To market Bitcoin to firms, NASDAQ mentioned MicroStrategy hosted the Bitcoin for Firms digital interactive seminar yesterday. The objective of the party is to share advice on how organizations can obtain BTC as a treasury strategy.

According to MicroStrategy CEO Michael Saylor, the initial working day was a resounding achievement, with more than 1,400 firms getting part. Working day 2 proceeds right now, with the concentration of dialogue on vendors presenting to the attendees.

Bitcoin as a Hedge Versus Uncertainty

MicroStrategy hit the headlines in August 2020 as the 1st community listed agency to invest in important Bitcoin quantities as element of its treasury strategy.

The organization outlined its factors for performing so in a press release. In it, they say the method intends to increase extended-time period price for shareholders. But far more than that, Saylor spoke of the gains of Bitcoin over dollars as a reaction to macroeconomic things.

“MicroStrategy invested months deliberating to establish our cash allocation technique. Our determination to invest in Bitcoin at this timewas pushed in component by a confluence of macro elements impacting the economic and business enterprise landscape that we believe that is generating long-phrase challenges for ourcorporate treasury system ― hazards that should really be resolved proactively.”

Due to the fact then, Saylor has turn out to be an evangelist for Bitcoin, marketing the result in on various fronts.

A lot more just lately, Saylor gave an job interview in which he gave a cost prediction of $15 million for each token. He thinks this is probable if the flood of capital from all other sectors, this kind of as actual estate, stocks, and so on., can make its way into the primary cryptocurrency.

Not Absolutely everyone Agrees With Saylor’s Evaluation

Organization analyst Frances Coppola applauded MicroStrategy’s transfer to use its piles of money, in particular in a zero-fascination market. But she questioned why the firm didn’t devote in new product or service strains or improve existing ones, instead than splurge on BTC. She also elevated the challenge of hard cash stream danger by likely Bitcoin significant.

To incorporate, holding significant portions of BTC could be bring about for thought that MicroStrategy is an financial investment organization or maybe a de facto Bitcoin exchange-traded fund. The implications of which may well have lawful and regulatory ramifications.

This difficulty is most likely the biggest stumbling block in conditions of CEOs leaping on board with Bitcoin. And Saylor is informed of the challenge. In a tweet to endorse the digital seminar, he reported:

“If you are interested in the authorized things to consider firms encounter though integrating #Bitcoin into their company system, you are not on your own. We have professionals from more than 1400 firms becoming a member of us tomorrow for this dialogue. There is however time for your authorized group to show up at.”

Working day 1 of the event features a dialogue on the lawful considerations corporations confront when obtaining Bitcoin.

Comments signifies that the seminar has been a smash strike. Saylor states an “avalanche” of companies will make the move from money into Bitcoin inside of the up coming 12 months.

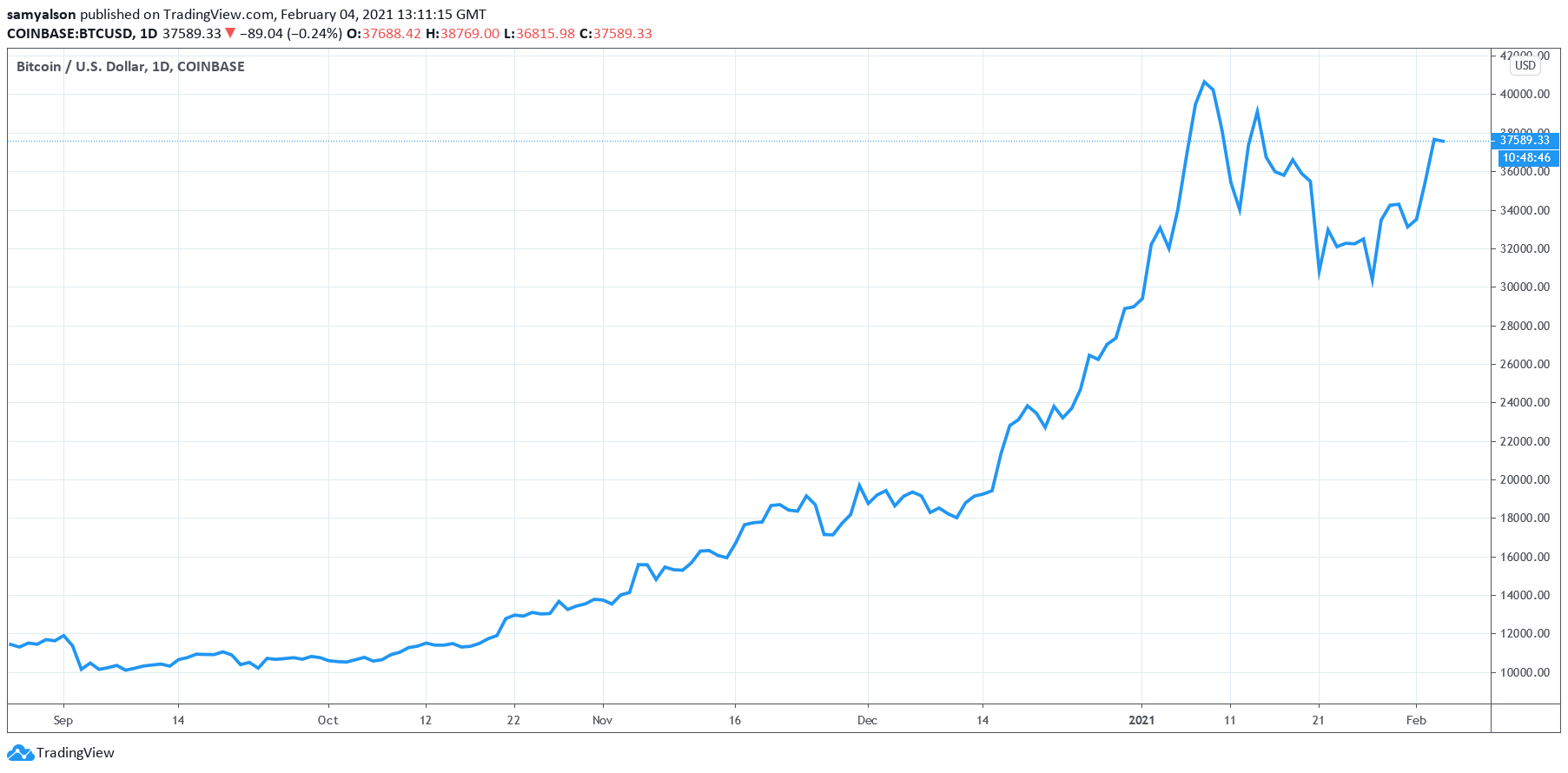

Source: BTCUSD on TradingView.com