Welcome to CoinNewsDaily Market’s Altcoin Roundup, a comprehensive newsletter that concentrates on investing from the perspective of fundamental analysis and seeks to identify emerging blockchain projects and tokens that fill market demands within the expanding cryptocurrency marketplace.

The concept of multi-sector investing has long been advocated in conventional finance as the traditional approach to creating a balanced portfolio. Typical allocations comprise representation of stocks, government and corporate bonds, commodities and real estate.

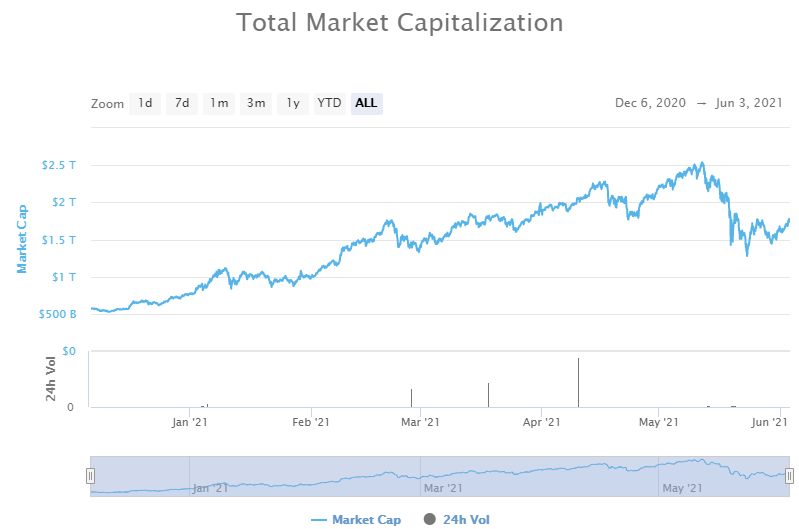

Now the cryptocurrency marketplace has grown to a multitrillion-dollar ecosystem with numerous emerging resources, clear sectors have started to emerge. Savvy crypto investors looking to apply portfolio diversification practices to their holdings must start to pay attention.

The prior Altcoin Roundup discussed some of the top layer-one solutions and coins such as Polkadot/DOT, Cosmos/ATOM and Solana/SOL that have been gaining prominence within the last year, but those projects may also fall under the large-cap investment umbrella alongside high-profile resources such as BTC (BTC), Ether (ETH) and Cardano’s ADA.After an investor has an adequate representation of blue-chip projects, other emerging sectors like decentralized finance (DeFi), oracles and stablecoins could be contemplated.Decentralized finance emerged during the summer of DeFi in 2020, and the sector helped kick off the current bull market by bringing a new level of excitement to the crypto ecosystem, which was in need of the upcoming major innovation.One of the greatest metrics used to demonstrate the rising success of DeFi as a whole is the total value locked (TVL) standing, which collectively reached an all-time large at $157.63 billion on May 14, based on data in Defi Llama, also stands at $116.62 billion at the time of writing.

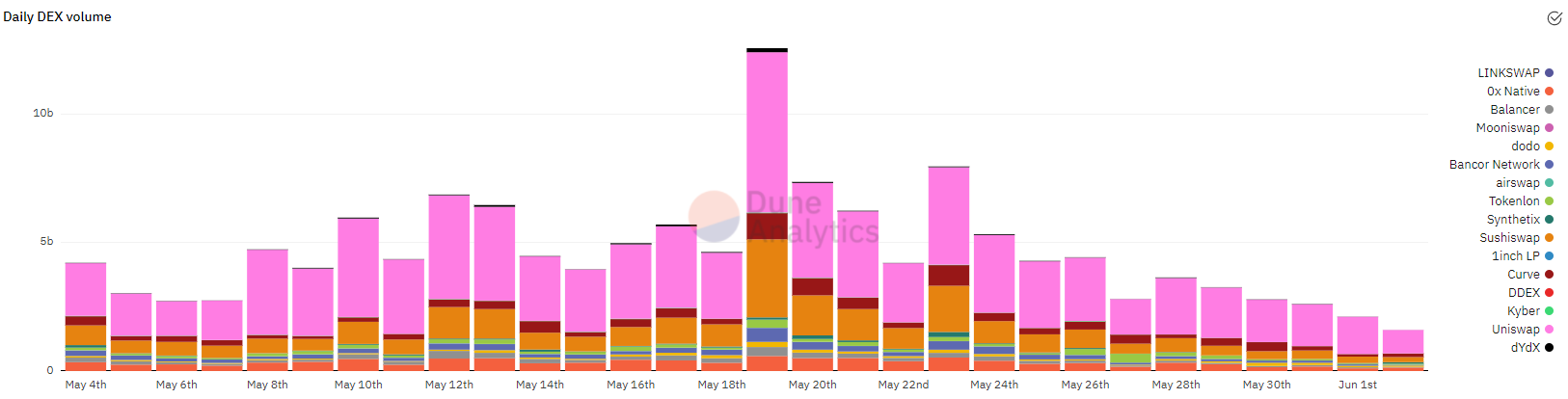

The release of Uniswap’s decentralized exchange (DEX) interface — which enabled new projects to immediately launch and created tokens available to the public — helped ignite a wave of innovation and growth across the market that continues to expand to the day.In under a year, Uniswap evolved to the top DEX serving the crypto community, visiting an all-time listing of $5.74 billion in 24-hour trading volume during the market sell-off on May 19 and $5.37 billion in total volume locked on the platform.

