The May 19 crypto marketplace sell-off saw $1.2 trillion in value erased by the total market capitalization since the froth and surplus leverage of foreign exchange markets was quickly removed.

But like a woods fire, whose destructive energy is vital to the rejuvenation of a forest’s ecosystem, dramatic marketplace shake-outs are a vital part of the full life cycle of a growing market, as excesses that have accumulated are burnt off and cleared in order to set the stage for a fresh round of growth.

According to data in Glassnode, the previous month saw a „historically large decline“ in on-chain activity,“transitioning rapidly from booming on-chain markets at ATH prices, to almost completely clear mempools and waning demand for transactions and payoff.“

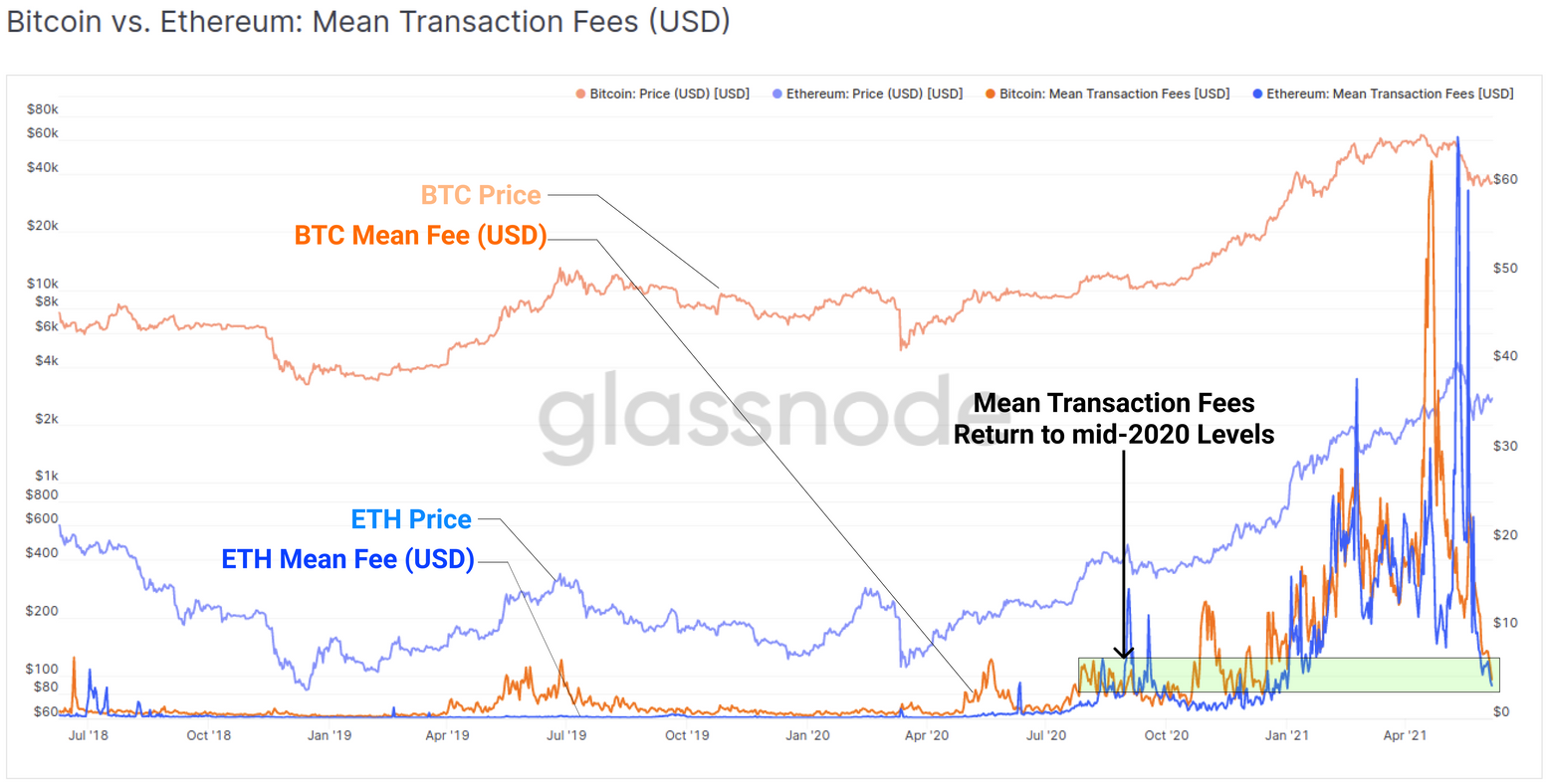

This clearing of congestion helped tackle the increasing price of fees on either Ethereum (ETH) and also BTC (BTC) networks which have now „returned to mid-2020 levels of around $3.50 to $4.50“ after experiencing short term spikes as large as $60 in April and May but given that the lingering price activity from BTC and Ether, traders are also concerned whether the marketplace has shifted from bullish to bearish.

