The derivatives exchange Bitget issued an formal announcement that in order to meet the desires of additional investing people and strengthen user encounter, Bitget will formally start USDT Unified Account and Quanto Swap Deal at the close of March. Several times in the past, Bitget launched a new characteristic voting and established up a $100,000 prize pool to invite customers to take part. Bitget will invite world-wide consumers to encounter the beta edition of USDT Unified Account and Quanto Swap Contract

Bitget will divide the contract solutions into 4 main sectors right after the new element is introduced: USDT Margined contract/Coin Margined Agreement/USDT Unified Account/Quanto Swap Agreement. The USDT Margined Deal utilizes secure currency USDT as the margin The Coin Margined Contract makes use of the coin held as the margin, and is priced, traded and settled by the coin

The major emphasize of USDT Unified Account is that end users can decide on USDT to trade a number of buying and selling pairs at the same time, in which several contracts share the fairness of a person account, and the gain and reduction, occupation and threat in the account are shared. At the moment, Bitget can assistance up to 20 currencies such as BTC, ETH, UNI, AAVE, and so on. This signifies that end users can open contracts of multiple investing pairs in the very same account when employing USDT as the margin, and know the multi-forex hedging in 1 account.

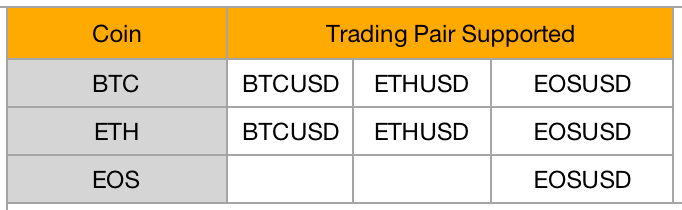

Quanto Swap deal supports a person or far more currencies as a margin to trade other cash. The emphasize is that it has changed the standard buying and selling system that coin margined contracts only use to trade the margined coin deal. Now just one coin can be employed as a margin for various trading pairs at the very same time, with out the need to have for forex exchange.

For case in point, a trader retains and is optimistic about BTC for the extensive term, but predicts that ETH is heading to increase just lately. The trader hopes that after completing the agreement transaction, BTC will be returned to his account.

It is not challenging to inform that, in comparison with traditional Coin Margined Contract, the benefits of Quanto Swap Contract are notably evident. To start with of all, all through the transaction approach, the procedure is incredibly straightforward, with no the loss brought about by the currency trade system. Secondly, in the settlement, the currency of the account can be made use of as a margin for revenue and loss settlement, and the consumer can eventually get the preferred forex. Thirdly, you can get a revenue when the margin coin price tag rises while investing. For illustration, when you trade ETH, use BTC as the margin. If the BTC rises, you can get each the investing profits and the greater cash flow. And lastly, the Quanto Swap Deal supports utilizing particular margin currencies to trade multiple buying and selling pairs at the exact time and accomplishes internal hedging, equity sharing, and risk-sharing.

It is reported that the Bitget Quanto Swap Contract will be launched at the conclude of March, and the international community beta will be released. Bitget will guidance the three mainstream currencies of BTC, ETH, and EOS. Bitget CEO Sandra reported, “USDT Unified Account and Quanto Swap Agreement are a honest operate released by Bitget for international users this calendar year. Following it is released at the conclusion of March, welcome to working experience them and give us tips. Quanto Swap Agreement will add extra cash centered on person feedback”