Bitcoin has started to fall reduce after once more even with the flush on Monday to $30,000. The main cryptocurrency currently trades for $32,500, beneath the $36,000 highs the cryptocurrency noticed in the course of a bounce before today.

Bitcoin’s drop will come in spite of the simple fact that the funding charges on foremost crypto-asset futures platforms have reset. The funding fee is the reoccurring payment that extensive positions fork out shorter positions to preserve the selling price of the long term to the spot cost. Significant funding premiums, these types of as individuals witnessed on Saturday, are what signaled a correction to numerous on the weekend.

The cryptocurrency could see further losses, some analysts say.

Related Looking at: Wall Avenue Veteran Kickstarts Own Bitcoin Fund With $25m Investment

Bitcoin Set to Fall Lessen?

Not all analysts are persuaded that the Bitcoin shakeout is performed inspite of the cryptocurrency losing almost 30% in the span of 48 hrs.

Commenting on the modern selling price action and what is most likely to appear up coming, one crypto-asset analyst a short while ago remarked:

“Still assume we could use an additional fall reduced to truly consider out some liquidity to fuel the following leg up to $50k+”

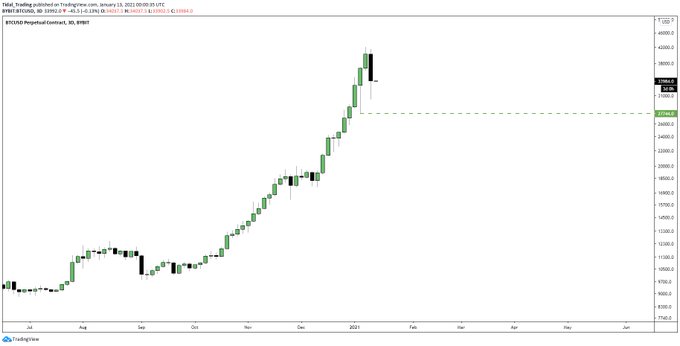

Chart of BTC's cost action more than the past couple of months with an examination by crypto-asset naalyst HornHairs (@CryptoHornHairs on Twitter). Supply: BTCUSD from TradingView.com

Linked Reading through: DeFi Founder Targeted in $8m Hack Claims He Has His Hacker’s IP

On-Chain Trends Remain Bullish

Inspite of Bitcoin’s fall, on-chain tendencies for this market place continue being bullish. Aleks Larsen, a undertaking investor at Blockchain Money, reported on HODLer trends for Bitcoin:

“6/ Looking fairly superior for progress costs in the HODLer segment! Wonderful and steady development for BTC by way of the bear market. Retail is commencing to pop in but for most of 2020 this was institutionally pushed – fewer supplemental holders, but a lot more substantial place sizes.”

Another optimistic signal to look ahead to is Grayscale Investments re-opening non-public placements for its cryptocurrency expenditure trusts.

Analysts observed in December that any time non-public placements were shut, Bitcoin underperformed. The reopening of these trusts to institutional and accredited players may drive prices increased as cash floods into the area.

Related Examining: 3 Bitcoin On-Chain Tendencies Exhibit a Macro Bull Marketplace Is Brewing

Featured Impression from Unsplash Chart from TradingView.com Price Tags: xbtusd, btcusd, btcusdt Bitcoin Just Dropped Under $33,000 Regardless of Recovery to $36,000