The fall in activity has caused a 65% decline in the overall USD denominated transfer quantity settled from the BTC network and a 60 percent drop in value moved on Ethereum, marking the second largest declines for the networks behind the 80% fall for BTC in 2017 and the 95% fall for Ethereum in 2018.

Long-term holders collect

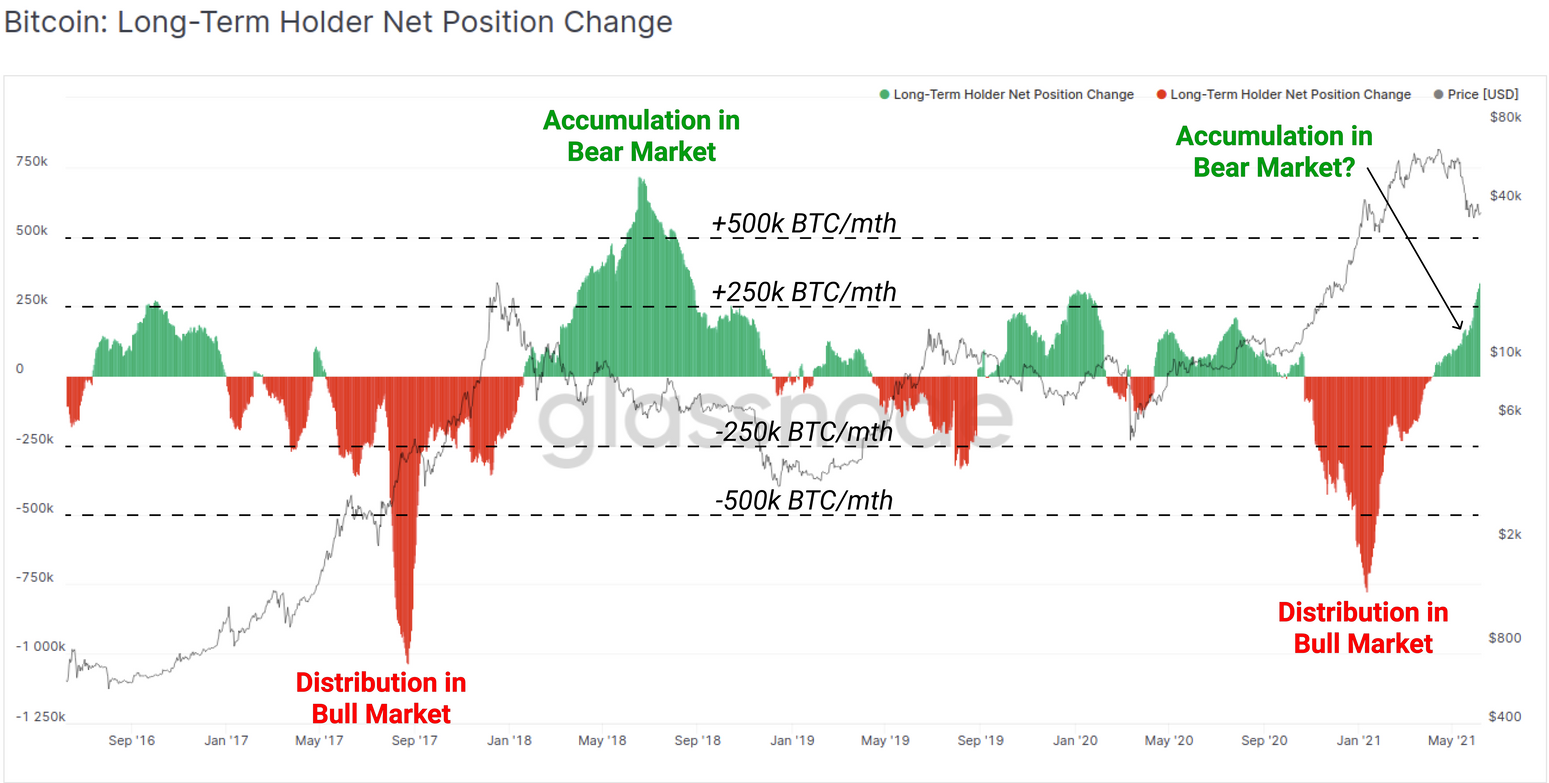

Although the on-chain activity paints a grim picture for some, as short term holders were the hardest hit by the recession, a closer look shows that long-term holders (LTH) have started amassing again, a sign that the worst of the shake-out may have passed.

As seen in the chart above, the supply maintained by long-term BTC holders has started to accelerate upward following a span of distribution that happened as the cost range from $10,000 to $64,000. This rising figure suggests that the“LTH supply is currently in a company uptrend,“ and is like the trend seen during the“late 2017 bull and ancient 2018 bear.““

Glassnode said:

„This fractal describes the inflection point where LTHs stop paying, start re-accumulating and hodling what are now considered economical coins.“

Additional bullishness are seen in the fact that the quantity of BTC currently held by LTHs is 2.3 million more than at the peak of 2017, indicating that the long-term perspective of the token holders is that the market is headed higher.

