When the sentiment on the market turns bearish, every piece of negative news, however insignificant, pulls the price down as traders panic sell. This is exactly what happened after China’s social networking giant, Weibo, suspended quite a few crypto-related reports and triggered fears a broader crackdown could happen.In other news, a note from Goldman Sachs said their meetings with 25 chief investment officers of long-only and hedge funds showed BTC (BTC) as the least favorite asset for investment.

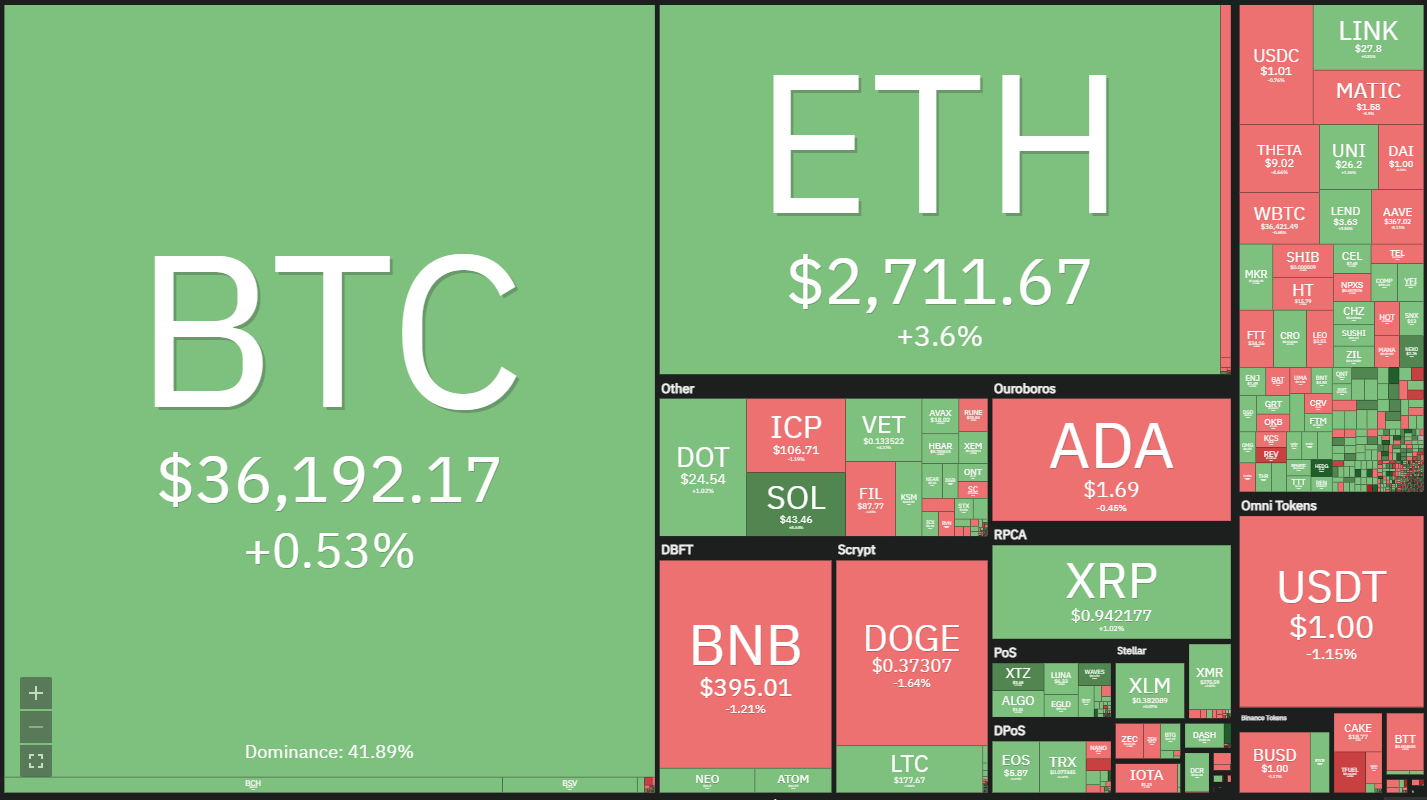

Crypto market information daily perspective. Source: Coin360

Crypto market information daily perspective. Source: Coin360

BTC/USD

While the news may be adverse in the brief term, it’s not likely to change the long term story of BTC.

