Bitcoin has failed various attempts at breaking past $10,500 around new weeks, however analysts say that the cryptocurrency is however on monitor to erupt into a new bull run in the coming months.

Associated Reading: In excess of a Dozen Best Crypto Assets Are Up Over 10% These days: Here’s Why

Bitcoin Charts Sign a Start off to A further Bull Operate

A distinguished trader shared the chart beneath on June 13th, exhibiting that Bitcoin’s two-week relative toughness index (RSI) is about to crack earlier a downtrend shaped in the wake of the rally to $20,000.

This is significant as the last time the two-7 days RSI looked as it did now was at the start of BTC’s preceding bull operate, prior to a ~4,000% transfer from ~$500 to $20,000.

The RSI breakout is not the only craze that has analysts believing that the start off of a macro uptrend is on the horizon.

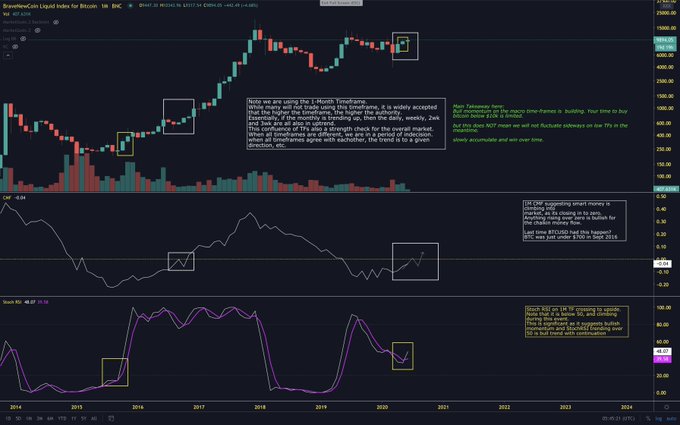

Technical analyst Eric “Parabolic” Thies shared the chart down below. It demonstrates BTC’s macro price tag action together with two critical craze indicators, the Chaikin Funds Movement (CMF) and the Stochastic RSI (Stoch RSI).

The analyst famous that both indicators glance just about particularly as they did at the start of the 2016-2017 bull operate, which as explained previously, took Bitcoin from the hundreds to $20,000 actually inside of the span of two years.

These signals present that “your time to purchase Bitcoin under $10k is limited,” Thies remarked.

The Acquire Stress Is There

The expectation that the start out of another Bitcoin bull run is below can be backed up by fundamental sector trends.

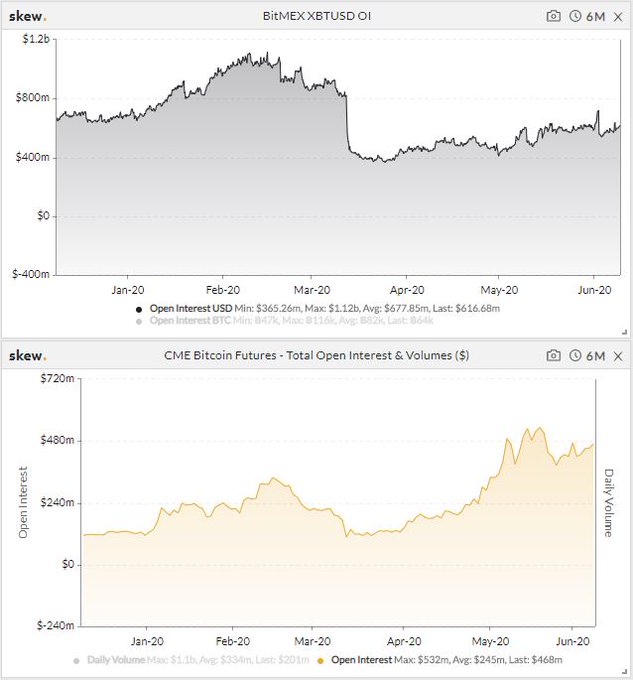

Knowledge demonstrates that there is a short while ago been exponential advancement in the CME’s Bitcoin futures industry. Derivatives tracker noticed that the total of value in the CME’s Bitcoin current market is up 310% in 2020 by itself.

The CME is typically employed by establishments due to the somewhat bigger barrier to entry of futures contracts, along with the high minimum buy sizes enforced by the trade.

“More proof for the ‘institutionalization’ of Bitcoin. CME Bitcoin Futures Open fascination is quick approaching BitMEX’s XBTUSD. CME Open up curiosity up 310% in 2020 alone,” electronic asset supervisor Charles Edwards stated.

Incorporating to this, crypto derivatives publication Ecoinometrics observed that there is now $300 million truly worth of Bitcoin contact selections held by establishments through the CME, up from all around $10-20 million from the begin of the yr.

There are also couple put alternatives, suggesting establishments are leaning bullish.

Investopedia clarifies that phone solutions are “financial contracts that give the option purchaser the right, but not the obligation, to get a stock, bond, commodity or other asset or instrument at a specified cost inside a certain time interval.” Phone calls are purchased by buyers that want to reward from an asset appreciating in worth.

Relevant Reading through: Crypto Tidbits: Bitcoin Fails at $10k, Ethereum Coins Explode, Coinbase Appears to be like to Add 18 Altcoins

Showcased Image from Shutterstock Selling price tags: xbtusd, btcusd, btcusdt Bitcoin Will Soon Print the Actual Similar Signal That Marked the Get started of a 4,000% Rally