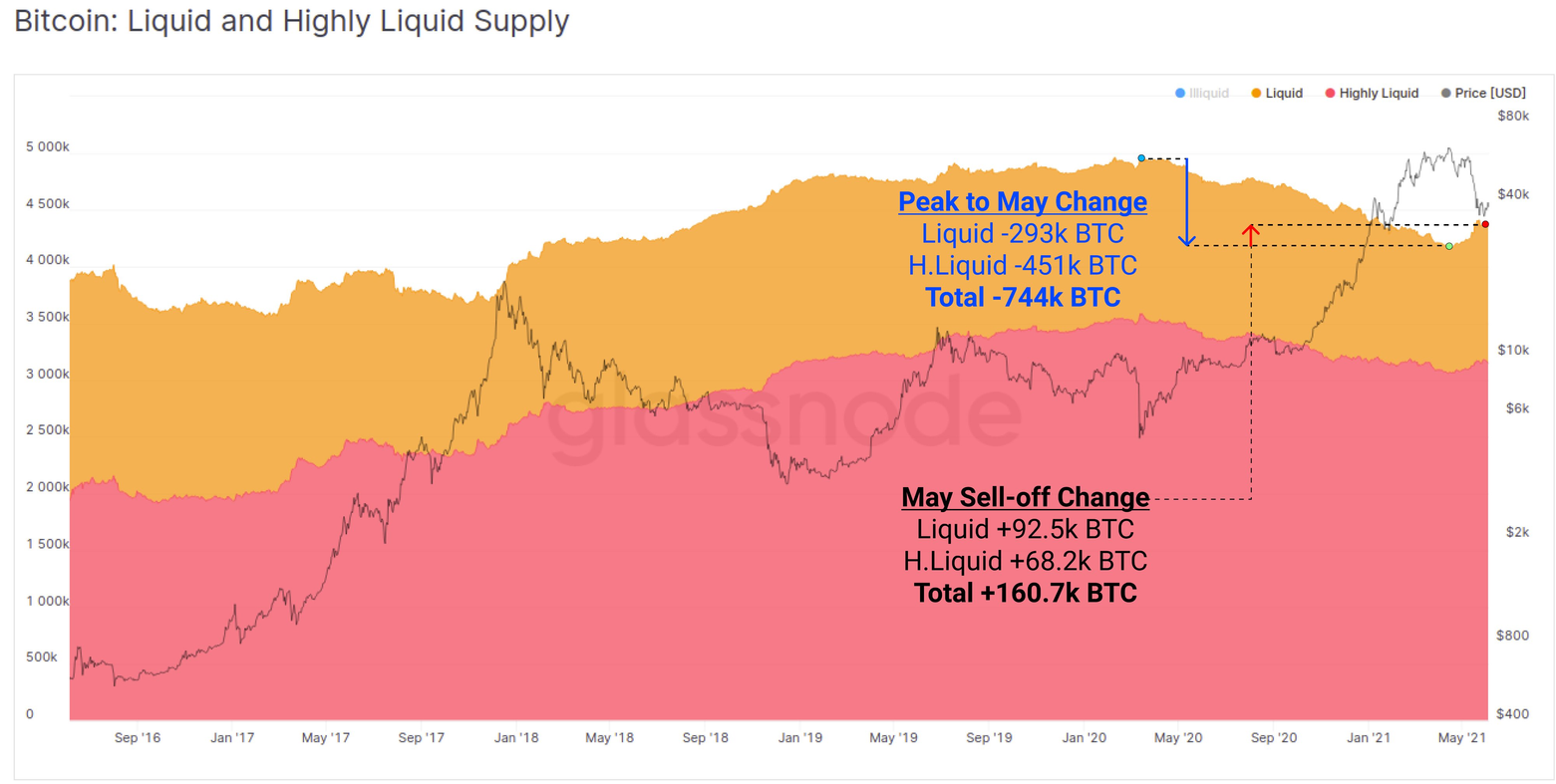

1 last indication that the marketplace may be consolidating in preparation for its next move higher can be found looking at the shift in the liquid and illiquid supply of BTC within the previous 6 months.

As seen in the chart above, 160,700 BTC went from an illiquid state back into liquid circulation during the month of May, representing only 22 percent of the total supply that transferred from liquid to illiquid since March 2020.

This means that 78% of those BTC obtained since then remains unspent, indicating a general optimistic outlook by long-term holders.

As soon as it’s not possible to be certain about the next steps for the cryptocurrency marketplace thanks to factors like irregular volatility, inconsistent tweets from influencers and the rumors of surprise government crackdowns, on-chain data suggests a positive long-term prognosis that should resume once the present shake-out and consolidation spans subside.

The views and opinions expressed here are solely those of the writer and do not always reflect the views of Cointelegraph. Every investment and trading proceed involves danger, and you must conduct your own research after making a decision.