The vast variety of liquidity pools would be the primary allure for investors looking to diversify their crypto portfolio. Through these pools, stakers have the capability to make a return by providing liquidity for the exchange in return for some of the trading fees. Quite a few pools offer staking returns ranging from 25% to 2,000 percent, and traders can pick pools based on an assortment of factors, such as their desire for risk.

While Uniswap has led the method of DEXs, there are other options such as Aave’s lending platform that has emerged as the highest-ranking DeFi protocol by total value locked, with more than $14.1 billion in TVL in the time of writing.

Aave’s recent decision to offer layer-two (L2) access on Polygon has brought renewable energy to the AAVE ecosystem, as traders and liquidity thankfully migrated into the lower-fee environment provided on Polygon. This led to a significant increase in TVL for the two AAVE and Polygon’s native market, MATIC, which is currently the second-ranked protocol by TVL, with $11.08 billion locked on the routine.

Every balanced portfolio also includes a small 1 percent to 5% allocation reserved for higher-risk resources, and the crypto market doesn’t have any lack of high-risk, high-growth assets.

For tokenholders that are open to a bit more risk in return for greater yields, the Binance Smart Chain-based PancakeSwap boasts a TVL of $7.67 billion, also provides annual percentage rates (APR) of around 482.54 percent, according to the project’s site, with rewards paid out in the protocol’s native CAKE token.

Stablecoins would be the new“savings account“

Even though a token that stays pegged to a fixed value might not seem like the most attractive chance for investors, stablecoins have evolved to play a crucial role in the functioning of the broader cryptocurrency ecosystem.

Stablecoins frequently serve as the backbone of trading monies on centralized and decentralized exchanges, as well as offering traders a simple way to lock in profits.

The two most notable stablecoins are Tether (USDT) and USD Coin (USDC), which have circulating supplies of $60.9 billion and $21.6 billion tokens, respectively. Tether is currently the most traded crypto token, boasting 24-hour trading volumes that range from $100 billion to $290 billion.

Source: CoinGecko

Other popular stablecoins comprise Binance USD (BUSD), the stablecoin made to be used over the Binance Smart Chain ecosystem, as well as the algorithmically controlled stablecoin DAI, which can be minted via pledging collateral on the Maker protocol.

For those looking to make a little extra return whilst in the security of stablecoins, then there are multiple options available such as depositing tokens to a lending protocol such as AAVE to make up to 5 percent on deposits or even the decentralized stablecoin exchange Curve, which provides yields of around 50% for some stablecoins pools provided.

Other popular options include supplying liquidity for the several decentralized exchanges such as PancakeSwap, which provides 8.64% for its DAI-BUSD liquidity pool, or QuickSwap, which offers a reward plus fee of the annual percent return of 15.01% for its USDT-USDC pool and 26.75% for its DAI-USDC pool.

Oracles

In a world that is becoming increasingly dominated by electronic information, no cryptocurrency portfolio could be complete without access to an oracle provider. These entities would be the industry’s heavyweights that facilitate the exchange of data and information inside the cryptocurrency ecosystem, as well as broader financial markets.

Presently, Chainlink is among the most dominant oracle projects and a key player that comprises a flourishing open-source community of information providers, node operators, intelligent contract developers, researchers and security auditors.

I visit an integrations all time being smashed with simplicity this month.

With #Chainlink you simply win, in every conceivable facet.

View all of Chainlink integrations in: https://chainlinkecosystem.com/ecosystem/

While the Chainlink network does not currently offer an immediate way to make a yield via a simplified staking or government mechanism, it’s simple for tokenholders to put their stash to operate in DEX liquidity pools and DeFi protocols such as Aave.

For investors that aren’t ready to trust decentralized exchanges and DeFi platforms, centralized yield-bearing companies such as Nexo, Celsius and BlockFi are also available for crypto investors looking to make a return on their holdings.

Centralized exchanges such as Coinbase and Binance also offer you direct staking capabilities. For instance, investors could bet BAND for as much as 11.7% APR on major exchanges.

As a consequence of the May sell-off, which saw more than $1.2 trillion in value phased out of the cryptocurrency marketplace, many of the top projects are now well below their all-time high values and trading in what some traders might describe as“bargain bin“ prices.

While market participants remain uncertain as to which way prices are headed in the brief term, it would be smart to explore these opportunities sooner instead of later, as the notoriously volatile crypto marketplace can make significant moves in the drop of a hat.

Want more info about diversification to the above mentioned projects?

The perspectives and opinions expressed here are solely those of the writer and do not always reflect the views of Cointelegraph.com. Every single investment and trading move entails risk, you should run your own research when making a determination.

Looking to construct a diversified crypto portfolio? DeFi, stablecoins and oracles are just three cornerstone sectors to take into account.