Update (3 several hours just after the shut): Bitcoin has shut the May perhaps candle previously mentioned the very important $9,360 degree, controlling to acquire $9,450. Analysts say this is “incredibly significant for bulls” and may show that there is more upside in the works.

This is an assertion that can be corroborated by other market place things.

For instance, blockchain info startup Glassnode not long ago famous that 60% of all BTC in circulation “hasn’t moved in above a year, exhibiting enhanced investor HODLing habits.”

This is significant mainly because the previous time this development was viewed was “right just before the BTC bull current market of 2017.” That is to say, this on-chain pattern was final seasoned just ahead of BTC rallied from underneath $1,000 to $20,000 in below a year’s time.

Chart of Bitcoin trader behaviors from crypto analytics company Glassnode (@Glassnode on Twitter). The graphic was shared on May perhaps 29th, 2020.

In just a couple minutes’ time, Bitcoin will near May’s price candle. Analysts say that this near will be vital for indicating in which route the cryptocurrency sector heads following.

A region of value that a lot of analysts are eyeing is the very low-$9,000s. As one analyst defined:

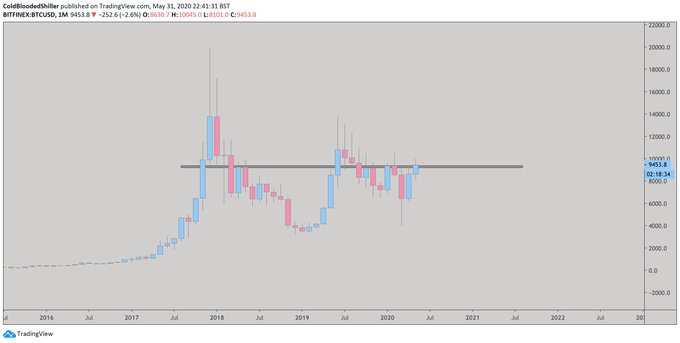

“We’ve not had a Monthly close earlier mentioned 9360 in just about 12 months. Rejections from this stage have led to checks of $6k and eventually $3k.”

Indeed, when Bitcoin unsuccessful to surmount this amount in February, rates dove to $3,700 in the course of March’s capitulation. And when BTC was turned down from this amount in 2018, there was a brutal bear market to $3,150 in the 10 months that adopted.

$9,360 is also all over the place the downtrend formed following the $20,000 higher now sits, incorporating to its specialized significance.

Correct now, things are coming down to the wire in phrases of Bitcoin closing previously mentioned this degree. The asset trades at $9,400 as of the time of this article’s composing and the near is just a short whilst away, TradingView has revealed.

BTC cost chart from a crypto trader “Cold Blooded Shiller” (@ColdBloodShill on Twitter).

Bitcoin Becoming Dragged Down by Inventory Market

Bitcoin’s retracement to $9,400 in advance of the every month candle shut arrives just after it surged as large as $9,700 on Saturday, wrested higher by Ethereum.

The underperformance of the flagship cryptocurrency would seem to be similar to a reversal in the S&P 500 futures, which reversed following passing 3,000 details final week.

The futures market place is at the moment down 1% in the course of the Sunday night investing session, which is slipping in response to a number of occasions.

This is bearish for Bitcoin because the markets are correlated. The Kansas Metropolis Federal Reserve wrote in a recent report:

Overall, our effects propose that the 10-12 months Treasury has frequently exhibited safe-haven conduct, gold has once in a while exhibited risk-free-haven conduct, and Bitcoin has never exhibited safe and sound-haven behavior since its introduction. What’s more, the introduction of Bitcoin does not appear to have materially altered the safe-haven houses of governing administration bonds or gold. Alternatively, Bitcoin at moments seems to have behaved a lot more like a risk asset than a risk-free haven.

Showcased Image from Shutterstock