Bitcoin has gone through a potent correction given that the $24,300 highs found this past weekend. The leading cryptocurrency currently trades for $22,600 though fell as minimal as $21,800 all over 24 hrs ago.

BTC is down 5% in the earlier 24 hrs. Bitcoin is outperforming most cryptocurrencies, which seem to be plunging as a final result of a robust dominance shift. This dominance go may perhaps have been activated by the rumor that the U.S. SEC will ultimately be pursuing lawful motion against Ripple with regards to XRP.

Analysts assume that Bitcoin might have fashioned a regional to medium-term substantial right after the peak this previous weekend.

Relevant Looking through: Here’s Why Ethereum’s DeFi Current market May possibly Be In close proximity to A Bottom

Bitcoin Most likely Forming a Leading in Close to to Medium Term

Bitcoin may well have fashioned a medium-term high soon after peaking at $24,300 this earlier weekend, some analysts have reported.

The chart below was shared recently by a primary trader. It shows that on a medium-term basis, Bitcoin may perhaps have identified a leading because of to a sturdy surge in the weekly relative toughness index (RSI) and the stochastic RSI. Both of those indicators are currently in an incredibly overbought assortment, suggesting that a pullback for this sector is due.

Of course, as the trader caveats, these indicators can stay overbought for extended periods of time. They have just proven him that it is okay to be cautious with further longs in the latest atmosphere:

“Weekly RSI and Stoch RSI appreciably overbought. It has been a trending industry and oscillators can remain overbought – but I’m just remaining careful here…. Area top?”

Chart of BTC's selling price action around the past number of many years with an investigation by crypto trader "TraderXO" (@Trader_XO on Twitter).

Supply: BTCUSD from TradingView.com

Related Examining: Tyler Winklevoss: A “Tsunami” of Cash Is Coming For Bitcoin

Robust Fundamentals

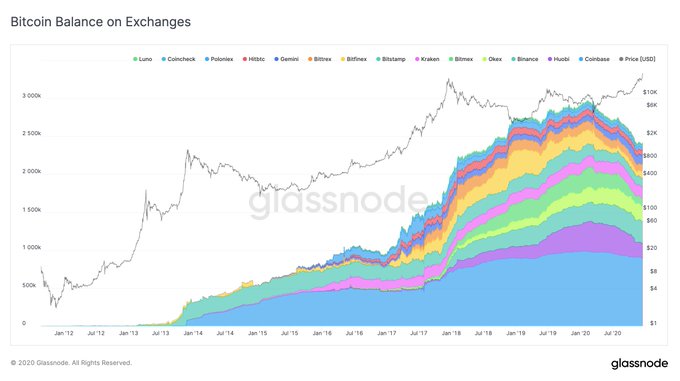

When Bitcoin’s rate action is weak, the on-chain fundamentals keep on being strong. Rafael Schultze Kraft, CTO of Glassnode, not long ago mentioned that with the range of BTC held on exchanges lowering, he thinks a provide-aspect liquidity disaster is taking part in out:

“#Bitcoin is in a source and liquidity crisis. This is extremely bullish! And hugely underrated. I believe we will see this significantly reflected in Bitcoin’s value in the future months. Let’s choose a look at the information.”

Chart of BTC's value action over the past 10 years with an on-chain assessment of BTC on exchanges from Rafael Schutlze Kraft, CTO of Glassnode Chart from Glassnode, a crypto data source

Analysts imagine that additional accumulation by extensive-term buyers will only pressure Bitcoin better more than time.

Relevant Examining: 3 BTC On-Chain Trends Exhibit a Macro Bull Sector Is Brewing

Showcased Graphic from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Analyst: BTC Could Be Forming a Area Top as Indicators Overbought