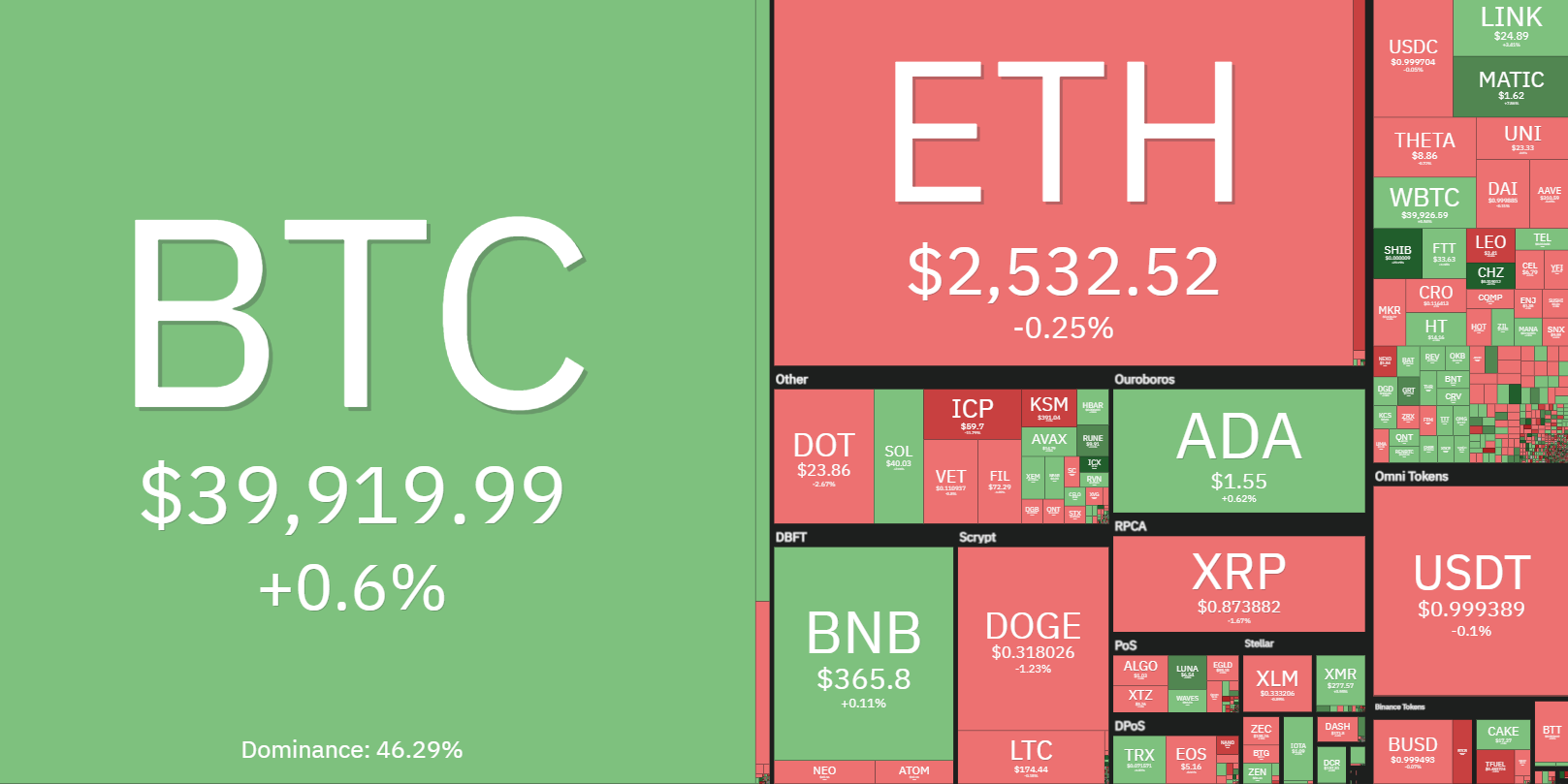

The overall mood of this cryptocurrency ecosystem is muted on June 15 with the majority of altcoins trading level while BTC (BTC) bulls look for a daily close above $41,000 as a sign that the market may be shifting in favour of bulls.

Data from TradingView shows that over the past couple of hours BTC cost shrunk to $41,330 but the breakout has been quickly fulfilled by advertising at overhead resistance levels.

