The open up desire of Bitcoin is rising once again, indicating at a likely massive price motion in the near phrase.

In the previous 24 several hours, the Bitcoin cost dropped by close to 2.2% from $11,093 to $10,860. Many traders talked about the worth of the $11,100 resistance level and BTC cleanly rejected it.

The spike in Bitcoin volatility coincides with the imminent expiration of 77,000 BTC possibilities contracts.

Bitcoin Solutions Open Desire is Rising, What Does It Signify?

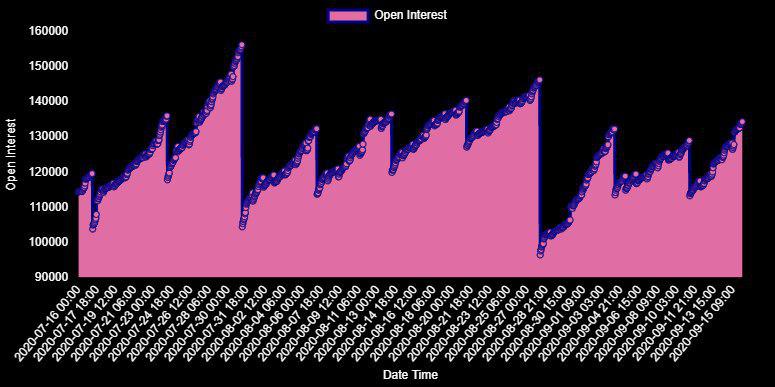

According to Deribit, the BTC solutions open interest is hovering at all around 134,000 contracts.

Historically, September has been a sluggish month for Bitcoin in conditions of volatility. Every single single September month to month candle has closed purple given that 2017.

The higher amount of solutions open up fascination indicates that a spike in volatility in October is starting to be extra probably.

No matter if that volatility would direct to a Bitcoin rejection and a significant pullback or bring about the bull marketplace to resume stays uncertain.

If Bitcoin follows the prior put up-halving cycle, BTC is probably to realize for a new all-time superior 15 months after the recent halving.

Due to the fact the most current halving occurred in Might, that will make an explosive rally by mid-2021 really probable.

In the near-time period, BTC could continue being in a vary among the $9,000s and $12,000, as the accumulation section continues.

After the September expiration transpires, which happens on the past Friday of each individual thirty day period, BTC would very likely display a direction. For now, the continual rejection of $12,000 and $11,100 can make a extended consolidation stage probable.

The Deribit staff wrote:

“Open curiosity is developing once again, 134k $BTC contracts remarkable which is ~74% of overall market place. Following is CME with all around 25k contracts excellent. The most important OI is held in the Sept ’20 expiry, a complete ~77k of which ~59K is held at Deribit.”

The solutions open up fascination of Bitcoin. Resource: Deribit

What Traders Hope in the Small Phrase

Some traders feel the modern Bitcoin rejection was a consider-revenue pullback. In the near expression, specialized analysts foresee a minor price drop.

A pseudonymous trader identified as “Byzantine General” wrote:

“It seriously was a very good location to consider revenue. That liquidation cluster at $10,600 almost certainly receives taken out now. Would be a awesome re-exam of the 50EMA as well.”

A different pseudonymous trader acknowledged as “DonAlt” also said that the rejection of BTC on the everyday chart is not “the response I required.” He mentioned:

“Weak push down initiated solely by regular markets. Could do anything at all from here on out.”

The every day chart of Bitcoin. Source: BTCUSD on TradingView.com, Edward Morra

Edward Morra, a Bitcoin trader, mentioned the sentiment remains cautiously bearish for now. He said:

“Perfectly retested MSB (market place construction split) degree, bullish if it can crawl above it, bearish for now.”

In the quick expression, traders are usually careful as Bitcoin seems to be for a path pursuing the $11,100 rejection.