There are several important distinctions between Ethereum and Bitcoin mining, which stem from the fact that these two cryptocurrencies are made for quite different purposes. It may seem difficult to find out the differences between these cryptos at first glance, but dig a bit deeper and you will see a stark comparison.

In a number of ways, Ethereum differs from Bitcoin. Ethereum is a decentralized application framework, for novices. Compared to Bitcoin, Ethereum includes a headquarters and a renowned founder in Vitalik Buterin. Ethereum adopts a two-tiered system accounts structure that includes both personal key, and contract-code accounts, the latter of which is well-known.

Recently, Ethereum miners have made more money than Bitcoin miners. According to The Block’s Data Dashboard, Ethereum miners are earning about $77 million per day, relative to about $67 million earned by Bitcoin miners. The data is based on a moving average (7MDA).

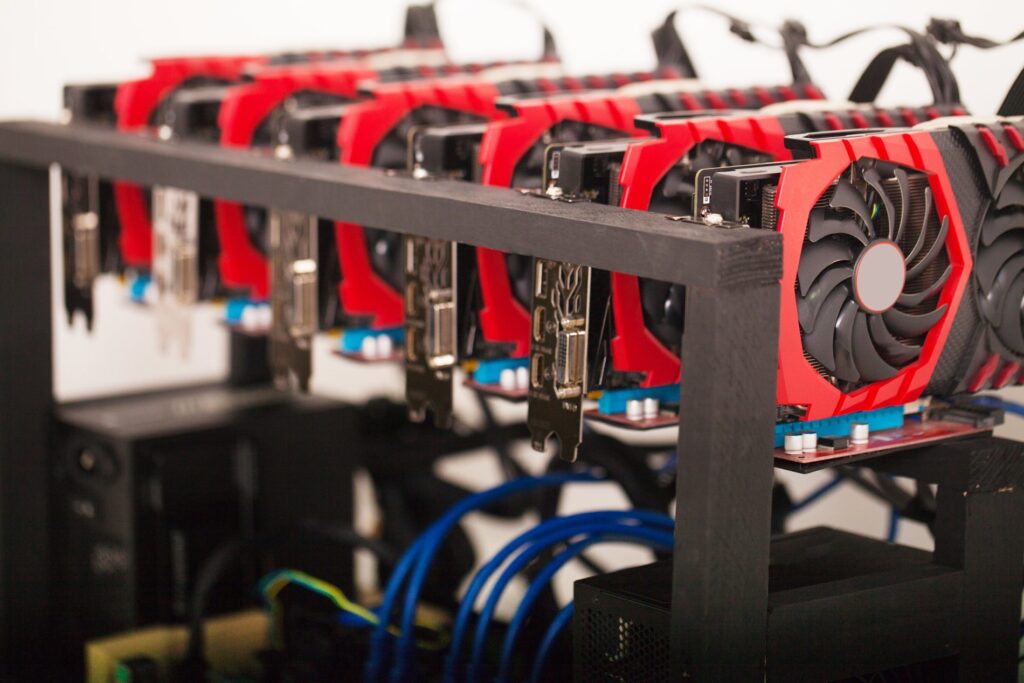

The startup costs of mining Bitcoin are becoming more expensive as a result of the ever increase Bitcoin mining difficulty. In the modern mining environment, you are going to require a large number of fantastic excellent ASIC miners to stay competitive.

AMD Radeon VII graphics card is a hardware with a low power consumption of 300W. The powerful graphics card is your ideal Ethereum mining hardware for the toughest computational application.

This AMD’s most recent high-end graphics card isn’t just great at transferring pixels in matches, it also seems to be one of the best for Ethereum mining in terms of efficiency.

AMD RADEON VII VS. AMD RX Vega 64 VS. NVIDIA Titan V Graphics Cards

AMD Radeon VII can achieve a hash rate of 90MH/s without any tuning, based on VoskCoin. That is more than twice the performance of the AMD RX Vega 64, and easily outperforms NVIDIA’s popular Titan V graphics card’s hash rate of 69MH/s.

AMD Radeon VII has one of the best motherboards for mining and also can do even better if you’re willing to tweak the GPU. It also has a memory of 1TB/s and 16GB of all HBM2, in comparison to 484GB/s and 8GB of all HBM2 on the elderly AMD RX Vega 64.

Most importantly, AMD Radeon VII is a far more power-efficient card, which lowers your operating costs when you’re mining 24 hours each day.

NVIDIA Titan V was once regarded among the best GPUs to get cryptocurrency mining, together with the ability to mine Ethereum twice as rapidly as the AMD RX Vega 64.

The fact that the AMD Radeon VII outperforms Nvidia’s GPU in Ethereum mining is notable because, despite being a couple of years old, the Titan V only now costs about $2,550 while AMD Radeon VII prices $1,780.00.

AMD Radeon VII graphics card is a much better buy for aspiring miners due to its lower price and superior functionality. Although cryptocurrency mining has recently declined in popularity, the launch of the card, which offers such great results for such a low cost, can persuade many people to restart their old mining rigs.

Brand — XFX

OS Compatibility — Windows

Hash Rate — 90MH/s

Total Memory Bandwidth — around 1024GB/s

Thermal Design Power — 300W

Connectors — 3 x Display Port, 1 x HDMI

Memory Interface — 4096-Bit

Thermal Threshold — 91°C

Transistor Count — 13.2 Billion

Triple fan cooling

Why It Matters: The Top Profits From Ethereum Mining

Ethereum miners make money in a variety of ways. Partly as a result of network’s record-high transaction expenses, as well as the rise in the cryptocurrency’s cost.

The network’s soaring transaction/gas prices has also been an important contributing element. Transaction fees accounted for more than 40 percent of Ethereum miners‘ earnings in April, while this is expected to improve after the July implementation of EIP-1559.

As stated by the EIP 1599, there will be two charges beginning from July: a base fee and an inclusion fee or tip for miners. Only the inclusion fee will visit the miners, while the bottom fee is going to be burned. The EIP’s ultimate aim is to lower transaction fees for consumers.

In 2021, Ethereum miners will continue to get rewarded handsomely for their efforts, as the wise contract blockchain network goes closer to abandoning its proof of perform consensus in favor of their proof of bet mechanism.

Most of the cryptocurrency area has had a wonderful couple of months, together with the likes of Bitcoin (BTC), Ethereum (ETH), and a variety of different altcoins seeing massive increases in value. The cryptocurrency mining ecosystem has gained straight from the higher number of users and transactions.

Conclusion

Ethereum miners have made a lot of money due to the prevalence of decentralized finance projects that operate on Ethereum’s blockchain. The Ethereum blockchain has seen a surge in transaction volumes and performance as a result of these various DeFi networks, leading to skyrocketing fees and longer processing times.

Because of this, Ethereum miners gained over $830 million in January 2021, the highest amount since the very first few weeks of 2018, just before Ether, Bitcoin, and also the wider cryptocurrency markets collapsed after the spectacular drops of December 2017.

While Bitcoin has become the most valuable cryptocurrency by market capitalization, BTC miners are not as rewarding as Ethereum miners.

Though mining Ethereum is currently lucrative, current miners and potential entrants have to be mindful of the first obstacles to entry.

Despite the fact that the electronic asset has returned over 480 per year thus far, its most fervent supporters and community assert that the rally has much farther to go.