People who use decentralized finance (DeFi) have been getting more and more experienced over the last year. Many of last year’s fastest-growing companies have faded into obscurity, but that doesn’t mean they have stopped working.

Aave (AAVE), a non-custodial liquidity protocol that lets users lend, borrow, or stake their assets to make money from them, is one of the projects that is getting more attention.

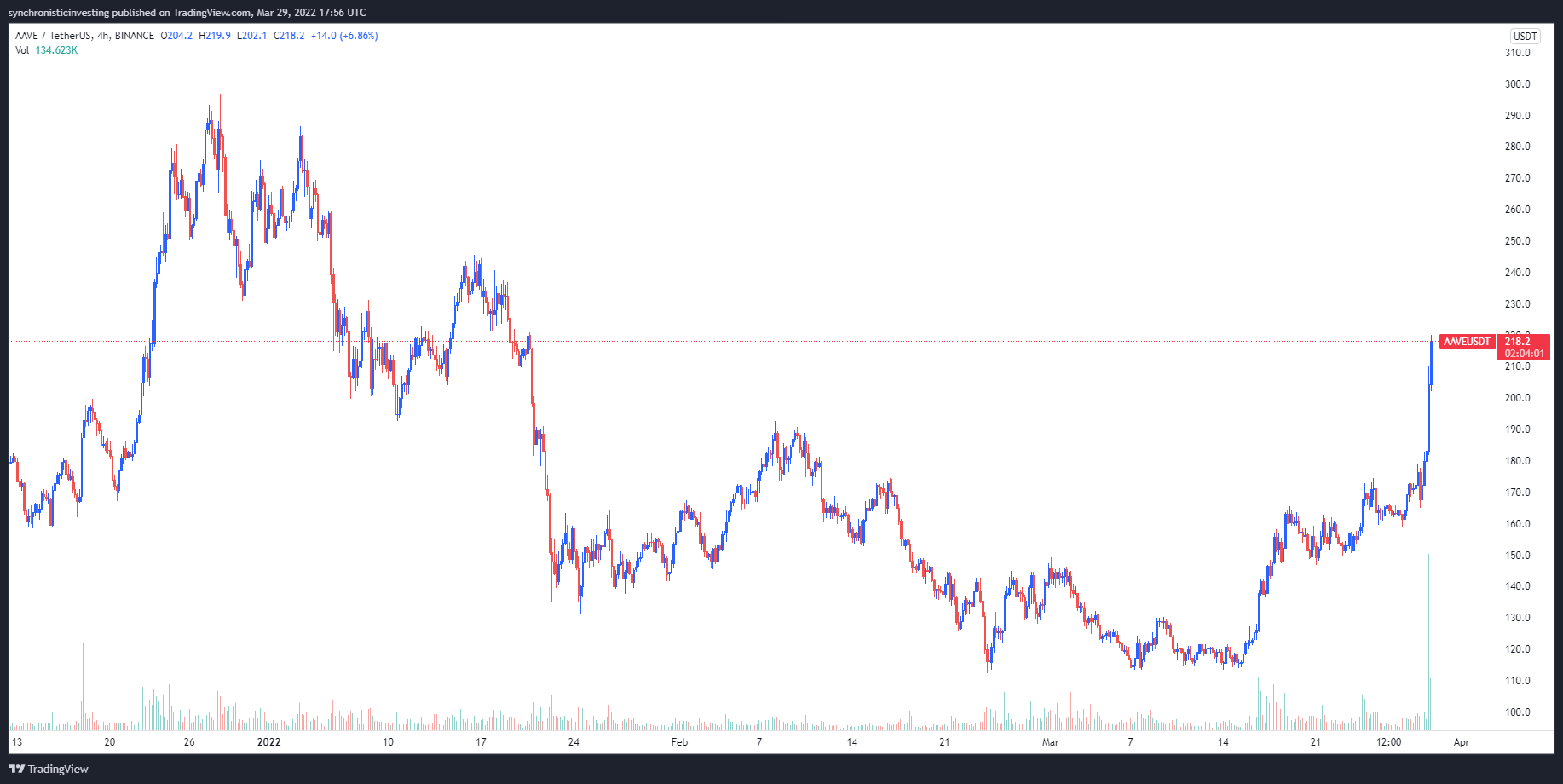

From March 15 to March 29, the price of AAVE went from $114 to $242. That’s a 110 percent rise, and the amount of money traded in a day went up by 442 percent to $1.26 billion.

