls vs. 60 puts. Bulls completely dominate by profiting $186 million.

As illustrated above, the imbalance favoring either side shows the prospective profit that may be made on the expiry.

This rough estimate takes call (buy) options into account when bullish strategies are utilized and put (sell) options into account when neutral-to-bearish trades are made.

However, a trader may have sold a put option, acquiring positive exposure to Ether above a predetermined price.

Regrettably, there is no straightforward method for estimating this effect.

$4,000 is likely to hold, at least until Friday’s expiry

To avert a $78 million loss, bears require a 3% fall from the present $4,100 price.

While this may not appear to be much, traders must also take into account recent favorable newsflow and on-chain indicators.

With less than ten hours till the Oct. 22 expiration, bulls are poised to secure a victory by maintaining Ether above the $4,000 mark.

For bears, focusing on the $1.1 billion monthly expiration on Oct. 29 appears to be the natural course of action.

The author’s thoughts and opinions are entirely his or her own and do not necessarily reflect those of CoinNewsDaily. Each investing and trading action entails risk; before making a decision, you should conduct your own research.