Altcoins are picking up steam since the relief rally in Bitcoin and Ether increases traction.

Bitcoin’s (BTC) active source — coins that have moved in the previous two decades or before — dropped into a five-month reduced of 44.5% on June 2, according to data from Glassnode. This indicates that investors who had bought Bitcoin over two decades ago are not keen to market after the 40 percent drop. Even miners, who offered during the May correction have since reversed their decision. The outflows from miner addresses are at the bottom level in seven months, meaning that miners are holding to their own Bitcoin.

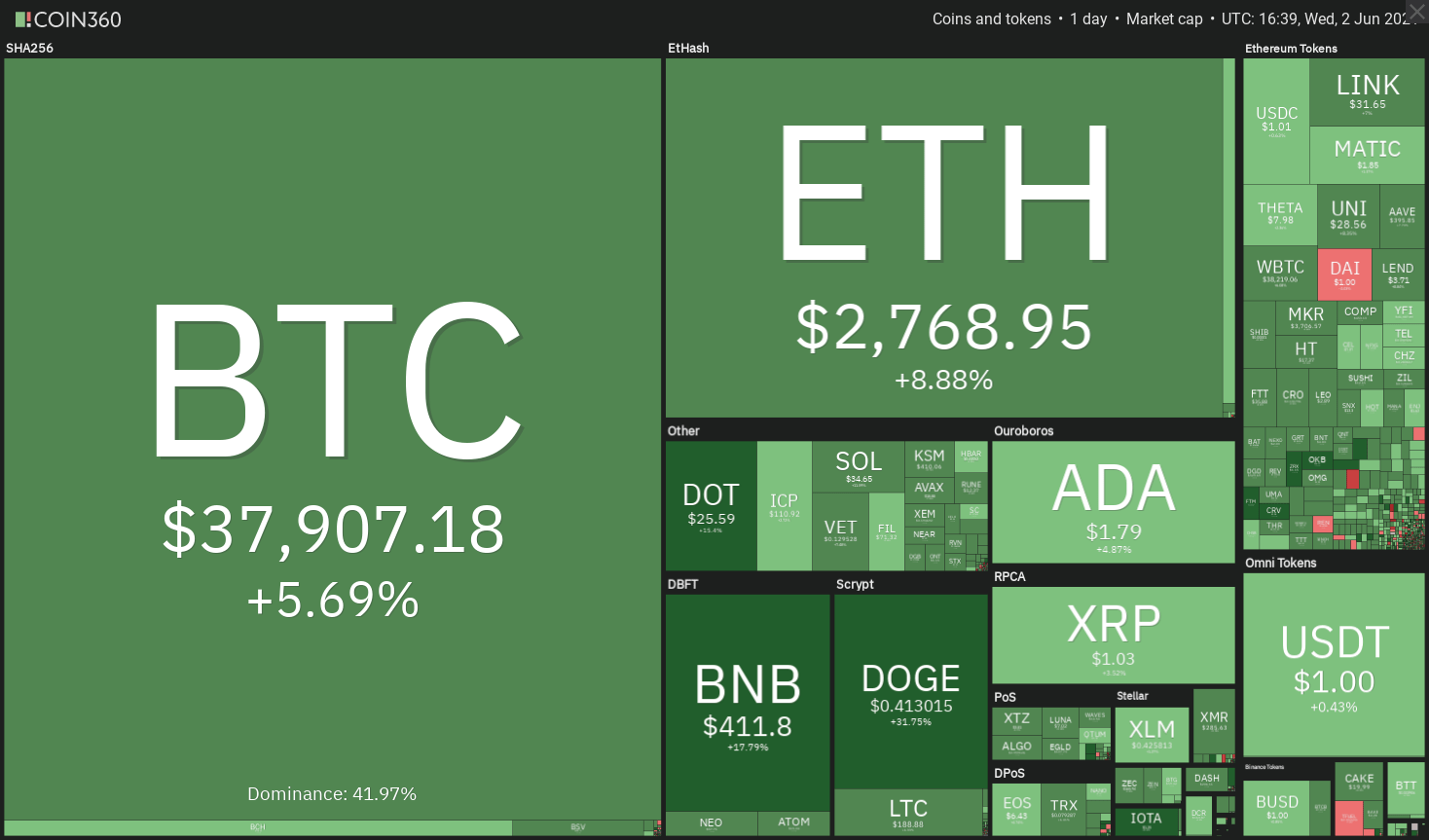

Daily cryptocurrency marketplace performance. Resource: Coin360

Daily cryptocurrency marketplace performance. Resource: Coin360

Veteran trader Peter Brandt believes that Bitcoin’s correction can expand below $30,000. Brandt reported that every 50% fall in Bitcoin’s history has increased to 70%. In addition, he highlighted that according to previous precedence, Bitcoin is not likely to hit a brand new all-time large within seven months of a 50 percent correction. But, PlanB, founder of the stock-to-flow-based Bitcoin cost versions, believes a further sharp fall under $30,000 is unlikely. In addition, he remains positive on the prospects of Bitcoin hitting a brand new all-time high this season.Right now, analysts are divided in their view on Bitcoin’s short-term cost action. Let us examine the graphs of this top-10 cryptocurrencies to ascertain the path of least resistance. Bitcoin continues to trade within a symmetrical triangle pattern as the bulls and the bears fight it out to establish their own supremacy. Although the symmetrical triangle generally functions as a continuation pattern, it’s difficult to predict with certainty until the price breaks out of the triangle.

BTC/USDT daily graph.

BTC/USDT daily graph.