AAVE’s price has risen because of the release of AAVE v3, the growth of the protocol’s ecosystem, and the steady improvement of its fundamentals.

It’s AAVE v3.

Aave v3, which was announced on March 16, has been a long time coming for traders.

It’s Aave V3!

V3 is the most powerful version of the Aave Protocol to date. It has new features that range from better capital efficiency to more decentralization. In the thread below, you can find out what’s new in V3. You can also go to https://t.co/H3jTyKRqNs to get started. pic.twitter.com/LXzn7660nA

It’s March 16, 2022. — @AaveAave.

According to Aave, the new features will help with capital efficiency, security, and cross-chain functionality. They will also help with decentralization in the DeFi ecosystem.

Users will be able to use portals, which will only show „permit listed“ bridge protocols that have been approved by Aave governance. They will also be able to use a high-efficiency mode (eMode) that lets them get the most out of their collateral by giving them a higher borrowing power for assets in the same asset category and an isolation mode, which will only show collateral for newly added assets.

You can already find it on Polygon (MATIC), FTM, Avalanche, Arbitrum, Optimism, and Harmony. More integrations are planned for the future.

Ecosystem growth:

New networks and partnerships with other DeFi protocols are two other things that have helped bring AAVE back to life in the last few years.

At the same time, Aave is still looking into new networks to launch on, like Metis. Aave is already available on seven different networks.

With the support of wallet providers and Web3 aggregators, Aave has also seen a rise in popularity. Instadapp, Debank, 1inch, Paraswap, DeFisaver, and Zerion are just some of them.

Aave V3 has arrived at Zapper.

There are six networks where you can see the value of your V3 portfolio: @0xPolygon, @avalancheavax.arbitrum.fdn.harmonyprotocol.optional, and @optimismPBC.

To start, go to https://t.co/UvfknT87el to get started. pic.twitter.com/ASFFGNsTu4

A tweet from @zapper fi: In 2022, March 21st is the date.

Following a unanimous decision by the board, Aave launched its v3 liquidity pool.

TVL is rising.

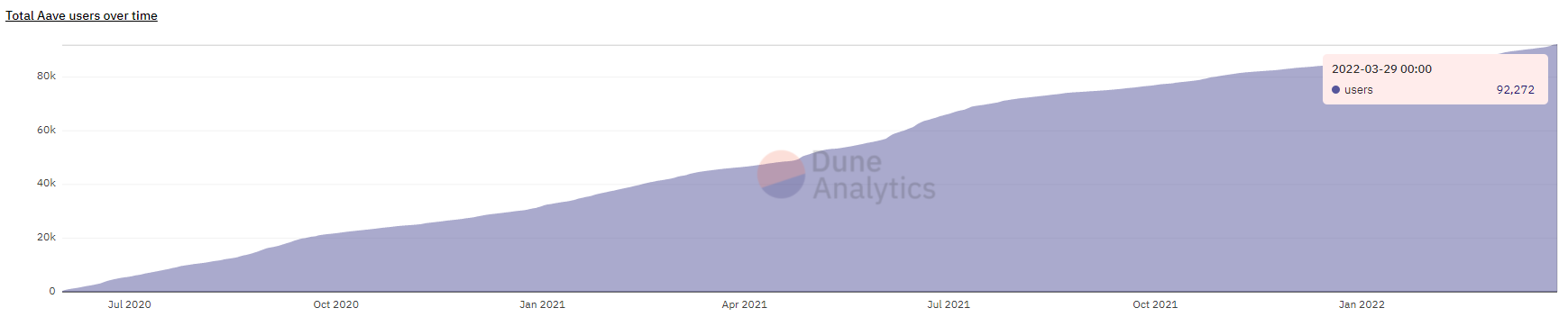

A third sign that Aave is becoming stronger can be found by looking at the community behind the protocol. Even though the DeFi industry as a whole has been having a hard time, new users have kept joining the ecosystem.

