Bitcoin is again in the cryptocurrency market’s spotlight immediately after smashing through the notorious $10,000 resistance barrier. Info from Glassnode reveals that much more than 763 million Tether (USDT) flooded a number of cryptocurrency exchanges while get orders began to pile up.

The huge cash influx allowed the flagship cryptocurrency surge and access a new yearly superior of virtually $11,500.

Tether Inflow to Crypto Exchanges. (Resource: Glassnode)

Regardless of the outstanding rate action that Bitcoin has liked about the previous couple of days, numerous bearish signals are popping up. These might suggest that BTC sits in overbought territory, which might guide to a pullback just before larger highs are achieved.

Technicals Alert of a Correction In advance of Bitcoin

In fact, the Tom Demark (TD) sequential indicator introduced offer alerts across a number of time frames, such as BTC’s 1-day, 9-hour, and 4-hour charts. The bearish formations developed in the kind of environmentally friendly nine candlesticks. A sudden raise in the marketing force driving the pioneer cryptocurrency could validate the pessimistic outlook.

If so, the TD setup estimates that Bitcoin may perhaps have the likely to retrace for one particular to four each day candlesticks ahead of the uptrend resumes.

TD Presents Provide Sign Throughout the Board. (Supply: TradingView)

The simple fact that the TD set up presented the identical promote signal across distinctive time frames is a purpose to fret. Although market place individuals have grown overwhelmingly bullish immediately after the recent price motion, a retracement may possibly assist keep the uptrend wholesome. By letting sidelined traders to re-enter the market, new cash may well assist propel BTC to increased highs.

Stiff Guidance Ahead

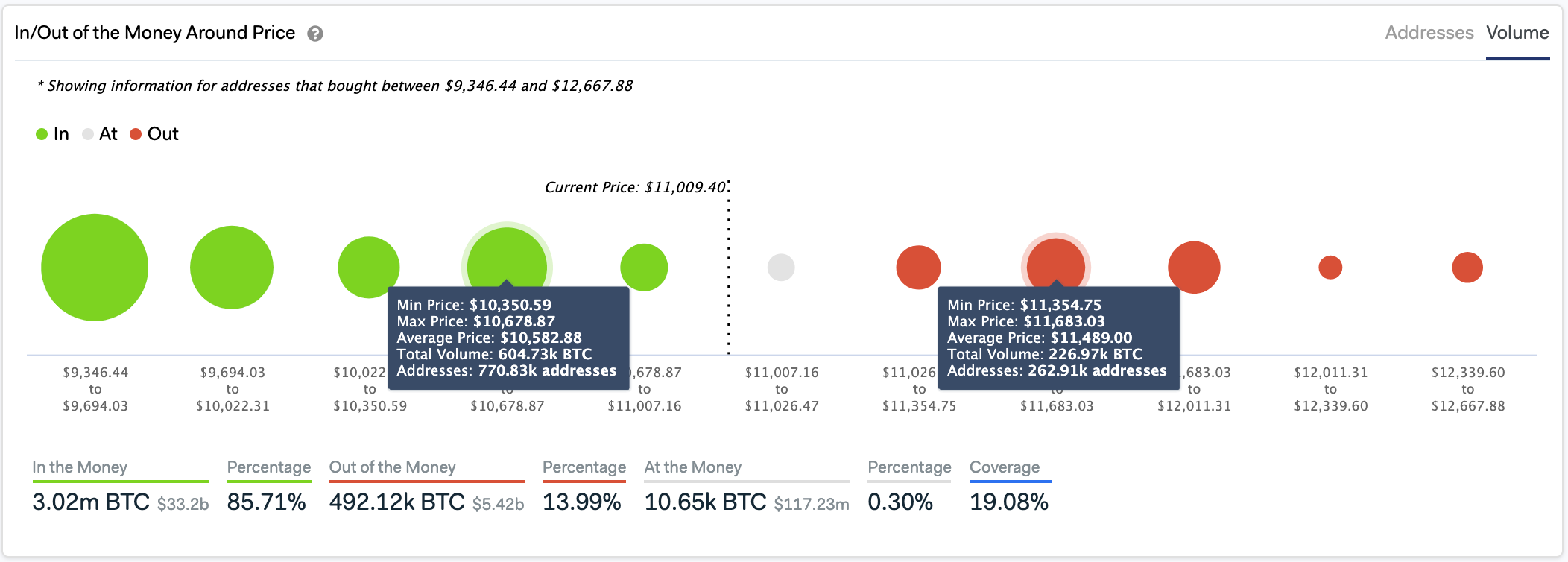

In the function of a correction, IntoTheBlock’s “In/Out of the Cash Close to Price” (IOMAP) design reveals that Bitcoin may well locate rigid assistance among $10,350 and $10,680. Close to these selling price degrees, roughly 771,000 addresses experienced beforehand ordered practically 605,000 BTC.

Given the magnitude of the current upswing, a offer-off may perhaps induce worry amongst market place members who purchased in as well late. If this ended up to occur, the pioneer cryptocurrency could shed the $10,600 as assistance. Underneath these situation, the up coming essential region of fascination lies all around $9,800.

This is a important help degree as holders in just this variety will try to continue being rewarding on their positions in the function of a downswing. They may perhaps even acquire a lot more Bitcoin to pressure its price to rebound in direction of greater highs.

Bitcoin Sits On Prime of Massive Provide Wall. (Source: IntoTheBlock)

On the flip aspect, the IOMAP cohorts exhibit that Bitcoin could have a tough time moving previous the $11,500 resistance barrier. Here, practically 263,000 addresses acquired approximately 227,000 BTC. These addresses will likely try to break-even on their positions in the occasion of a bullish impulse.

Having said that, breaking above this price tag hurdle raises the odds for a even more advance toward the up coming resistance wall at $13,000. Knowledge suggests that there aren’t any key offer obstacles in-between that will protect against these types of an upward movement price motion.

Showcased Image from Shutterstock Cost tags: xbtusd, btcusd, btcusdt Charts from TradingView.com