Bitcoin’s value has reeled lessen currently subsequent the latest rejection it posted at $9,800.

This motion lessen seems to have been driven by two most important things. In addition to the rejection at $9,800 pointing to some underlying weakness, yesterday Bitcoin observed a enormous spike in miner outflows.

This usually means that miners are shifting their cryptocurrency away from cold storage wallets and in the direction of exchanges, signaling that they intend to promote this recently minted crypto on the open up marketplaces.

It is very probable that the benchmark electronic asset could be poised to see additional weakness in the in the vicinity of-phrase, as the outflows amplified even more just a handful of hrs back.

Bitcoin Sees Significant Spike in Miner Outflows as Specialized Framework Weakens

Bitcoin’s price tag reeled down to lows of $9,300 before nowadays as its specialized construction flashed some signals of degrading. This came about soon immediately after the rejection it posted at $9,800 yesterday.

This rejection even more confirmed the heavy resistance it faces at this rate area, signaling that buyers do not at present have more than enough power to surmount the resistance that has formed more than the previous couple of months.

It does show up that Bitcoin has some large guidance just below its current value amount, as it has bounced amongst $9,000 and $9,200 over the previous numerous months.

Where by it traits up coming will likely be mostly dependent on whether or not or not customers are ready to assistance it previously mentioned this price region.

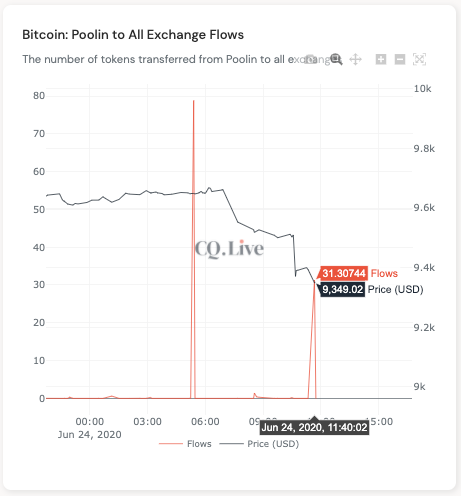

A person trend that could affect how the benchmark cryptocurrency trends in the coming couple of hours could be a latest spike in miner outflows.

Details displays that miners have been sending a significant amount of money of their Bitcoin holdings to exchanges in latest moments. This usually means that they intend to sell these tokens to finance their operational bills.

Ki Younger Ju – the CEO of blockchain analytics agency CryptoQuant – defined in a current tweet that spikes in outflows practically generally precede big price declines.

“If you know when the miner sends revenue to exchanges, you can infer when the BTC rate will plunge. The total of BTC sent doesn’t make any difference when seeking at the ‘Miner to Exchange flows.’”

Graphic Courtesy of Ki Youthful Ju

Miner Offering Activity Implies Ongoing BTC Slide is Considerably from Around

Though Bitcoin is speedy approaching its significant aid at its selection-lows of $9,000, it is doable that this aid won’t hold robust for also significantly extended due to even further miner outflows viewed this morning.

Ju spoke about these in a article from previously right now, noting that this latest spike in outflows indicates the plunge will continue on.

“Outflow once more. Probably the plunge carries on,” he claimed whilst pointing to the chart witnessed under.

Image Courtesy of Ki Youthful Ju

It is nevertheless unclear as to whether or not these likely imminent sales from miners will be more than enough to force Bitcoin below $9,000.

Featured picture from Shutterstock.