Even the downsloping moving averages and also the relative strength indicator in the negative territory imply that bears have the upper hand. If the BTC/USDT pair breaks beneath the triangle, the bearish momentum can select up. There’s a minor service at $28,000 but if that also cracks, the set may retest the $20,000 level. This negative opinion will probably invalidate if the bulls push and maintain the price over the resistance line of the triangle. If that happens, it will imply that bulls have overpowered the bears. The set may then try a rally into the 50-day simple moving average ($49,201). This amount may again function as a stiff resistance but if the bulls propel the price over it, the pair may indicate that the downtrend could be over. ETH/USDT Ether (ETH) turned down from the 20-day exponential moving average ($2,762) on June 1 but the positive sign is the bulls did not give up much ground. This implies that the buyers did not hurry to shut their positions.

ETH/USDT daily graph.

ETH/USDT daily graph.

The 20-day EMA is flattening out and the RSI has climbed near the midpoint, indicating the selling pressure has reduced. If buyers drive and maintain the price over the resistance line of the symmetrical triangle, the ETH/USDT pair may start a relief rally that may reach the 61.8% Fibonacci retracement level at $3,362.72 and then the 78.6% retracement level at $3,806.91. Contrary to this assumption, if the bulls fail to sustain the price over the triangle, the set may consolidate within the triangle for a few more days. A breakdown and close beneath the triangle will signify advantage to the bears. BNB/USDT Binance Coin (BNB) has climbed over the 20-day EMA ($399) but it could face stiff opposition at $423.83. In the event the price turns down from this overhead resistance, the bulls will attempt to arrest the decline at the trendline.

BNB/USDT daily graph.

BNB/USDT daily graph.

