Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

_____

Investments news

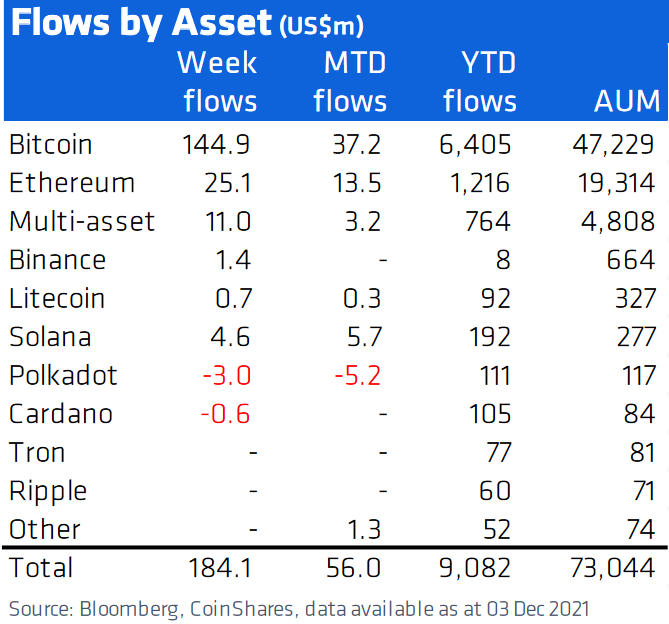

- According to CoinShares data, digital asset investment products witnessed inflows totaling USD 184 million last week. Bitcoin (BTC) received inflows of USD 145 million last week (down from USD 247 million a week earlier), though it experienced withdrawals of USD 42 million on Friday and bore the weight of market worries, the business said. Ethereum (ETH) received USD 25 million in inflows (USD 2 million more than a week ago), but, like BTC, received USD 4.7 million in outflows last Friday.

- The company that publishes the FTSE 100, the primary barometer of the UK stock market’s performance, is set to launch a crypto index that will „sit alongside“ the benchmark equities, CITY A.M. reported, citing Kristen Mierzwa, the head of ETF strategy and business development at FTSE Russell, a London Stock Exchange subsidiary that publishes global market indices.

- As expected, the Chicago Mercantile Exchange Group today released Micro Ether futures (MET) with a 1/10th of an ethereum contract size.

- According to TechCrunch, a number of investors, including Sequoia Capital India and Steadview Capital, are in talks to invest in Polygon (MATIC) via token acquisition. According to their unnamed sources, the investors are interested in purchasing tokens worth between USD 50 million and USD 150 million.

- According to TechCrunch, Stacked, a web-based platform that provides passive investment options for retail investors interested in cryptocurrency, has raised a USD 35 million Series A round led by Alameda Research and Mirana Ventures.

The cash will be used to double the company’s 40-person workforce within six to eight months and to spend in user acquisition, expansion, and marketing. - Ault Global Holdings, a multinational holding company based in the United States, announced that its subsidiary BitNile was the lead investor in Earnity Inc.’s Series A USD 15 million financing. Earnity is a California-based DeFi marketplace. Institutional investors Thorney, an ASX-listed LIC firm, and blockchain fund NGC Ventures have joined the round.

Exchanges news

- Norwegian Block Exchange (NBX) said it has applied for listing on the Euronext Growth exchange and plans to become the first publicly listed crypto exchange in the Nordics. NBX also said it intends to obtain a license as an e-money institution.

- Binance is reviving plans for a UK launch by applying for an Financial Conduct Authority (FCA) licence, having hired an army of compliance officers and former employees of the City watchdog, the Telegraph reported. The exchange’s CEO Changpeng Zhao was quoted as saying that relations with the regulator had improved since Binance was censured this summer by the FCA.

- Singapore’s financial regulator has suspended Bitget, possibly for promoting the digital currency Army Coin, which is named after the followers of South Korean band BTS, The Guardian reported. Bitget has removed the Monetary Authority of Singapore’s logo from its website, but it still claims to have licenses from Australia, Canada, and the United States.

- Indian bank Kotak Bank decided to let crypto exchange WazirX open an account with them following almost eight months of payment freeze by most high-street banks that continue to shun crypto investors and bourses, Economic Times reported. However, the account has yet to become operational, and paperwork and know-your-customer (KYC) procedures are still going on.

- FTX released the “key principles” for regulating crypto exchanges, which will be part of CEO’s Sam Bankman-Fried’s written commentary to accompany his in-person testimony to the House Committee on Financial Services during its hearing on Wednesday, December 8th, 2021. They stated that the set of 10 principles details a regulatory environment that, if enacted, will allow policymakers to effectively regulate the digital asset ecosystem while maximizing the potential growth and innovation.

NFTs news

- Tom Brady, an American football quarterback for the Tampa Bay Buccaneers of the National Football League, is launching a set of his new non-fungible tokens (NFTs), Tom Brady Origins Collection, on his Autograph NFT platform that highlights a resume he had created prior to his 2000 draft selection and includes a stopwatch, cleats, and jersey used at the NFL combine, among other items.

Adoption news

- Cold-brew coffee company Oaza Beverages announced that they will start accepting cryptocurrency as a form of payment via payments provider BitPay. The company added that they will “confidently hold” BTC and ETH on their balance sheet.

Regulation news

- The UK Financial Conduct Authority said in a discussion paper that particularly high risk or alternative investments, such as cryptoassets and unlisted securities, could in certain circumstances be excluded from the Financial Services Compensation Scheme, which protects investors when companies fail. The FSCS protects as much as GBP 85,000 (USD 112,700) per customer if a firm goes down.

CBDCs news

- Zimbabwe’s central bank is exploring the use of a digital currency rather than allowing cryptocurrencies as legal tender and plans to send a team to Nigeria to learn from their experiences in launching the first digital currency in Africa in October, Bloomberg reported, citing the nation’s central bank Governor John Mangudya.

Career news

- Tech veteran Brian Roberts is joining NFT marketplace OpenSea as its first chief financial officer (CFO), Bloomberg reported. Roberts was previously the CFO of ridesharing company Lyft for seven years.