Since the price corrects, several institutional investors are likely to consider crypto investments to hedge their portfolio against the potential surge in inflation in the USA.

From the point of view of the majority of traders, BTC’s current decrease continues to represent a buying opportunity for the longer duration. Let us analyze the charts of the top-5 cryptocurrencies which could outperform in the upcoming few days.

BTC turned down from the 20-day exponential moving average ($39,127) on June 3 but is finding support around the trendline of the triangle. This shows that bulls are buying on dips, and bears are selling on rallies. The next trending movement is likely to begin after the purchase price escapes from the triangle. When the bulls propel and sustain the purchase price above the resistance line, then the BTC/USDT pair may rally into the 50-day simple moving average ($47,198) and then to the blueprint goal at $52,622.90.

On the contrary, in the event the purchase price turns down and breaks under the trendline of the triangle, it is going to imply that supply exceeds demand. That could result in a drop to the $30,000 to $28,000 support zone. Whether this zone cracks, then the selling could intensify as several traders who bought lately may depart their positions. That will pull the purchase price down to $20,000. The moving averages around the 4-hour chart have flattened out, and the relative strength index (RSI) is oscillating roughly between 40 and 60, indicating a balance between sellers and buyers. But this condition of uncertainty is not likely to last for long and the price is likely to crack above or below the triangle within the upcoming few days. If the price breaks out and sustains above the triangle, then it is going to suggest the setup acted as a change pattern. Conversely, if the price breaks below the triangle, it is going to imply that the current consolidation was a temporary halt in a strong downtrend. It is difficult to predict the direction of the breakout, hence traders may wait for the rest to occur before considering fresh positions.

ETH/USDT

Ether (ETH) turned down from the 50-day SMA ($2.908) on June 4 and re-entered the symmetrical triangle. However, the positive thing is that bulls did not give up much ground, indicating strong buying around $2,550. If the buyers push the purchase price above the resistance line of the triangle, the ETH/USDT pair will again challenge the 50-day SMA. A breakout and close above this immunity will clear the path for a transfer to the 61.8% Fibonacci retracement level at $3,362.72.

Contrary to the assumption, if the purchase price turns down from the 50-day SMA once again, it is going to imply that bears are safeguarding the immunity aggressively. A break below $2,550 could pull the purchase price down to the service line of the triangle. A break below the triangle is going to be the first indication that the bears are back in the driver’s seat.

ETH/USDT 4-hour chart.

ETH/USDT 4-hour chart.

The 4-hour chart shows the creation of an ascending triangle pattern which will complete to a breakout and close above $2,906. If that occurs, the set could muster to $3,600 and then to the blueprint goal at $4,083.26.

This bullish perspective will invalidate whether the price turns down and breaks under the trendline of the triangle. The bears will subsequently try to pull the purchase price down to $2,200 and then into the critical support at $1,728.74.

ADA/USDT

Cardano (ADA) has been stuck at a large range between $1.94 and $1 for the past couple of days. The altcoin turned down from the immunity on the range on June 4 and has fallen into the moving averages.

ADA/USDT daily chart.

ADA/USDT daily chart.

The bulls are currently attempting to shield the zone involving the 20-day EMA ($1.66) and the 50-day SMA ($1.55). In the event the purchase price rebounds off the current levels, it is going to suggest the sentiment is turning positive and traders are buying the dips to the moving averages.

A close and breakout above $1.94 will signify that the bulls are back in the driver’s seat. In the event the purchase price sustains above this amount, the ADA/USDT pair may retest the all-time high at $2.47. A break above this immunity will indicate the start of the next leg of the uptrend.

