No matter if or not cryptocurrency marketplaces have been in a so-named “alt season” as of late looks to have been a matter of considerably discussion.

Looking Ahead to Conference You at iFX EXPO Dubai May well 2021 – Creating It Happen!

Immediately after all, at $57K, Bitcoin is not also considerably from its all-time large (ATH), neither in conditions of dollars nor days. The final BTC all-time higher of $64,863.10 took location just more than three months ago.

On the other hand, when you compare the efficiency of BTC to other property in the crypto house, the tale receives a tiny diverse. Though BTC has carefully slid down a few hundreds of dollars from its peak, other crypto property have been booming.

For case in point, the rate of Ether (ETH) has been hitting new ATHs pretty much each and every working day this week. The most recent ATH of $3,541.46 took place approximately 12 hrs just before push time. (The price tag had due to the fact cooled to $3,451.90.)

Other choice cryptocurrencies have also been performing very well this week. A CoinTelegraph report pointed to a surge in the price tag of DogeCoin (DOGE) as “the foremost indicator for alt season.” DogeCoin also strike a new ATH yesterday of $.69.

Are cryptocurrency marketplaces in an alt time? And why does it make a difference?

Scott Melker: “Crypto markets have been in an ‘alt season’ for the entirety of 2021.”

As for the previous question, Scott Melker (aka “The Wolf of All Streets”), instructed Finance Magnates that “crypto markets have been in an ‘alt season’ for the entirety of 2021,” an alt season that “continues to speed up.”

Melker pointed beyond asset value functionality by itself: “Bitcoin Dominance, the measure of the share of the market cap of the full crypto market represented by Bitcoin, has dropped from just about 75 % to under 50 % in [2021], indicating altcoins increasing in equally value and industry cap.”

Marie Tatibouet, the main advertising and marketing officer at Gate.io, also pointed to the drop in Bitcoin dominance as an indicator that alt year has arrived. “This exhibits that the market has matured as investors are beginning to see what else is there in the supermarket aisles,” she reported. Although Bitcoin has struggled to reclaim the $60,000 psychological degree, Ethereum has significantly surpassed the $3,000 stage, when coins like Chainlink are testing new highs.”

Scott Melker added that “a uncomplicated look at Ethereum’s increase in rate vs . Bitcoin is a very clear indicator of altseason, along with astronomical gains on other altcoins of a vast wide variety,” he reported. ETH’s price tag is up 370 percent since January 1st DOGE is up much more than 15,000 p.c.

As DeFi grows, Ethereum grows together with it–and vice versa

The increase of Ether might be significantly sizeable for numerous reasons. For a person detail, optimistic movement in the value of ETH could indicate optimistic reception of the application improve to “Eth2..” The improve will raise transaction speeds, reduce transaction fees, enhance ETH shortage, and reduce the environmental effects of the Ethereum network, amid other items.

Moreover, the expansion of Ethereum could also signify expansion in the decentralized finance (DeFi) ecosystem that exists on best of the community. Due to the fact any Ethereum-dependent DeFi platform employs small quantities of ETH to execute transactions, the presence of extra DeFi users could signify a much larger amount of ETH holders.

Scott Melker told Finance Magnates that “DeFi assets have been riding the coattails of Ethereum, the platform that most of DeFi is currently being designed on top rated of. A lot of, such as myself, are projecting a ‘DeFi summer season,’ a lot like we saw in 2020. The most remarkable developments in crypto are in the decentralized finance place, which really should be mirrored relocating forward in the similar belongings.”