People who use Dune Analytics‘ data say there are now more than 92,000 unique wallet addresses that have used the AAVE protocol. Having more and more chains supported by Aave makes it very likely that this number will keep going up.

There have been a lot of new users and the protocol has added new chains that can be used, which has made the total value locked (TVL) on the protocol go up again. It now stands at $13.99 billion.

Recent support for liquid staking assets, like stETH from Lido Finance, has also helped the TVL on AAVE. This may be because ETH stakers are looking to get the most out of their money.

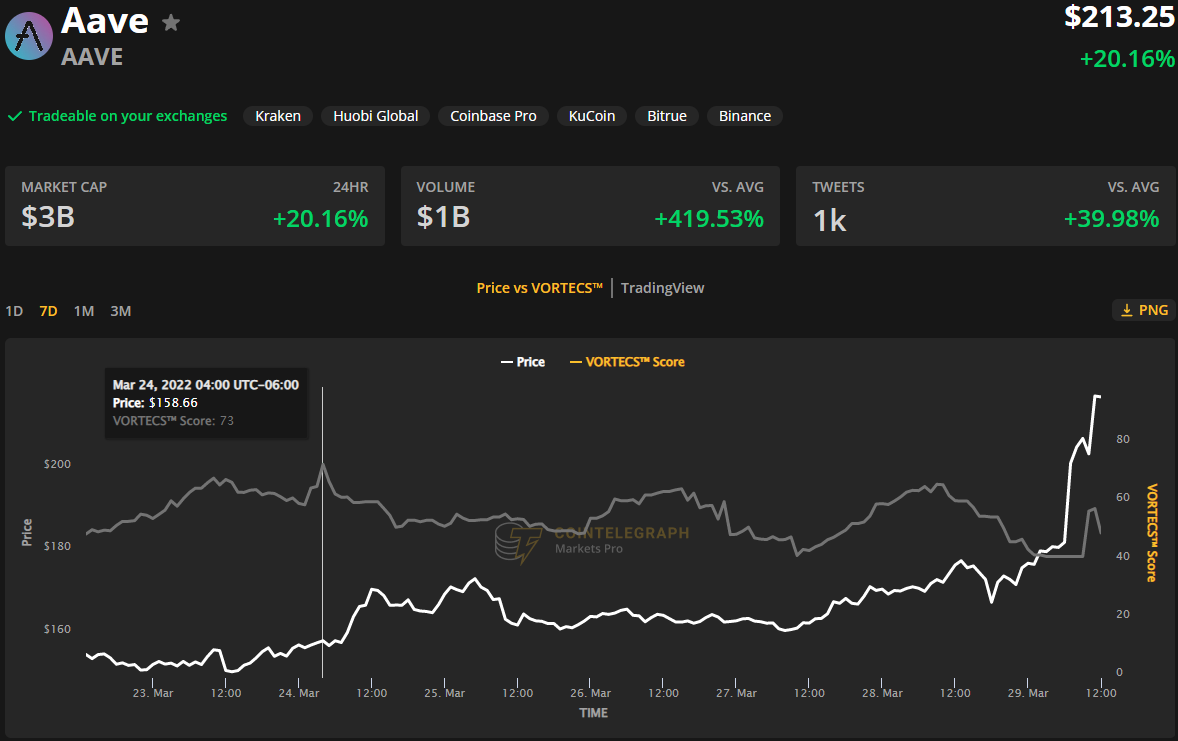

VORTECSTM data from Cointelegraph Markets Pro started to show a positive outlook for AAVE on March 24, before the recent price rise. This was before the recent price rise.

To use the VORTECSTM Score, which is only available on Cointelegraph, an algorithm looks at how people are feeling about the markets, how much money is being traded and how the prices have changed recently.

The VORTECSTM Score for AAVE reached a high of 73 on March 24, about an hour before the price began to rise by 45.8% over the next five days.

In this post, the author says what he thinks and doesn’t always agree with Cointelegraph.com. Every time you invest or trade, there is a chance you could lose money. You should do your own research before making a decision.