Binance Coin has been consolidating inside a narrow trading array. Its cost action has been generally contained amongst the $15 assist stage, and the $18 resistance about the previous two months.

From a complex standpoint, the ongoing stagnation section forced the Bollinger bands to squeeze BNB’s 1-working day chart. Squeezes are indicative of durations of very low volatility and are typically succeeded by wild value actions. The for a longer period the squeeze, the higher the chance of a potent breakout.

Since this specialized index does not supply a distinct path for Binance Coin’s route, the spot among the reduce and higher band is a acceptable no-trade zone. An increase in volume that permits a each day candlestick to close underneath or previously mentioned this significant zone will establish the place this utility token is headed future.

Binance Coin Consolidates Inside of Narrow Investing Array. (Resource: TradingView)

It is just a make any difference of time in advance of assist or resistance breaks to deliver a apparent sign of the direction of BNB’s development. Even so, the significant amounts of exercise on its network adds credence to this optimistic outlook.

Binance Coin’s Community Exercise Explodes

In spite of the lackluster selling price action, Binance Coin’s network has been very lively about the earlier pair of weeks. BNB’s daily lively addresses have entered an uptrend though price ranges stay stagnant. The divergence involving the two indicates that a bullish impulse is on the is effective, in accordance to Santiment.

The habits analytics system mentioned in a modern website put up that at the time the bulls step in Binance Coin may see its price explode.

“This model is indicating that there may perhaps be a significant bounce at the time marketplaces start to roll all over again, with a number of spikes perfectly about the +.5 threshold above the past week. As a single of the largest gainers and the very least impacted crashers after the conclusion of the 2017 bull operate, persons could shortly be reminded why Binance Coin produced so much hoopla two and a half years ago,” said Santiment.

Binance Coin's Daily Active Addresses Are Trending Up. (Resource: Santiment)

Despite the fact that investors surface to have shifted their focus towards smaller-cap coins, particularly people in the DeFi current market sector, Binance Coin has “some significant potential” to surged centered on the every day energetic addresses expansion.

On-Chain Volume Should Select Up

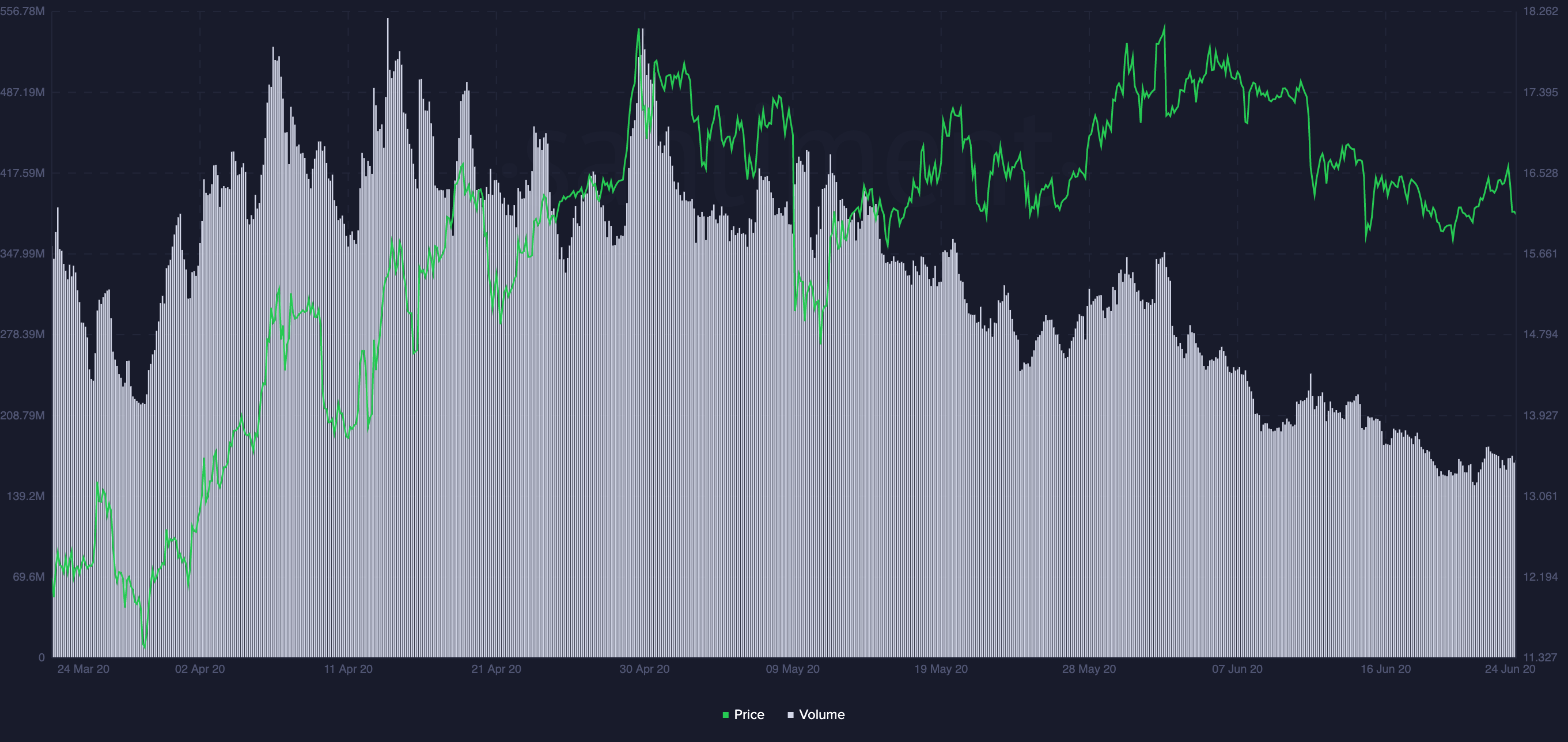

The steady drop in on-chain quantity, even so, is favoring the bears at the minute. These types of a steep divergence amongst selling price and quantity signifies a destructive sign that suggests that momentum for a downswing is creating up slowly.

An eventual enhance in volume can serve as confirmation of the bullish perspective. Right up until this comes about, traders ought to keep on being on the sidelines as there is continue to a prospect for a downward impulse.

Binance Coin's On-Chain Volume Declines. (Supply: Santiment)

It is worth mentioning that owing to the unpredictability of the cryptocurrency market, it is essential to wait for a break of possibly aid or resistance right before getting into any trade. Now that the current market appears to be to be at the cusp on its future bullish cycle, obtaining fresh new funds to deploy is a will have to.

Featured Image from Shutterstock Charts from TradingView.com Action on Binance Coin's Network Swells In spite of Lackluster Cost Motion