Bitcoin has acted weak in excess of the past number of days, slipping as small as $8,950 as touching $9,800 on Monday. But there are specialized alerts suggesting that a bull development is before long to appear.

A person sign that was final noticed at the begin of the March crypto rally is about to surface once more. And which is excellent for the bull situation.

Linked Looking at: Crypto Tidbits: Bitcoin At $9k, Grayscale Ethereum Trust, Cryptocurrency & PayPal

Bitcoin Is Flashing Some Bullish Signs Regardless of Retracement Fears

The Stochastic relative energy index (Stoch RSI) has lengthy been a foremost signal in technological assessment. As Investopedia clarifies, the Stoch RSI “gives traders an strategy of no matter whether the latest RSI worth is overbought or oversold.”

The indicator has been alternatively correct in predicting Bitcoin’s cost motion in excess of the past number of decades. The a single-7 days Stoch RSI flipped bearish just a 7 days or two immediately after the $14,000 peak in 2019, predicting the 60% crash that followed.

The exact same indicator also flipped bullish in December, preceding the ~40% rally to $10,500.

An analyst has now observed that the Stoch RSI on the 12-hour, a person-day, two-day, and three-working day is flipping bullish:

“12h, 1D, 2D and 3D are in excess of-bought and look like they want to reverse although regular also is turning bullish!”

Stoch RSI investigation across numerous of Bitcoin's time frames by analyst "JB" (@blackswan0815 on Twitter). Charts from TradingView.com

The 3-working day Stoch RSI is especially vital as a bullish cross was last viewed times right after March’s crash to $3,700. Not to mention, yet another a person of these crosses is about to take place.

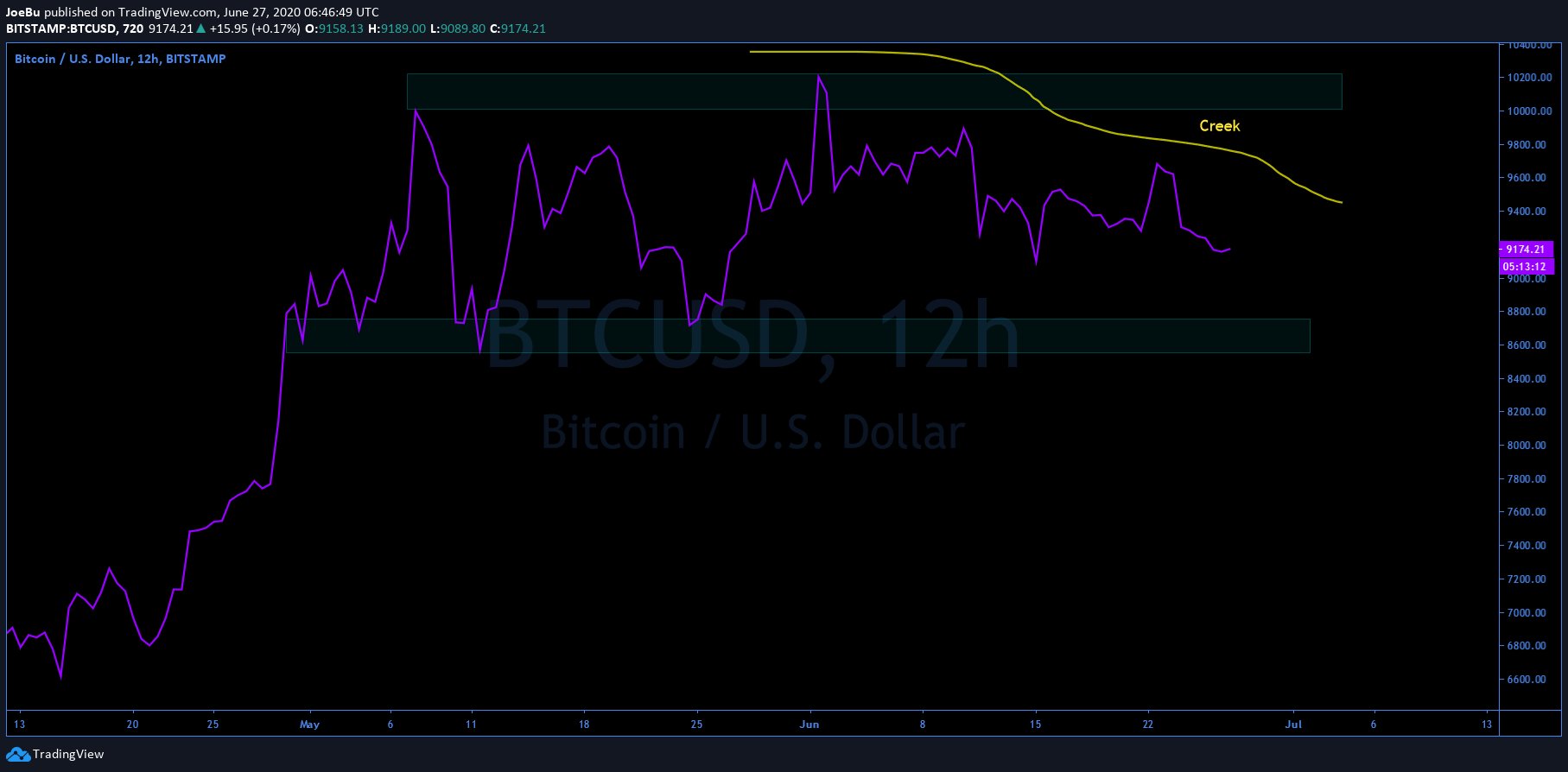

Incorporating to the bull situation, the identical analyst also shared the chart down below.

It demonstrates that Bitcoin is possibly forming a Wyckoff Re-Accumulation rather than a Wyckoff Distribution. BTC playing the Wyckoff Re-Accumulation circumstance will necessarily mean the cryptocurrency is about to enter one more bull pattern. It will possible bring BTC towards $12,000 and outside of thinking about the proportions of the consolidation more than current weeks.

Wyckoff evaluation by analyst "JB" (@blackswan0815 on Twitter). Charts from TradingView.com

Not the Only Bull

The analyst that shared the charts above is in very good enterprise. There is a confluence of other corporations and analysts that are bullish on the main cryptocurrency.

Bloomberg’s senior commodity analyst Mike McGlone recently released a report about Bitcoin.

In that report, the analyst reported that “something needs to go wrong” for the top cryptocurrency not to recognize. This was manufactured in reference to the asset’s best storm of macro, specialized, and on-chain developments signaling amplified adoption and increased rates.

McGlone doubled down on his optimism in a latest tweet, revealed June 26th. In it, he said that BTC is pretty much like a “caged bull” eyeing a breakout to $13,000 in the coming months.

Associated Examining: Silk Road’s Ross Ulbricht Brand names Ethereum’s MakerDAO a “Cool Concept”

Highlighted Image from Shutterstock Price tag tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Bitcoin Past Flashed This Signal at $3,700. It can be Back again Once more