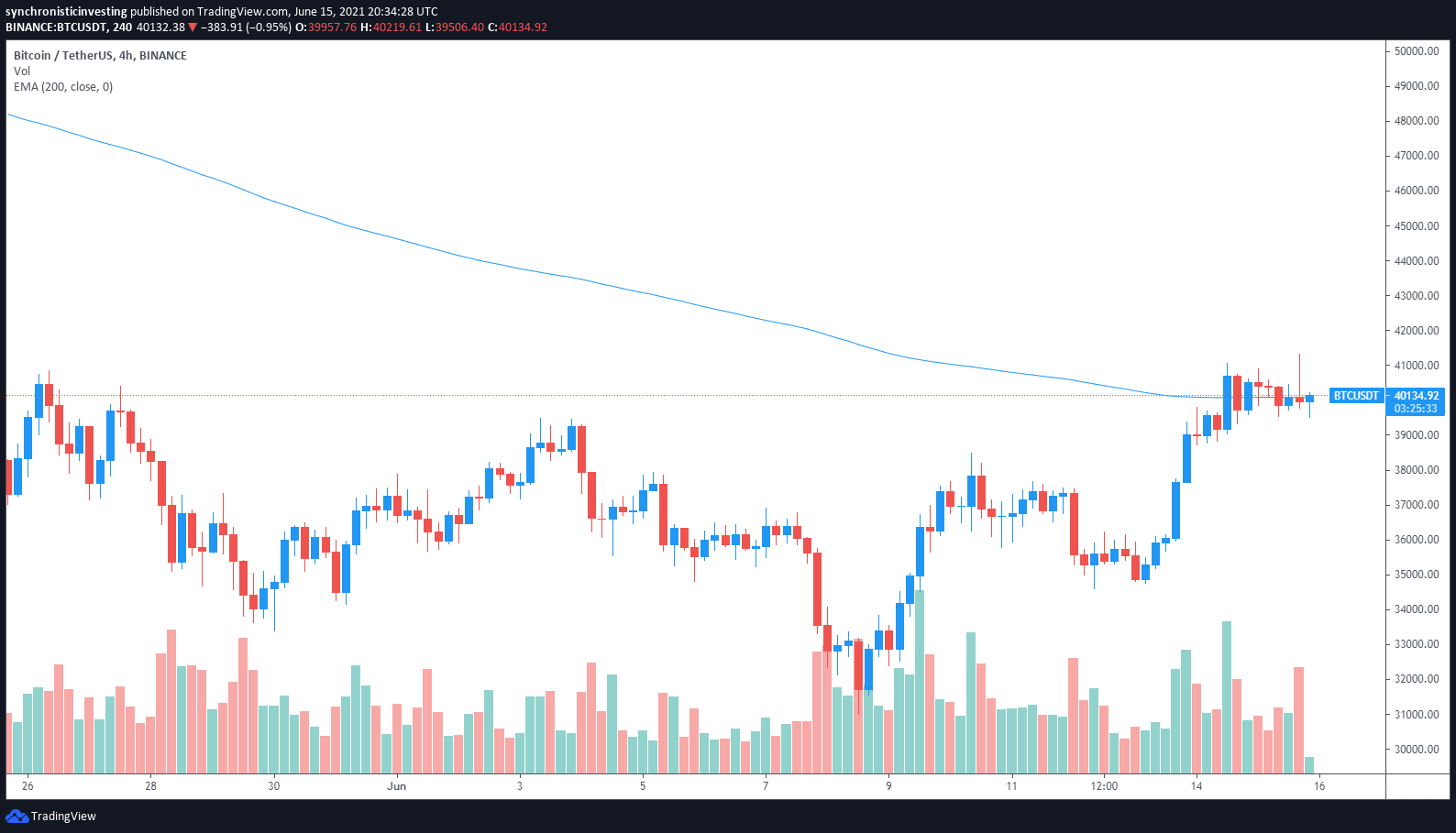

Another gauge of investor sentiment as emphasized by Rekt Capital is the 200 exponential moving average (EMA), which BTC tried to surpass on Tuesday but has been firmly rejected.