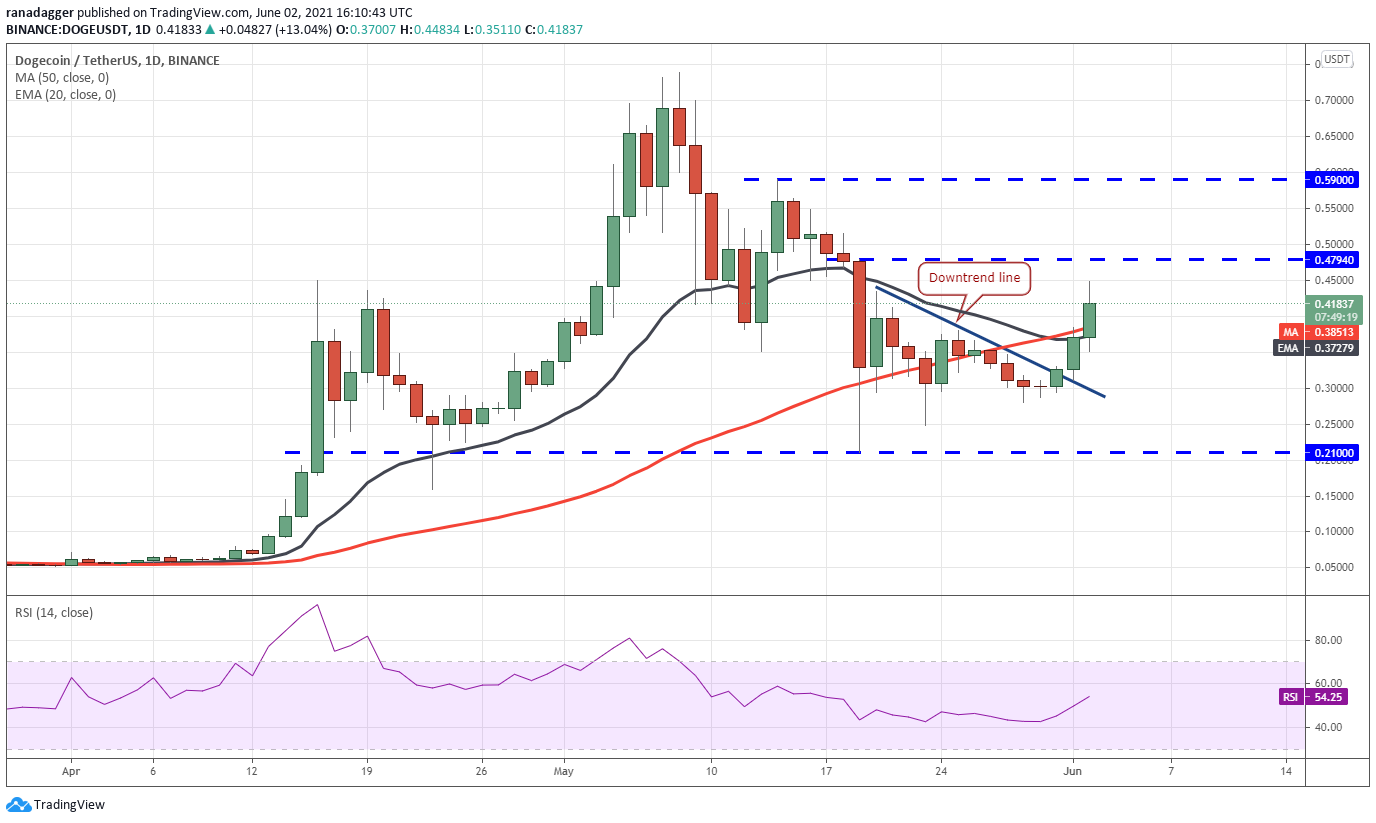

If they succeed, it will indicate the bulls are attempting to form a greater low. This will increase the prospect of a fracture above $423.83. The BNB/USDT pair may then rally into the 50-day SMA ($505). A breakout of this immunity will indicate the downtrend might be over. To the contrary, in the event the price turns down from the present level and plummets under the trendline, it will indicate the sentiment remains negative and dealers are selling on rallies. The set may then retest the critical support at $211.70.ADA/USDT Cardano (ADA) broke above the downtrend line on June 1 along with the bulls are attempting to expand the relief rally over $2 now. The 20-day EMA ($1.64) has begun to turn up along with the RSI is trading over 54, suggesting that the bulls have the upper hand. If buyers succeed in pushing the cost above $2, the ADA/USDT pair may rally into the all-time large at $2.47.On the flip side, if the price turns down from $ two, the bears will attempt to pull the cost back beneath the downtrend line. If that happens, it will imply that buying dries up at greater levels. The set may then drop to the 50-day SMA ($1.52).A breakdown and close beneath the 50-day SMA could entice additional selling and the set may drop to $1.33 and after to $1. DOGE/USDTDogecoin (DOGE) broke above the downtrend line on May 31 and rid the 20-day EMA ($0.37) barrier today. The RSI has jumped into the positive territory and the 20-day EMA has begun to turn up, suggesting the bulls are making a comeback.

DOGE/USDT daily graph.

