Bitcoin is ripping higher as soon as once more. In the previous handful of hours, the main cryptocurrency has started to exam the yr-to-date highs at $11,500. And just minutes back, BTC achieved a regional large of $11,700 immediately after an inflow of acquiring pressure.

It is unclear if this rally is sustainable but: Bitcoin has yet to near previously mentioned $11,500 on any for a longer period-phrase time frames like the 4-hour, 12-hour, or 1-working day charts.

Chart of BTC's rate motion about the earlier 10 times from TradingView.com

Analysts say that Bitcoin breaking earlier $11,500 improves the potential for the asset to surge even greater in the weeks in advance. This is mainly thanks to the reality that $11,500 was a pivotal macro amount all through early 2018 — just after the $20,000 peak in December 2017.

Relevant Reading through: Crypto Tidbits: Ethereum Surges 20%, US Banking companies Can Maintain Bitcoin, DeFi Continue to in Vogue

Bitcoin Breaking Earlier $11,500 Is Pivotal

Bitcoin decisively surging higher than $11,500 is setting the stage for an even better move to the upside, say analysts.

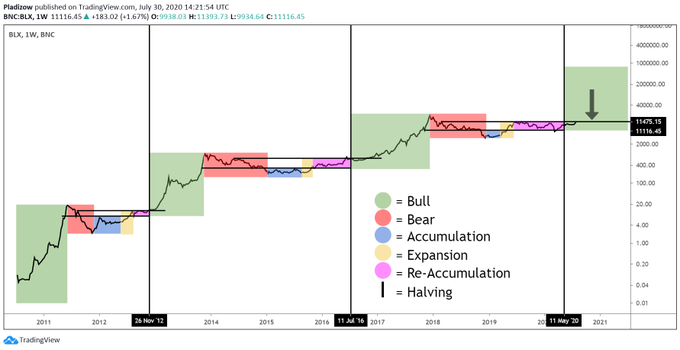

A cryptocurrency trader shared the chart underneath on July 31st. It suggests that BTC retaking $11,500 — or $11,463 to be extra distinct — on a weekly and month-to-month time body will deliver go away Bitcoin with minor resistance till the $20,000 all-time superior.

“Few several hours to go prior to a large regular close. Couple times to go to close the weekly higher than 11.5k.I personally would not have any challenges with the Ear of maize hovering involving 10k and 11.5k if that is what essential for sustainable expansion to ATH.”

Chart of BTC's macro price tag motion from trader Pierre (@Pierre_crypt0 on Twitter). Chart from Tradingview.com

The great importance of $11,500 to the prolonged-expression Bitcoin bull scenario has been echoed by a ryptocurrency chartist. The chartist indicated that for each a “structural fractal” that requires inputs from all of BTC’s past bull cycles, Bitcoin breaking past $11,500 will direct to a entire-blown bull market place: c

“This structural fractal and its latest degree seem to be to align perfectly at around $11.5K with the 50% fib fractal I posted yesterday. Various charting techniques that converge on similar rate ranges lend them credence. What do you think?”

Chart of BTC's macro cost motion from trader/chartist "Nunya Bizniz" (@pladizow on Twitter). Chart from Tradingview.com

A Sustainable Rally?

Derivatives details suggests that Bitcoin’s ongoing move increased is probable sustainable — or at the very least a lot more so than the surge earlier $10,000, then $10,500, then $11,000 on Monday.

Table of BTC's funding rates across top rated perpetual swap futures markets. Data shared by Byzantine Typical (@Byzgeneral on Twitter).

The higher than desk is Bitcoin’s funding costs throughout leading margin exchanges. Funding rates are at present moving in the direction of %, indicating that customers are not overextended and have space to push BTC better.

Connected Reading through: On-Chain Metric Indicators the BTC Marketplace Is not Overheated: Why This Is Bullish

Showcased Impression from Shutterstock Value tags: Charts from TradingVIew.com BTCJust Broke Previous $11,500—and That's Massive For Bulls