The 200 EMA (black) is a long-term gauge of investor sentiment

When #BTC is above the 200 EMA – investors are bullish on BTC $BTC is trying to break beyond the 200 EMA right now#Crypto #Bitcoin pic.twitter.com/uOlDfBoB0i

BTC’s rejection in the 200 EMA was followed with a rapid sell-off to $39,500, demonstrating that a possible move lower is not from the question.

Several altcoins rally positive news

Even though most of the altcoin market saw muted price action on June 15, Shiba Inu (SHIB) rallied 33% following the revelation that trading for the token could be encouraged on Coinbase Guru on June 17.

Inbound transfers for CHZ, KEEP & SHIB are now available from the areas where trading has been supported. Traders cannot put orders and no orders will be filled. Trading will start on or after 9AM PT on Thurs 6/17, if calculating conditions are met. https://t.co/r2L6N477Uj

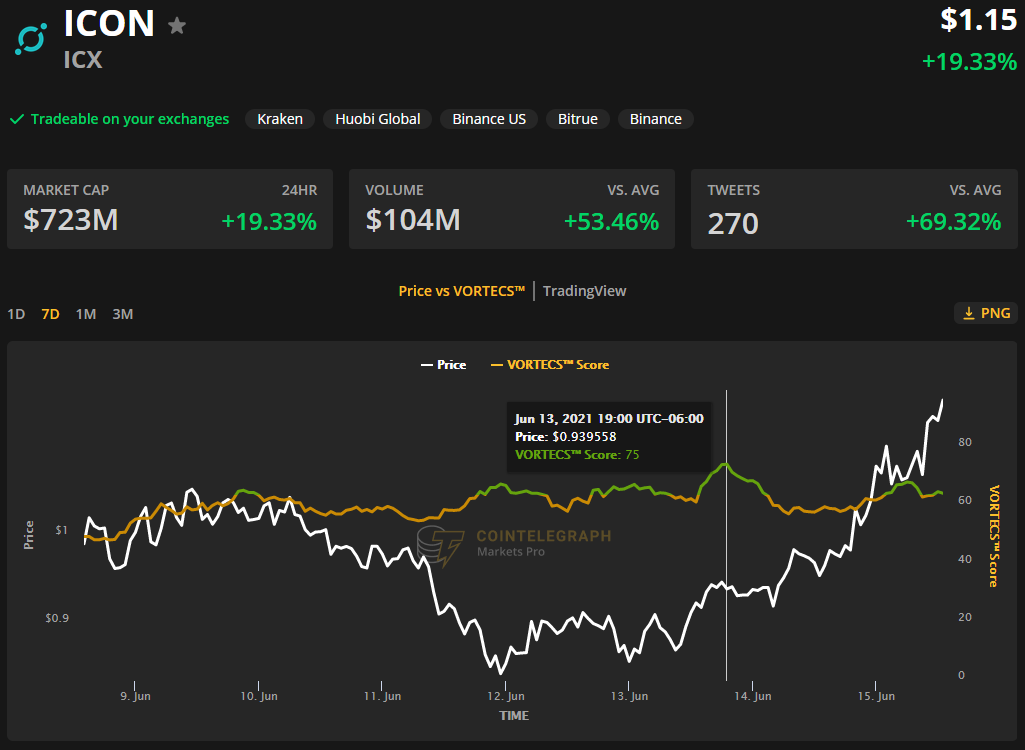

Icon (ICX) also received a boost following the release of a new Ethereum (ETH) Virtual Machine (EVM) compatible blockchain known as ICE. ICE is forecast to turn into the program hub for the Icon project and it will have its own native token.

VORTECS™ info from Cointelegraph Markets Pro started to discover a bullish outlook for ICX on June 13, before the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of information points including market sentiment, trading volume, recent price movements and Twitter action.

As seen from the graph above, the VORTECS™ Score started to turn green June 12 and finally attained a high of 75 on June 13, 10 hours before the cost increased 35% over the next two days.

Other notable altcoin performances include a 22% jump in Amp (AMP) plus a 20% profit to get iExecRLC (RLC) and Ultra (UOS).

The overall cryptocurrency market cap now stands at $1.685 trillion and BTC’s dominance rate is 44.6%.

The views and opinions expressed here are solely those of the author and don’t always reflect the views of CoinNewsDaily. Every investment and trading proceed entails risk, you need to run your own research when making a determination.