Is this a Bitcoin crash?

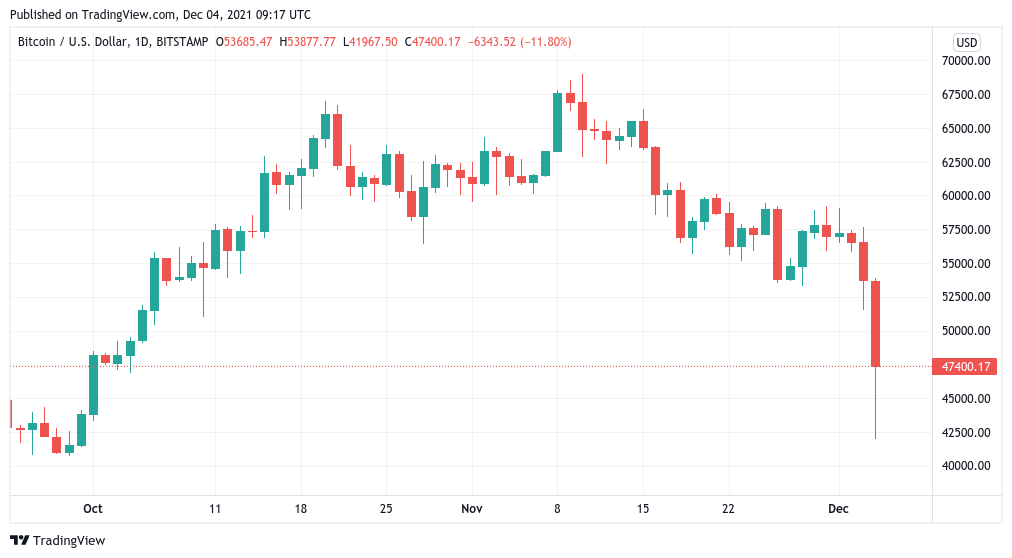

BTC traded near $47,000 on December 4 after a rapid drop verified investors‘ worst thoughts with daily losses of 22 percent in the previous week.

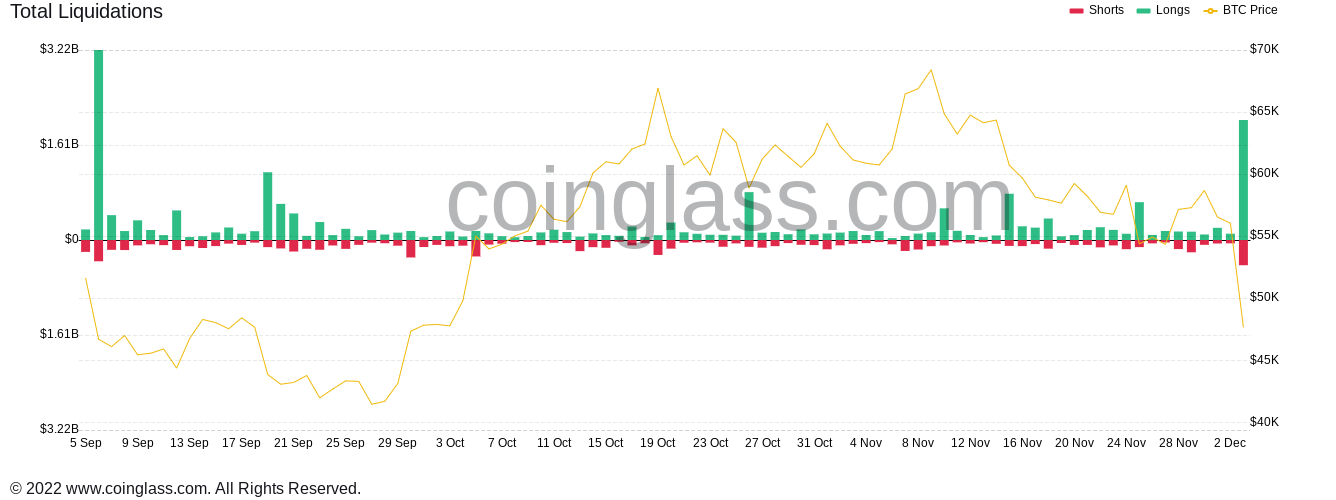

Crypto liquidations pass $2.5 billion – a classic Crash

According to data from Cointelegraph Markets Pro and TradingView, the bitcoin to dollar exchange rate touched a local low of $41,960 on Bitstamp, the lowest level since September 30. As panic set in, leveraged positions were unwinded and traders capitulated, resulting in cross-crypto liquidations totaling more than $2.5 billion in a 24-hour period.

Filbfilb, co-founder of trading platform Decentrader, detailed the move in a new synopsis after the move. „$50k is going to remain resistance for a substantial amount of time now unless stonks to spectacular things,“ he said.

„Because of the size of the dump and the spread, it is likely that consolidation will occur in Q1 of next year. Although the Moon mission is not dead, some will believe the cycle has ended.“

In addition to Bitcoin’s $1 trillion asset valuation — which was previously a popular choice for long bets — the magnitude of the decline also wiped out key important support levels.

Earlier this week, as CoinNewsDaily reported, traders expressed alarm about their own behavior as statistics revealed that the market might easily be overleveraged at earlier levels approaching $60,000.

With that leverage now all but gone, there was still plenty of room for optimism from familiar faces, with Cointelegraph contributor Michael van de Poppe claiming that the spike below $42,000 marked a „bottom.“

„We’re still in the midst of a bull market,“ he continued.

Bitcoin, on the other hand, has just escaped an attack on its $40,000 support level, which would be a reason to „turn negative“ if it were to create weekly resistance, according to analyst TechDev. Is this a Bitcoin Crash?

„Wait. Relax. The market will reveal itself „This is what he informed his Twitter followers.

„If cycle bull phase deviates substantially from history, expect any bear phase to do the same.“

Close week below 20W SMA (50.8) ➡️ Concerning

Macro LL on a weekly close (40K) ➡️ Flip bearish

Lose the 2W RSI Floor ➡️ Flip bearishWait. Relax. Market will reveal.

If cycle bull phase deviates substantially from history, expect any bear phase to do the same. https://t.co/6smUaIWlKY

— TechDev (@TechDev_52) December 4, 2021

Ethereum preserves strength on BTC pair

On the day in question, there was a faint silver lining in the form of Ether (ETH), which was on the verge of matching its highest levels since mid-2018.

Despite losing less than Bitcoin in the drop vs the dollar, the ETH/BTC pair defied the trend and rose beyond the 0.0831 mark.

All of the top ten cryptocurrencies by market capitalization, however, were down more than 10% against the U.S. dollar, with Polkadot (DOT) leading the way with a 21% decline.