DOGE/USDT daily graph.

If buyers propel the price over $0.47, the DOGE/USDT pair may select up additional momentum and rise to $0.59. Conversely, if the price turns down from $0.47, the set could adjust into the 20-day EMA. Whether this service holds, it will suggest the sentiment has turned into positive and dealers are buying on dips. The bulls will then make an additional attempt to push the price over $0.47. However, in the event the price turns down and breaks under the 20-day EMA, the set could drop to $0.28 and then to $0.21.XRP/USDTThe bulls attempted to push XRP over the 20-day EMA ($1.07) on June 1 but met with stiff opposition from the bears. On the other hand, the buyers did not give up much earth, indicating strength.

XRP/USDT daily graph.

XRP/USDT daily graph.

The bulls will try to thrust and maintain the price over the 20-day EMA. If they have the capacity to do that, the XRP/USDT pair may start its relief rally into the 50-day SMA ($1.30) and then to the downtrend line. Alternatively, if the price turns down from the 20-day EMA, the set may again drop to the $0.88 to $0.80 support zone. A break below this zone could lead to a retest of the May 23 reduced at $0.65.

The cost had turned down from this immunity on May 28, hence the bears are likely to defend this amount aggressively.

DOT/USDT daily graph.

DOT/USDT daily graph.

If the DOT/USDT set turns down from $26.50 but bounces off the trendline, it will imply that bulls are accumulating on drops. That could result in the creation of a bullish ascending triangle pattern, which will complete to a breakout plus close above $26.50. The pattern target of this setup is 35.91. Alternatively, if the bears sink the price under the trendline, the set may drop to the service at $15. A powerful rebound off this service will indicate a couple of days of range-bound activity between $15 and $26.50.

UNI/USDT Uniswap (UNI) turned down from the 20-day EMA ($28.41) on June 1 but that the positive sign is the bulls did not permit the cost to ramble down. The buyers are trying to push the price over the 20-day EMA today.

UNI/USDT daily graph.

UNI/USDT daily graph.

The repeated retest of a resistance level will weaken it. The 20-day EMA is flattening out and the RSI has climbed over 48, indicating the selling pressure has reduced.If buyers thrust the cost over the 20-day EMA and $30, the UNI/USDT pair may rise to the 50-day SMA ($33.67). A breakout of this immunity could indicate an end of the downtrend.Conversely, if the price turns down from the 20-day EMA and falls under $25.94, the bears will probably try to pull the pair down to $21.50. A breakdown and shut below this service will imply that the bears have reasserted their supremacy.

ICP/USDT Internet Computer (ICP) remains feeble since the bulls have not been able to push the price back over $120 in the previous five days. This implies a lack of competitive buying even at the present levels. When the bears sink and maintain the price under the 103.71 service, the ICP/USDT pair may resume its downtrend and challenge that the May 19 reduced at $86. Whether this support cracks, the set may drop to $60.To the contrary, if bulls propel and maintain the cost over $120, it will indicate accumulation at lower levels. That may clear the route for an up-move to $168. In the event the price turns down from this immunity, a couple of days of range-bound activity is likely. The set may select up bullish momentum onto a breakout and close over $168.BCH/USDT The bears tried to pull on back the price below the amount on June 1 but they couldn’t maintain the lower levels. This implies buyers are attempting to form a greater low.

BCH/USDT daily graph.

BCH/USDT daily graph.

The relief rally is likely to face stiff opposition at the 20-day EMA ($801). In the event the price turns down from this immunity, the bears will probably create yet another attempt to sink the BCH/USDT pair under the $685 to $600 support zone. If they succeed, the set may retest the May 23 reduced at $468.13. Conversely, if bulls drive the price over the 20-day EMA, the momentum can pick up along with the set may rally into the 50-day SMA ($958). This amount may again function as a stiff resistance but if the bulls can thrust the cost above it, the rally may extend to the 61.8% Fibonacci retracement level at $1,198.53.

The views and opinions expressed here are solely those of the writer and do not necessarily reflect the views of CoinNewsDaily.

Every single investment and trading move involves risk. You should conduct your own research after making a decision.

Market information is supplied by HitBTC exchange.