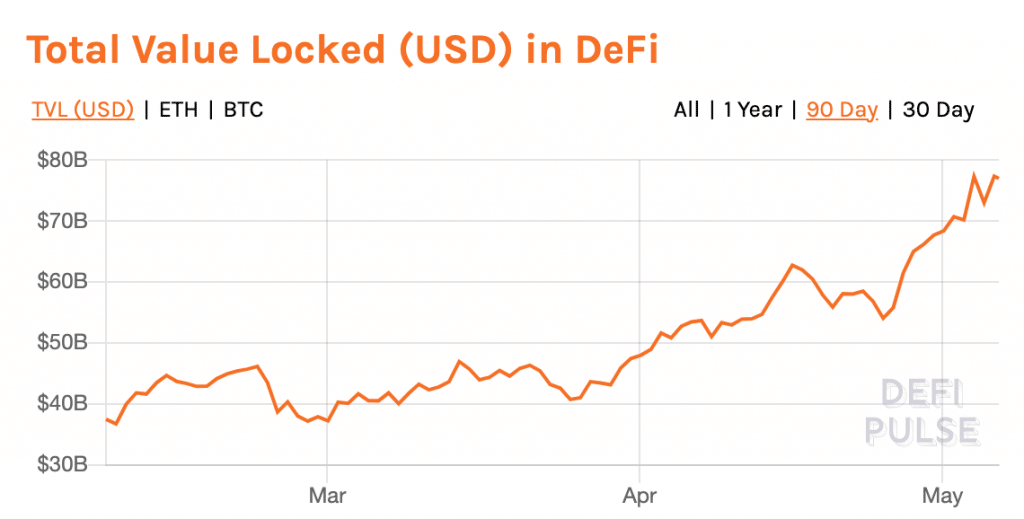

Gate.io’s Marie Tatibouet also pointed out that DeFi’s total price locked (TVL) has crossed $75 billion: “More and a lot more builders are coming into the space to ‘buidl’ more than at any time before,” she claimed. “The market is maturing much more than just ‘fun internet coins to hold’ to turn into a decentralized net system of the potential.”

Instructed content articles

Best 9 Crypto Margin Investing ExchangesGo to article >>

Why is DeFi growing at this kind of a quick speed? ETH’s overall performance is surely one particular component. Garrette Furo, a blockchain consultant and advisor for Cosmos Network, also informed Finance Magnates that DeFi assets could be carrying out so perfectly because many of them are remaining utilized in practical means.

“A typical criticism of crypto belongings has normally been ‘what does it do’ or ‘how does it make money’,” Furo said. “When you believe about conventional finance–and valuing belongings off of dividends and provide elasticity, et cetera–this criticism helps make a lot of sense,” he reported. Nevertheless, “because of DeFi, these inquiries have immediate responses that really do not count on obscure understanding.” For illustration, “Bitcoin can be collateralized for loans in stablecoins.”

The expansion of the DeFi ecosystem could provide Ethereum to new heights

Nate Cox, the chief investment officer of digital assets financial investment business Two Key, instructed Finance Magnates that the complete likely of Ethereum’s DeFi ecosystem is unfamiliar.

He drew a parallel in between Apple’s Apple iphone and the dawn of the Application Store: “When Apple launched the Iphone, it was impossible to compute the number of industries it would disrupt,” he mentioned. “While the phone alone pushed Apple to turn out to be the most precious organization in the entire world, the programs sent by means of the app keep have arguably designed multiple moments the price of the hardware providing it.”

“Similarly, Ethereum offers a decentralized platform (similar to Apple’s Application Keep) that is now disrupting some of the most worthwhile industries in the entire world,” Cox described. “Finance, mental residence, and insurance plan could all be reimagined on the blockchain, and we’re just finding warmed up.”

What’s future for Bitcoin?

Could ETH’s industry cap outgrow Bitcoin’s?

Nate Cox believes it may possibly materialize: “the upside benefit of Ethereum could conveniently surpass the $1 trillion degree, and at its recent advancement amount, might overtake Bitcoin as the world’s most valuable digital asset,” he explained to Finance Magnates.

However, Scott Melker is not convinced: “As Ethereum carries on to increase, persons are now revisiting the outdated narrative of the ‘flippening’ – the concept that Ethereum market place cap could surpass Bitcoin’s,” he said. “It is considerably also early to focus on that, an first indicator of euphoria in the altcoin current market. Anything is probable, but there’s no rationale to hope it for now.”

Still, the continuation of sideways or downward movements on BTC charts could more contribute to the increase of ETH and other altcoins.

“Anytime Bitcoin cools off and consolidates, we are inclined to see meaningful movement in the altcoin market place,” Scott Melker stated.

So, “Investors have been asking ‘what’s upcoming?’ for the premier electronic asset in the entire world,” Nate Cox explained. When it may well be easy to produce off bitcoin as a gradual-progress asset appropriate now, it’s vital to maintain some viewpoint. In a person 12 months, bitcoin has acquired additional than $800 billion in market place cap with a worth now really worth additional than $1 trillion.” Ethereum, by comparison, is presently worth $395 million.

Scott Melker also reported that it is critical to keep matters in viewpoint: “After these kinds of a large operate, any asset is expected to devote time investing sideways, which is what we are viewing on Bitcoin.”

“There is no purpose to be basically or technically bearish on Bitcoin – we are however in the early innings of this cycle. My perception is that the probable acceptance of a Bitcoin ETF will be the next catalyst for a significant go.”

“We are even now really early,” Melker advised Finance Magnates. “The notion that people today are much too late or have missed their opportunity to attain publicity to Bitcoin and crypto is absurd. These will be the most vital property of our technology.”

![naga review unveiling the platformac280c299s copytrading value proposition 1[1]](https://www.coinnewsdaily.com/wp-content/uploads/2022/04/naga-review-unveiling-the-platformac280c299s-copytrading-value-proposition-11-350x250.png)