This positive view will invalidate whether the pair turns down and breaks below the 50-day SMA. The bears will subsequently try to pull the purchase price down into the $1.33 to $1.22 support zone. The 4-hour chart shows the creation of an ascending triangle pattern which will complete to a breakout and close above $1.94. This bullish setup has a goal objective at $2.88. However, it’s not likely to be a direct dash to the goal because the bears may mount a stiff resistance at the current all-time high at $2.47.

The 20-EMA has begun to turn the RSI is only below the midpoint, indicating a potential drop to the trendline of the triangle. A break below this service will invalidate the bullish setup and that might result in a drop to $1.36 and then to $1.

SOL/USDT

However, the sellers have not been able to sink the purchase price under the 20-day EMA ($36.39), which indicates the sentiment has turned positive. VORTECS™ information from Cointelegraph Markets Pro began to detect a bullish outlook for SOL on June 1, before the rally picked up momentum. The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a blend of information points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ rating (green) vs. SOL price. Source: Cointelegraph Markets Guru

VORTECS™ rating (green) vs. SOL price. Source: Cointelegraph Markets Guru

As seen from the chart above, the VORTECS™ rating for SOL flipped green June 1 when the price was near $32.10.

The VORTECS™ score has always remained in the green because then and the price of SOL has shrunk to $43.33 today, recording a 35% profit in five days. This reveals how the VORTECS™ score gave an early indication of a counter trend rally even as other tools would have been bearish. This implies the bulls aren’t waiting to get a deeper correction to buy.

If buyers push the purchase price above $43.38, then it is going to signal the downtrend is over. The pair may then rally into the 78.6% retracement level at $49.97 and then into the all-time high at $58.38. The 20-day EMA has begun to turn up and the RSI is at the positive territory, suggesting the buyers have the upper hand.

This positive view will invalidate whether the purchase price turns down and slumps under the trendline. The pair may then decline to $25.58 and later to $21.

SOL/USDT 4-hour chart.

SOL/USDT 4-hour chart.

The moving averages around the 4-hour chart have turned up and the RSI is investing at the positive territory, suggesting the bulls are making a comeback. The up-move may pick up momentum if buyers thrust the price above $43.38.Conversely, if the purchase price turns down and breaks down the 20-EMA, it is going to imply that supply exceeds demand. The pair could then drop to the 50-SMA and then to the trendline. A break below the trendline will signify that bears are back into the match.

THETA/USDT

THETA is trading inside a descending channel. The bulls tried to push and sustain the purchase price above the resistance line of the channel on June 4 and 5 but neglected. This implies the bears are safeguarding this immunity aggressively.

THETA/USDT daily chart.

THETA/USDT daily chart.

However, the 20-day EMA ($8.19) has begun to turn up and the RSI is at the positive territory, indicating the bulls have a small advantage. If the THETA/USDT pair pops off the 20-day EMA, the buyers will make one more effort to propel the purchase price above the channel.

Should they succeed, it is going to suggest the downtrend could be over. The pair could then begin an up-move to $13 and later into the all-time high at $15.88. This bullish perspective will invalidate whether the bears sink and sustain the purchase price under the 20-day EMA. Such a movement could result in a drop to $6.

THETA/USDT 4-hour chart.

THETA/USDT 4-hour chart.

The 4-hour chart shows the pair has turned down from the resistance line of the channel on two occasions. However, the bears have not been able to sink and sustain the purchase price under the 20-EMA, signaling demand at lower levels.If the pair pops off the current level, the bulls will make an additional effort to push the purchase price above the channel. Should they manage to do that, the next leg of the uptrend may start.

On the other hand, if the price breaks below the 20-EMA, then the pair could slide to the 50-SMA. A break below this service will suggest the start of a deeper correction.

The perspectives and opinions expressed here are solely those of the writer and do not always reflect the views of CoinNewsDaily. Each investment and trading proceed entails danger, you should conduct your own research after making a determination.