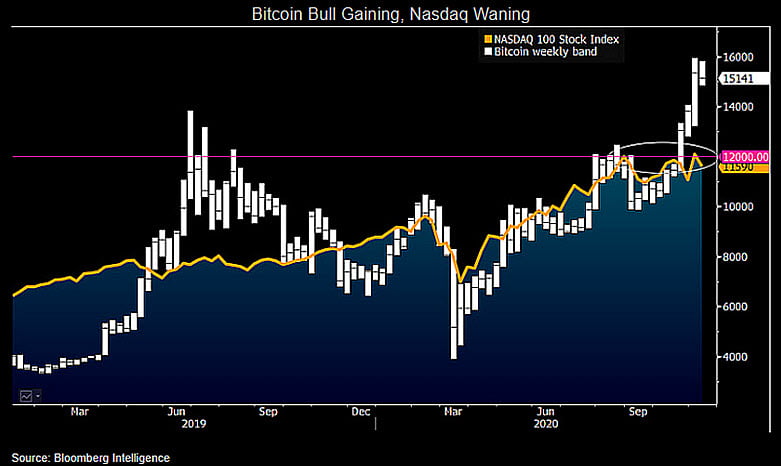

Bitcoin is on track of additional cost appreciation as it decouples from a vintage beneficial correlation with tech shares, according to Mike McGlone of Bloomberg Intelligence.

On Wednesday, the senior commodity strategist highlighted the ongoing pattern deviation among the flagship cryptocurrency and the Nasdaq 100 Inventory Index — a benchmark that tracks the current market effectiveness of foremost US technological know-how companies.

He posted a chart that confirmed BTC/USD in a clear uptrend in comparison to a somewhat bearish Nasdaq 100, at the very least in the past 5 months. Excerpts:

“Underpinnings for even further appreciation in Bitcoin are strengthening vs. the Nasdaq 100 Stock Index. The extended backlink since 2017 among the cost of the benchmark crypto and know-how-led fairness gauge seems to be ending, with essential and technological elements favoring Bitcoin.”

Bitcoin-Nasdaq correlation. Source: Bloomberg Intelligence

Nasdaq-BTC Heritage

The rise of coronavirus infection charges before this 12 months played a key part in sending tech stocks larger. Apple and Microsoft reclaimed its trillion-dollar marketplace capitalizations. In the meantime, the global lockdowns also served Alphabet (Google) and Amazon enter the cuatro comma club.

All round, the Nasdaq 100 surged by as significantly as 41.22 percent as of September 3 on a yr-to-date timeframe. In comparison, the Nasdaq Composite Index was up by a highest of 30.17 per cent.

Nasdaq 100 consolidates after topping out September 2. Resource: US100 on TradingView.com

Bitcoin, a tech asset itself without having a listing on foremost Wall Street indexes, surged 121.36 p.c immediately after establishing its yearly significant in close proximity to $16,000 previously this thirty day period. That pushed the cryptocurrency’s marketplace capitalization (~$200 billion) above that of PayPal Inc (~$186 billion).

The Nasdaq 100 started correcting reduced simply because of a string of reasons, ranging from a extended delay in the 2nd coronavirus aid bill and — extra lately — the inventory reallocation that followed a productive demo of a prospective COVID-19 vaccine by Pfizer and its spouse drugmaker BioNTech.

Bitcoin Unnerved

When Bitcoin corrected together with the Nasdaq 100 on the stimulus delay woes, it refused to bulge into the vaccine information. A provide-off endeavor in the cryptocurrency sector met with a sturdy bullish reaction. As of Wednesday, BTC/USD was hinting to retest $16,000.

Bitcoin carries on heading larger towards $16K. Supply: BTCUSD on TradingView.com

The contrasting moves concerning the Nasdaq 100 and Bitcoin attempted to show investors’ absence of reliance on the tech shares for additional sector cues on the cryptocurrency. As Mr. McGlone also highlighted, Bitcoin now has its own essential and technical catalysts to gas its price tag rally.

Just one of them is the hottest endorsements by mainstream traders. Months soon after hedge fund veteran Paul Tudor Jones called Bitcoin “the fastest horse” in the economic marketplaces, billionaire investor Stan Druckenmiller explained that he retains the cryptocurrency as insurance plan in opposition to financial inflation.

Very last month, PayPal also forayed into the Bitcoin sector by launching solutions that allow millions of its people to provide, obtain, retail outlet, and shell out cryptocurrencies.