It’s been a gradual previous handful of weeks for the Bitcoin sector. Following hitting $10,500 at the get started of June, the cryptocurrency has entered a brief-phrase downtrend.

Whilst some say that this price tag action is a precursor to a steep correction, a crucial pattern indicator is about to print a bullish indication. This is critical as this indicator has been relatively accurate in predicting rallies and corrections around new months.

Associated Looking through: Right here Are 2 Means to Advantage From the Impending Bitcoin Volatility Spike

Bitcoin’s Stochastic RSI Is About to Print a Bullish Signal

As pointed out by a cryptocurrency trader, a important indicator on Bitcoin’s three-day chart is about to register a bullish crossover.

The indicator in issue is the Stochastic RSI, in some cases just named the Stochastic. Investopedia describes the complex indicator as follows: “A stochastic oscillator is a well-liked specialized indicator for building overbought and oversold signals.”

In accordance to the Stochastic, Bitcoin not too long ago attained oversold amounts but is commencing to reverse bigger. The past time this trend was witnessed was in March, just times after BTC hit $3,700 then began a 150% rally that peaked at $10,500.

Bitcoin 3-working day Stoch RSI investigation by trader "Fractalwatch" (@Fractalwatch on Twitter). Chart from TradingView.com

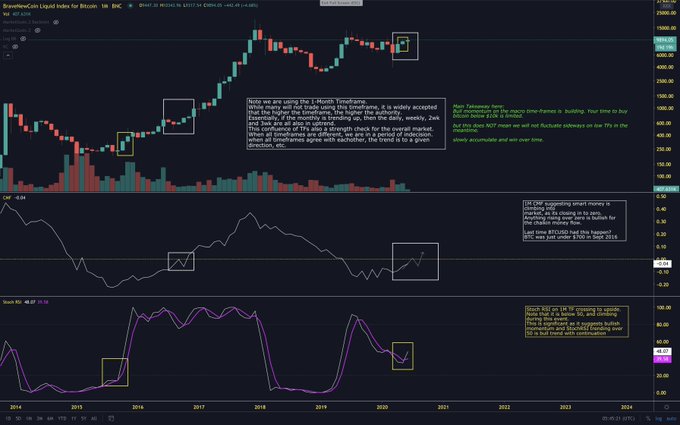

The Stochastic RSI on the month to month time frame is also bullish, in accordance to another analyst.

As documented by NewsBTC beforehand, trader Eric “Parabolic” Thies recognized in June that Stochastic RSI on Bitcoin’s every month time body is also bullish.

He shared the chart down below conveying that the indicator appears to be like like it did prior to BTC rallied from the hundreds to $20,000 from 2015-2017.

Macro BTC cost chart shared by crypto trader Eric "Parabolic" Thies (@Kingthies on Twitter). Chart from TradingView.com

Referencing the chart earlier mentioned, Thies wrote that “your time to purchase Bitcoin below $10,000 is limited.”

Linked Reading through: Crypto Tidbits: Bitcoin Stalls at $9k, Cardano Shelley, Elon Musk & Ethereum

Basic Variables Corroborate Specialized Pattern

The imminent bullish crossover in the Stoch RSI comes as a Bloomberg analyst has discovered variables signaling BTC will rally increased.

In a report released July 2nd, Bloomberg’s Mike McGlone wrote:

“The number of energetic Bitcoin addresses applied, a crucial sign of the 2018 value decrease and 2019 recovery, indicates a benefit closer to $12,000, primarily based on historic patterns. Reflecting increased adoption, the 30-day normal of one of a kind addresses from Coinmetrics has breached last year’s peak.”

He included that taking into consideration reducing volatility, money printing by central banks, and adoption of Bitcoin by establishments, the scenario for BTC to value is solid.

McGlone’s evaluation and the aforementioned Stoch RSI sign exhibit that the two fundamentals and specialized propose Bitcoin has home to appreciate. But where by Bitcoin will rally to and when is at present anyone’s guess.

Highlighted Picture from Shutterstock Value tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Bitcoin Surged 150% Just after This Sign Last Appeared. It's Almost Back All over again